by Mish Shedlock, Mish Talk:

As mortgage rates surge to 7.7 percent, Goldman Sachs revises is 6.5 percent forecast.

As mortgage rates surge to 7.7 percent, Goldman Sachs revises is 6.5 percent forecast.

Mortgage Rates Easily Launched to New Long Term Highs by Upbeat Data

Mortgage News Daily reports Mortgage Rates Easily Launched to New Long Term Highs by Upbeat Data

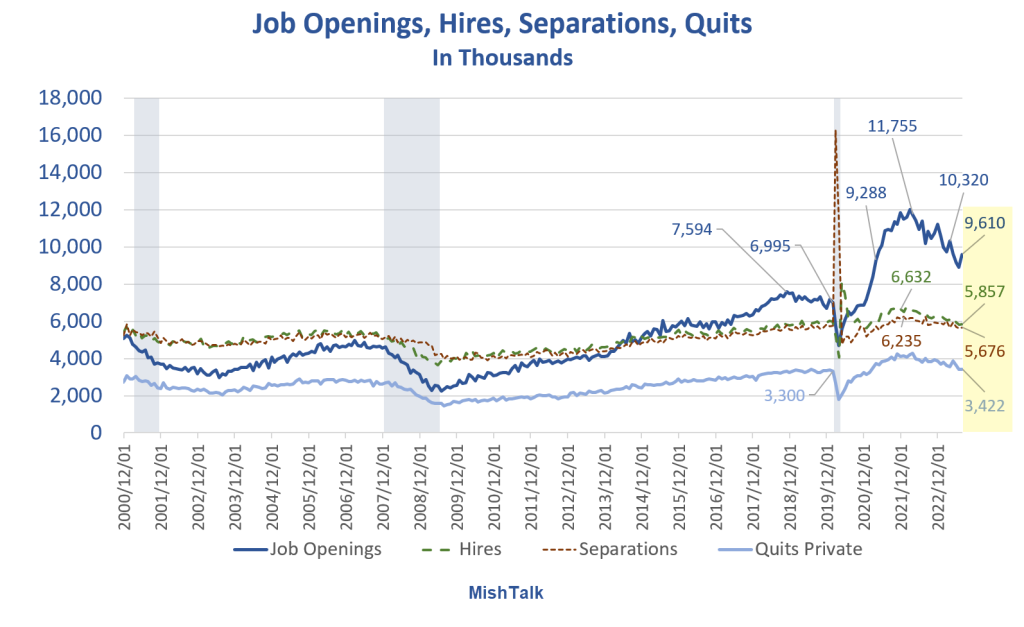

Mortgage rates were already close to the highest levels in more than 20 years yesterday–an unpleasant milestone that was easily surpassed after today’s Job Openings data came in much higher than expected.

TRUTH LIVES on at https://sgtreport.tv/

Interest rates are always dependent on the economy and inflation–sometimes more than others. Even without the Federal Reserve, rates would still need to pay attention to these things and stronger econ data would still imply higher rates, all other things being equal.

Job openings have been declining since March, and that’s a good thing for rates, technically, but the decline hasn’t been as quick as expected. Then days like to day cast doubt on the decline. Openings jumped to 9.61m from 8.92m previously. They’d need to be under 8m for the Fed to feel that its policies were having the desired impact on the labor market (and thus, on inflation prospects).

The average mortgage lender is now offering rates over 7.7% for top tier conventional 30yr fixed scenarios. Many borrowers are now seeing 8% rates (or seeing high upfront costs required to buy one’s rate down into the 7’s).

Goldman Changes Forecast from 6.5 Percent

Yahoo!Finance has this amusing report: Goldman Sachs calls an audible: Mortgage rates going up, after all, in 2023

In January, the firm’s housing economists predicted mortgage rates would land at 6.5% by the end of this year. Now? Well, never mind. Goldman Sachs believes rates will run higher.

“We are revising our forecasts for mortgage rates higher, to 7.1% for year-end 2023 and 6.8% for year-end 2024 from prior forecasts of 6.6% and 5.9%, respectively,” Roger Ashworth, managing director at Goldman Sachs, wrote in a note for the firm’s housing team.

Job Openings Rise in August, Quits and Layoffs Vary by Sector

Yesterday, I commented Job Openings Rise in August, Quits and Layoffs Vary by Sector

The number of job openings is very suspect for many reasons: Companies do not take down filled positions, survey responses are sporadic, companies are not really looking to hire but if the perfect candidate comes along they will, motivation reasons, and it costs northing to leave an opening in place.

There is no reason to have any faith in the number of job openings. However, the direction of the trends is likely accurate.

By direction, I meant lower. This data is very noisy and response rates are miserable.

While the Fed puts a ton of faith in the JOLTS report, we do have to keep three things in mind. First, it’s a lagging data-point. Second, it’s notoriously volatile. Third, the response rate is all the way down 32% — traditionally it has been closer to 70% and was 50% pre-Covid. pic.twitter.com/emm0JXrtbY

— David Rosenberg (@EconguyRosie) October 3, 2023

“The response rate is all the way down 32% — traditionally it has been closer to 70% and was 50% pre-Covid.”

Sentiment Changed

Regardless why, sentiment towards bonds has changed. The desire to hold them is falling. That’s what’s happening, no more, no less.

And when the 10-year treasury yield rises, mortgage rates tend to rise as well.

Why the Selloff?

- Because market participants, right or wrong, believe the economic data is strong and that will force the Fed to hike more. The recession theory went out the window.

- Also, there are concerns over budget deficits. Such concerns don’t matter until they do.

We can guess why but here are a few more reasons for the change in sentiment. People can see the Inflation Reduction Act is not reducing inflation.

And the extreme polarization in Congress makes it perfectly clear “No one will do anything about anything because the political system is totally broken.”