by Ronan Manly, BullionStar:

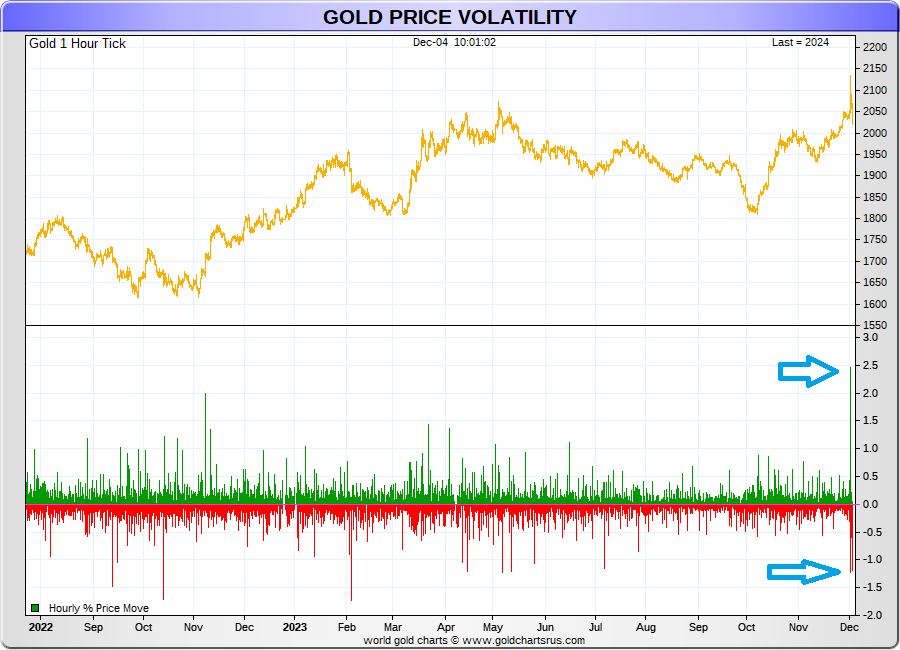

With less than 20 trading days left until the end of 2023, we have just witnessed a series of record-breaking price developments in the international gold price, as well as heightened gold price volatility, and the price moving in a $120 range intraday.

While a new all-time high monthly close in the US dollar gold price was achieved on Thursday 30 November at $2040/oz, and new all-time highs on the weekly close and daily close were achieved on Friday 01 December at $2072/oz, these new record highs were in hindsight, overshadowed by what happened subsequently.

TRUTH LIVES on at https://sgtreport.tv/

For following the weekend pause of Saturday and Sunday (when gold market venues around the world are closed,) the gold market re-opened into the new trading week with a shock and awe surge to $2143, the speed and magnitude of which has not been seen for many years.

$70 rise condensed into 20 Minutes

As the gold market opened at 6 pm New York time on Sunday 3 December (11 pm Sunday London time, 7 am Monday morning Singapore / Shanghai time), this price surge began to take shape a mere 15 minutes after opening, with the gold price blasting up by $70 from $2073 to $2143 in a little over 20 minutes – that’s a 3.38% surge in the gold price in a mere 20 minutes – shattering all resistance levels in a flash, and breaking through the psychologically important $2100 level.

Equally spectacularly, after this price spike to $2143, the gold price went down again, as first violently, and then over the next 12 hours in a very controlled fashion.

For the record, here are the details, using New York times as the reference point. Note that the ‘gold market’ opens on Sunday evening New York time when the CME’s Globex electronic trading platform opens for gold futures trading. This is a time of relatively low liquidity as none of the world’s major gold markets are officially ‘at their desks’, although its just before the Shanghai Gold Exchange (SGE) begins trading.

Starting at 6:15 pm New York time on Sunday evening, the spot gold price rose over a 5 minute period from $2074 to $2088. Between 6:19 pm and 6:24 pm, the price then rose again from $2088 to $2112.

Then between 6:24 pm and 6:29 pm, the price increased again from $2112 to $2124. Finally, between 6:29 pm and 6:34 pm, the gold price accelerated even further from $2124 to $2143.37. To reiterate, that was a $70 surge in a 20-minute period.

Waterfall Down into LBMA Fixing

Following this surge, the gold price fell back again, initially in a whipsaw fashion. By 6:44 pm New York time, the gold price had dropped to $2112. Then at 6:49 pm, the price was up again at $2126. Then by 7:09 pm, it had fallen to $2107. By 8:09 pm, the gold price was down to $2089. There then followed a relatively calm period of four and a half hours, after which, at 12:44 am New York time Monday morning, the price was still around $2089.

Then the consistent slams began, in a steady descending waterfall trajectory. By 3 am New York time (8 am London time), the gold price was down below $2060. Importantly, this level was below the Friday 01 December all-time closing high of $2072. It could be argued that the market participants which drove the price back down were the very same participants which drove the price up to new all time highs. This would make sense if the objective was to break the positive psychology of the market, which as you will see, has been temporarily achieved.

No matter who or what drove the price up, predictably the BIS, New York Fed and bullion banks would not want a Monday morning opening gold price higher than the Friday close. Which is why, just before the morning LBMA Gold Price fixing auction at 10:30am, the gold price was still at $2067, below Friday’s market close of $2072.

COMEX – The Broken Record

Then even more predictably, as COMEX opened at 8:30am New York time, the gold price was taken even lower, being slammed down by $50 from $2069 to $2021 (by 10:30am NYT) – in the space of two hours, and again leaving the price well down as the afternoon LBMA Gold Price auction began. This was also a more than $120 fall in 16 hours from the all-time peak price of $2143.

November Monthly Closing High – Breakout Confirmed

Before looking at interpretations for the gold price action over Sunday evening 3 December – Monday morning 4 December, its important that this does not overshadow the all-time record highs in the gold price that were recorded on the monthly close (30 November) and weekly close (1 December).

On 30 November, the spot gold price closed at $2040. This was the highest monthly close ever in the gold price, and the first monthly close ever above $2000. The previous all time high monthly close was April 2023 just below $2000.

This November monthly close at $2040 was made possible by a rally which began in early October on the back of heightened middle eastern geopolitical risk (Israeli-Palestinian conflict) when the gold price was below $1820. By the end of October, the gold price, partially due to safe haven demand had rallied nearly $190 to $2007. This was followed by a two-week period in which the gold price fell to $1933.

But there then followed a 3-week rally in which the gold price consistently rose all the way to $2040 to achieve the November close, i.e. a gain in excess of $100 over 3 weeks. Importantly, this November all time record close signalled a breakout in the gold price on a monthly basis, and drove the momentum which carried on in Friday’s trading session where the gold price continued higher to record a weekly (and daily) all time high close of a then staggering $2072.