by Mish Shedlock, Mish Talk:

Consumer credit is finally showing signs of rolling over. And credit card delinquencies surged in the third quarter.

Consumer credit is finally showing signs of rolling over. And credit card delinquencies surged in the third quarter.

Total Household Debt Reaches $17.29 Trillion in Q3 2023

The New York Fed reports Total Household Debt Reaches $17.29 Trillion in Q3 2023; Driven by Mortgage, Credit Card, and Student Loan Balances

TRUTH LIVES on at https://sgtreport.tv/

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows total household debt increased by $228 billion (1.3%) in the third quarter of 2023, to $17.29 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

Mortgage balances rose by $126 billion from the previous quarter and stood at $12.14 trillion at the end of September. Credit card balances increased by $48 billion to $1.08 trillion in Q3 2023, representing a 4.7% quarterly increase. Auto loan balances rose by $13 billion, consistent with the upward trajectory seen since 2011, and now stand at $1.6 trillion. Student loan balances increased by $30 billion and now stand at $1.6 trillion. Other balances, which include retail cards and other consumer loans, increased by $2 billion.

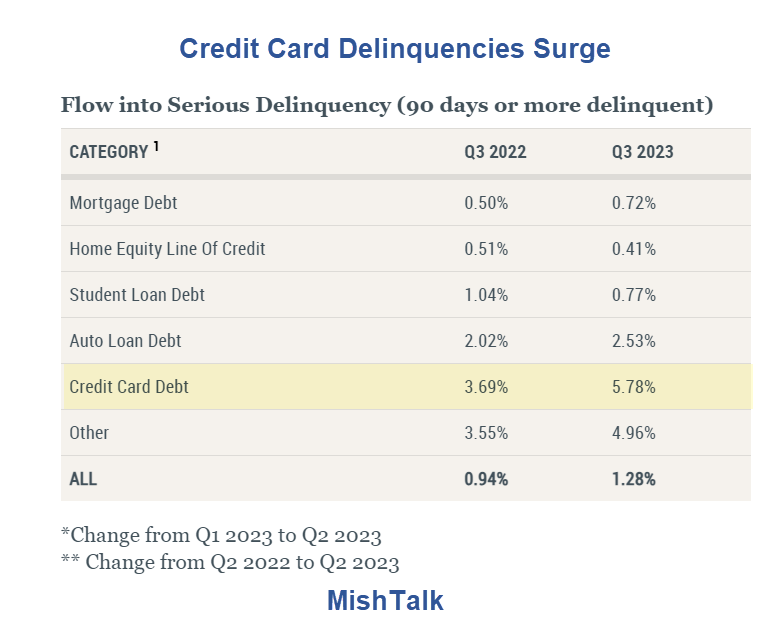

Aggregate delinquency rates increased in Q3 2023, with 3% of outstanding debt in some stage of delinquency at the end of September. Delinquency transition rates increased for most debt types except student loans and home equity lines of credit. The increases in credit card delinquency were the sharpest among borrowers between the ages of 30 and 39.

“Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, Economic Research Advisor at the New York Fed. “The continued rise in credit card delinquency rates is broad based across area income and region, but particularly pronounced among millennials and those with auto loans or student loans.”

Consumer Credit in Billions of Dollars

The third and largest of the three rounds of fiscal stimulus shows clearly in the above chart. Starting around March of 2023, stimulus finally seems to have been used up.

Delinquencies are on the rise over credit stress.