from ZeroHedge:

Somebody knows something…

Dollar pukefest, Swiss Franc panic-bid, bond yields plunge-gasm, gold surge-plosion, Crypto spike-a-thon… and stocks UNCH.

Looking at stocks today you could be forgiven for thinking that today was a typical ‘meh’ mid-week between Xmas and NYE day with all the US majors hovering around unchanged (until the last second idiocy from algos)…

TRUTH LIVES on at https://sgtreport.tv/

BUT, It was far from it in every other asset class as the dollar dumped while gold, bonds, swiss franc, and crypto all ripped higher as Magnificent 7 stocks were liquidated shortly after 10amET.

Source: Bloomberg

Notably, 0-DTE call-covering was very heavy as the Magnificent 7 was sold around 10am (after 0-DTE call-buying dominated at the open)…

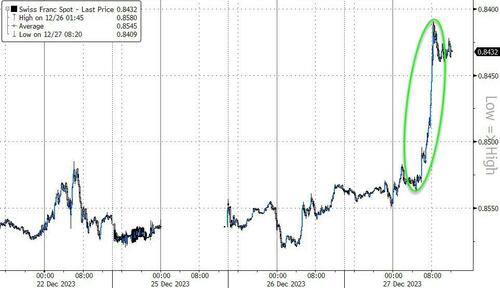

The Swiss Franc soared today by over 1% against the USD – the second biggest ‘ultimate safe-haven’ gain of the year outside of FOMC/ECB days…

Source: Bloomberg

That lifted Swissy to its strongest since the SNB intervention in Jan 2015. 2023 has seen the Swiss Franc’s strongest annual gains against the dollar since 2010…

Source: Bloomberg

2Y yields crashed today, gapping down by 8bps this morning as a wave of safe-haven buying hit multiple asset-classes.

Source: Bloomberg

But the entire curve was lower in yield on the day (down 10-11bps) thanks to a strong 5Y auction also…