by Wolf Richter, Wolf Street:

Including $1.56 trillion in Q4 2023 & Q1 2024 combined. Government has gone nuts.

Including $1.56 trillion in Q4 2023 & Q1 2024 combined. Government has gone nuts.

The US government is borrowing such huge amounts to fund its gigantic and reckless deficits that the whole world is paying attention. The Treasury Department’s Quarterly Refunding announcements are normally greeted with a global meh, but under the current tsunami of new issuance of debt, it has turned into a hot button.

TRUTH LIVES on at https://sgtreport.tv/

Today, the net amounts of marketable Treasury securities to be sold to the markets in Q4 2023 and Q1 2024 were released; and on Wednesday, the financing details, such as the amounts of longer-term Treasuries and auction sizes, will be released. The financing details of the last Quarterly Refunding announcement turned into a real hoot, leaving markets rattled by the upsized auctions of longer-term Treasuries, and longer-term yields rose sharply.

Both quarterly net borrowing amounts for Q4 and Q1 assume a quarter-end balance of $750 billion in the government’s checking account, the Treasury General Account at the Federal Reserve Bank of New York. So according to the Quarterly Refunding announcement today:

- Q4 2023 net borrowing: $776 billion, lower than its July 31 projection for Q4 of $852 billion, “largely due to projections of higher receipts somewhat offset by higher outlays.”

- Q1 2024 net borrowing: $816 billion.

In total, over those two quarters marketable debt will have increased by $1.59 trillion! This follows the $1.01 trillion increase in Q3, and the surge in June after the debt ceiling ended.

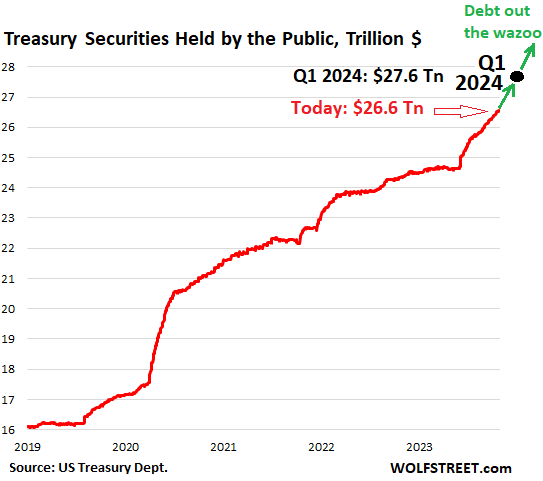

At the beginning of Q4, marketable debt outstanding was $26.04 trillion. The government will add $1.59 trillion to it, pushing it to $27.6 trillion by March 31, 2024.

Over the 10 months between June 1 2023 through March 31, the government will have added $2.85 trillion to the marketable debt, which is totally nuts – in an economy that is growing nicely.

In terms of today, current marketable debt as of Oct 27 reached $26.56 trillion (red line). By March 31, five months from now, it will be $27.6 trillion, as per the Quarterly Refunding data today.

Roughly $600 billion of the $1 trillion in new debt in Q3 was used to refill the checking account, the TGA, which had been drawn down to near-zero during the debt ceiling fight as the government continued funding its unmitigated deficit spending. The TGA ended Q3 with a cash balance of $657 billion.

As of October 27, the TGA balance was $828 billion.

The total amount of Treasury securities outstanding has reached $33.68 trillion. Of that amount, $26.56 trillion are held by the public, and $7.12 trillion are securities held by government entities, such as government pension funds, the Social Security Trust Fund, etc. Those securities “held internally” are not traded and don’t have direct consequences on the supply of new securities to the market.

Here we’re talking about the debt held by the “public,” such as foreign holders, the Fed, cash-rich corporations, banks, bond funds, insurance companies, individuals, and folks like me. And that public is going to have to buy the additional $1.59 trillion in securities by the end of Q1.