by Peter Schiff, Schiff Gold:

After running the third-largest budget deficit in US history in fiscal 2023, the Biden administration kicked off fiscal 2024 with another big budget shortfall.

The US government ran a $66.56 billion deficit in October, according to the Monthly Treasury Statement. This was slightly lower than last year’s October shortfall of $88 billion due to record federal receipts as Americans impacted by natural disasters paid deferred tax bills.

TRUTH LIVES on at https://sgtreport.tv/

The government took in $403.43 billion in October, a 26.7% increase over last October. It was the largest influx of October federal receipts on record. This was due to a surge in tax receipts from people in California and other states who were allowed to extend their annual April tax deadline to October as they coped with natural disasters. This resulted in a 70% increase in non-withholding taxes from individuals and a whopping 170% increase in corporate tax receipts.

This papered over a general downward trend in federal tax receipts through last year. Federal revenue fell by 9.3% in fiscal 2023.

The federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned at the time that it wouldn’t last. And government tax revenue will decline even faster as the economy spins into a recession.

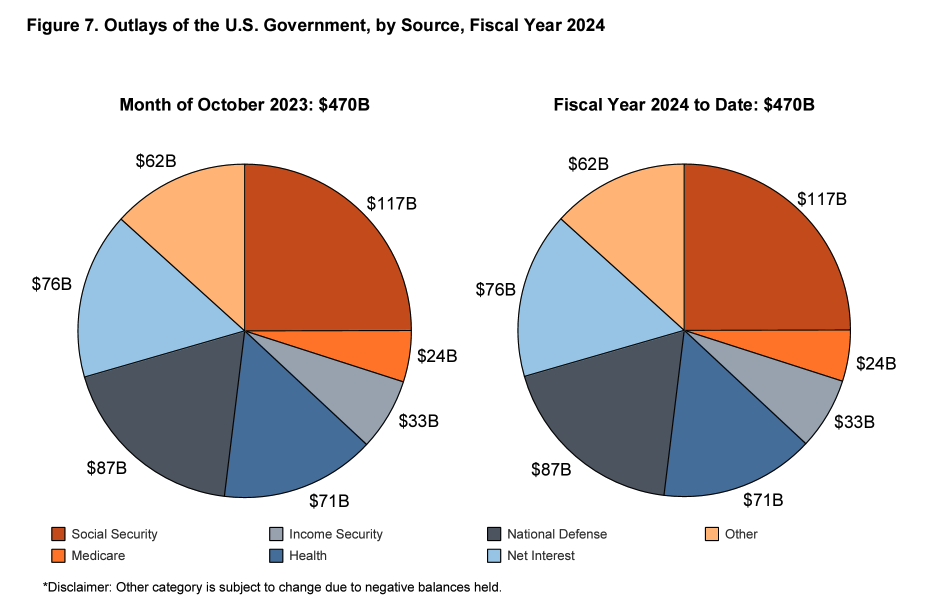

Meanwhile, the Biden administration blew through $470 billion last month. Federal spending increased by 15.7% compared to October 2023.

This underscores the fact that the fundamental issue isn’t that the US government doesn’t have enough money. The fundamental problem is that the US government spends too much money. Despite the pretend spending cuts, the debt ceiling deal didn’t address that problem. Even with the new plan in place, spending will go up. And it’s already historically high. That means big budget deficits will continue and the national debt will mount.

In fact, the Biden administration is already looking for more money. The president recently proposed a $100 billion aid package for Israel, Ukraine and other “national security” priorities. No matter what you hear about spending cuts, the federal government is constantly finding new reasons to spend more money.

The national debt blew past $33 trillion on Sept. 15. Just 20 days later, it pushed about $33.5 trillion. In other words, the Biden administration added half a trillion dollars to the debt in just 20 days.

Most people seem to think the excessive spending, the growing deficits and the national debt don’t really matter, but somebody has taken notice. Last week, Moody’s Investor Service lowered its outlook on US government credit from “stable” to “negative.” This could be a prelude to a downgrade in the country’s AAA credit rating.

THE BIGGER PROBLEM

This rapid increase in the national debt is happening during a time of sharply rising interest rates. This is a big problem for a government that primarily depends on borrowing to pay its bills.