by Pam Martens and Russ Martens, Wall St On Parade:

Jerome Powell became the Chairman of the Federal Reserve on February 5, 2018 after being nominated by then President Donald Trump and passing his Senate confirmation. Powell was sworn in again on May 23, 2022 for a second term as Chair. His second term runs until May 15, 2026.

Unlike most Fed Chairs, Powell has no economics degree. He has a law degree from Georgetown University. For more background on Powell, see our May 18, 2020 article: The Fed’s Chair and Vice Chair Got Rich at Carlyle Group, a Private Equity Fund with a String of Bankruptcies and Job Losses.

TRUTH LIVES on at https://sgtreport.tv/

Powell’s tenure as Fed Chair has been mired by the biggest trading scandal in the Federal Reserve’s 110-year history. That scandal has yet to be resolved in a manner that meets the test of accountability. See our October report: After Two Years, There’s Still No Law Enforcement Report on Former Dallas Fed President Robert Kaplan’s Trading Like a Hedge Fund Kingpin.

But the biggest Fed scandal hiding in plain sight involves the trillions of dollars in bailout loans that the Fed has funneled to Wall Street trading houses during the tenure of Powell as Fed Chair.

Despite Powell sticking to the same refrain in his Congressional testimony throughout his tenure as Fed Chair — that the U.S. banking system is operating in a safe and sound manner — the second, third and fourth largest bank failures in U.S. history occurred in a seven week span between March 10 and May 1 this past spring. Thus far, those failures have cost the Federal Deposit Insurance Corporation $32 billion in losses.

On June 21 of this year, Powell sat before the House Financial Services Committee and told its members that “The U.S. banking system is sound and resilient.” He told the U.S. Senate’s Banking Committee the same thing the next day.

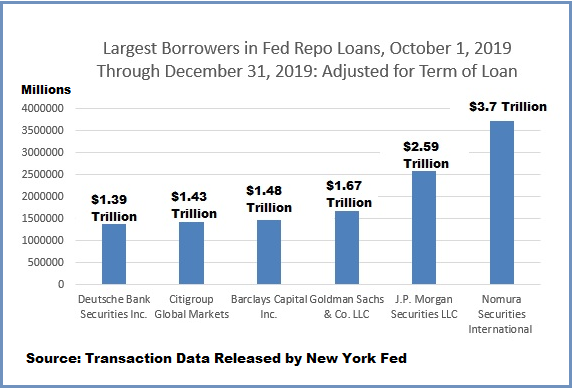

But the charts below, using data directly from the Fed, show a banking system in need of regular life support in the form of trillions of dollars in cumulative loans from the Fed. That is proof that there is a structural problem in the U.S. banking system, where exorbitant risk is concentrated among a handful of highly interconnected mega banks.

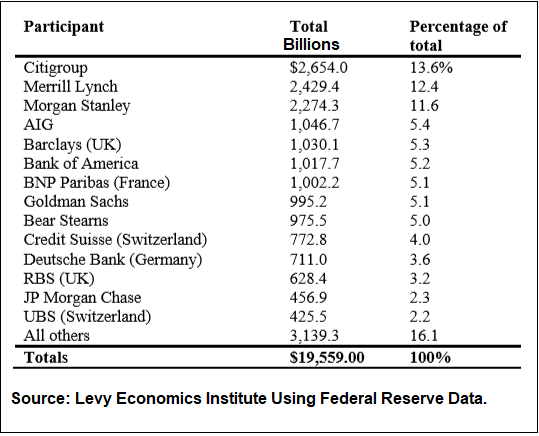

Largest Recipients of $19.6 Trillion in Federal Reserve Bailout Funds, 2007 to 2011

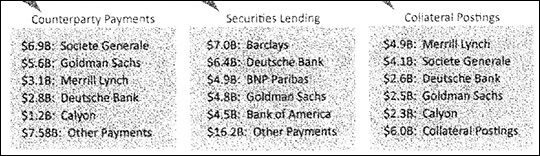

Where a Large Part of AIG’s Government Bailout Money Went in 2008. Figures are in Billions. (Source: Congressional Oversight Panel)

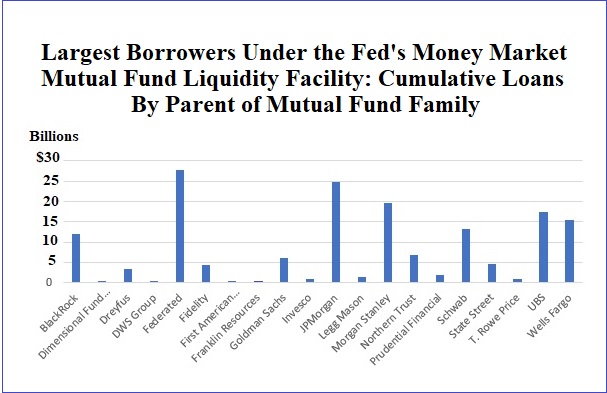

The Fed’s Money Market Mutual Fund Liquidity Facility made emergency loans from March 23, 2020 through April 23, 2020, but the program did not end on April 23, 2020. That’s because these were not overnight loans. They were loans made for periods up to as long as 11 months in some cases – taking the program into 2021.

Read More @ WallStOnParade.com