by Tom Parker, Reclaim The Net:

Several Democrats praised digital ID and CBDCs during a recent hearing.

Several Democrats praised digital ID and CBDCs during a recent hearing.

During a recent House Financial Services Committee hearing, several government officials shared updates on their work on digital ID and central bank digital currencies (CBDCs) — two types of technology that have the potential to give the government unprecedented levels of control and surveillance power.

Several Democrats also praised these technologies and criticized lawmakers who are pushing legislation that would shut down CBDCs.

TRUTH LIVES on at https://sgtreport.tv/

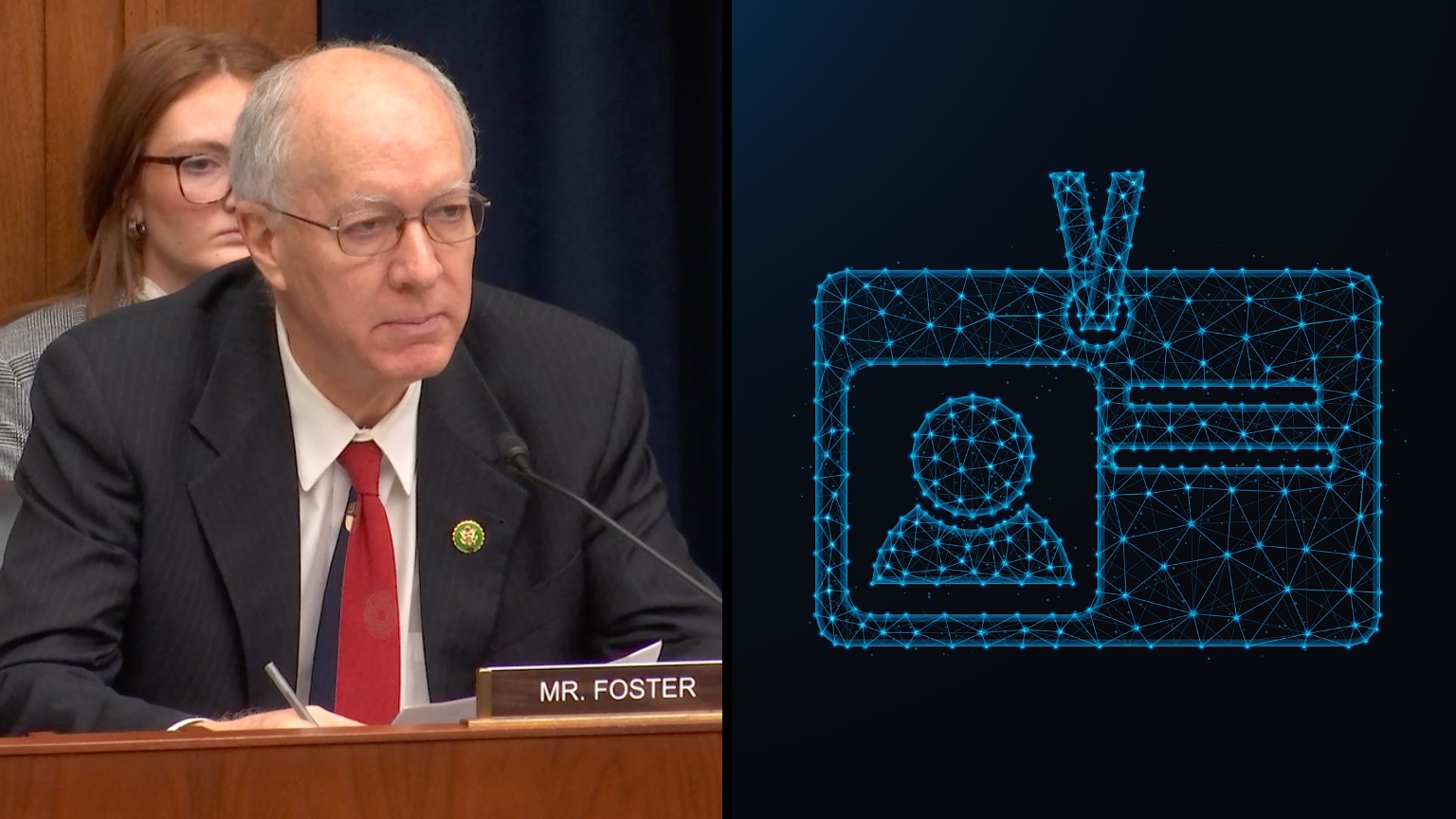

Digital IDs received an enthusiastic endorsement from Rep. Bill Foster (D-Il), who positioned them as a way to mitigate the risks of artificial intelligence (AI). He also praised digital ID systems in other countries, such as India, Estonia, and Korea.

“A secure digital ID biometrically synced to your smartphone allows individuals to remotely verify that they are who they say they are, saving costs, reducing likelihood of fraud, and to allow individuals to defend themselves against deep fake identity fraud,” Foster said.

He continued by asking the witnesses whether digital ID would have been beneficial during Covid and whether using digital ID for online transactions would be beneficial.

While Foster seemed to be a fan of India’s digital ID system, he didn’t mention any of the many controversies swirling around it, which include large-scale privacy issues, the financial blacklisting of those who refuse to participate, and the enforcement of checkpoint-style digital ID authentication in certain areas of society.

Foster also positioned the digital IDs in India, Estonia, and Korea as optional, saying that these countries “provide citizens who wish with a secure form of digital identification that can be presented online.”

But in Estonia, citizens don’t get to choose whether they use digital ID. Before they even have a name, babies are plugged into the system and given an identity code.

Charles Vice, Director of Financial Technology and Access, National Credit Union Administration (NCUA), also discussed digital ID.

He told lawmakers that his agency is evaluating digital ID technology, noted that several credit unions have piloted digital ID, and praised the mobile digital driver’s licenses that have rolled out in several US states.

Rep. Stephen Lynch (D-MA) turned the focus to CBDCs and warned that “the US should not risk falling behind” other countries with its CBDC exploration.

He also complained that “many of my colleagues on this subcommittee want regulators to encourage innovation, yet are pushing legislation that shuts down a CBDC before agencies have adequately researched and explored it.”