by Craig Hemke, Sprott Money:

Janet Yellen has served as both Chair of the Fed and U.S. Treasury Secretary. During her time on the job, she has muttered some doozies that leave you scratching your head. Her latest, from an appearance last week, might be one of her craziest yet.

I suppose I could spend most of this column adding text and screenshots from some of Yellen’s most outrageous statements, but we’d be here all day and who has time for that? Instead, here are just two of my favorites:

TRUTH LIVES on at https://sgtreport.tv/

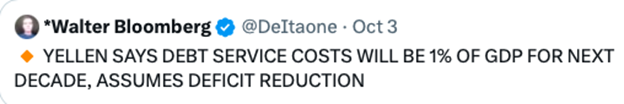

But she really outdid herself last week. Check this one out. It might be her best yet:

My apologies in advance for this, but for context, we’re going to have to do some math. Please bear with me…

The current total debt of the United States is about $33.5 TRILLION.

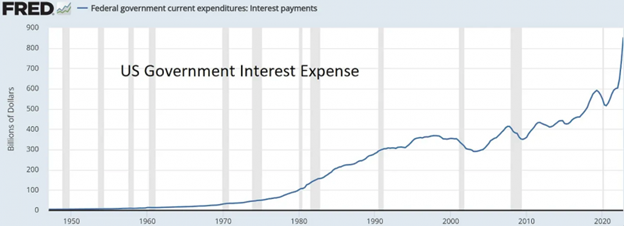

The current annual cost of servicing that debt is approaching $900 BILLION.

That means, as of right now, the average interest cost on the accumulated debt is about 2.5%.

However, in Yellen’s quote from last week, she equated debt service with total GDP, which at last count was about $27 TRILLION.

So let’s now do Yellen’s math. If the total GDP is $27T and the current annual debt service cost is $900B, then the debt service relative to GDP is 3.3%.

But Yellen says this number is going to average just “1% for the next decade”. Hmmm. Sorry, but we must do even more math…

The Congressional Budget Office has projected that the total U.S. debt could reach $50T as soon as 2030. If the U.S. economy manages to grow at 3% per year over the next seven years, total GDP will reach $35T by 2030. Using Yellen’s math, this assumption places debt-to-GDP at nearly 150%.

But again, Yellen was talking about DEBT SERVICE COSTS, so let’s reverse engineer the math on her statement.

If the total U.S. GDP is at $35T in 2030 and the total debt is $50T, then the average interest rate on that accumulated debt would have to be 0.7%. Again, it is currently 2.5%. So, to make Yellen’s statement rational and reasonable, one has to assume one of two things—or both:

- The total U.S. GDP is going to soar much faster than the 3% per year I assumed in growing it from $27T today to $35T in 2030.

- That interest rates and the total interest paid to service the existing debt are both going to be sharply lower than where they are at present.

And neither of those scenarios are likely to be true. It’s far more likely that the total U.S. GDP grows to just $33T by 2030 and that the service on the accumulated $50T in debt is near $1.5T. That places total debt service to GDP at 4.5%, not Yellen’s expectation of 1.0%.