by Ronan Manly, BullionStar:

There have been some interesting developments in the long running saga of criminal prosecutions by the US Department of Justice (DoJ) against J.P. Morgan and its lawbreaking traders for precious metals price manipulation and fraud.

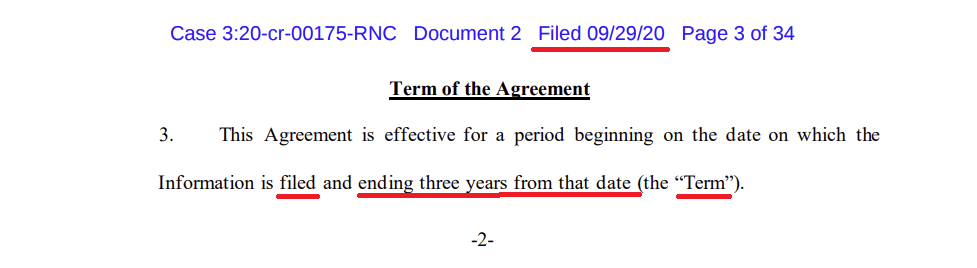

While three of JP Morgan’s top former gold traders were sentenced to jail in late August and September 2023, JP Morgan itself walks free after now having exited its 3 year-long Deferred Prosecution Agreement (DFA) with the US Department of Justice (DoJ) – an agreement which was signed in late September 2019, but began on September 29, 2020 and which expired in late September 2023.

TRUTH LIVES on at https://sgtreport.tv/

This Deferred Prosecution Agreement relates to the September 2019 deal where JP Morgan paid US$ 920 million “in a criminal monetary penalty, criminal disgorgement, and victim compensation” to buy a ‘Get out of Jail Free card“, and avoided prosecution by the DoJ while admitting criminal wrongdoing.

With the expiry of this Agreement, JP Morgan now effectively gets out of the DoJ penalty ‘sin bin’, and will no longer have the DoJ looking over its shoulder, and will no longer have to submit annual compliance reviews to the DoJ.

“You Told Many Lies to the Market”

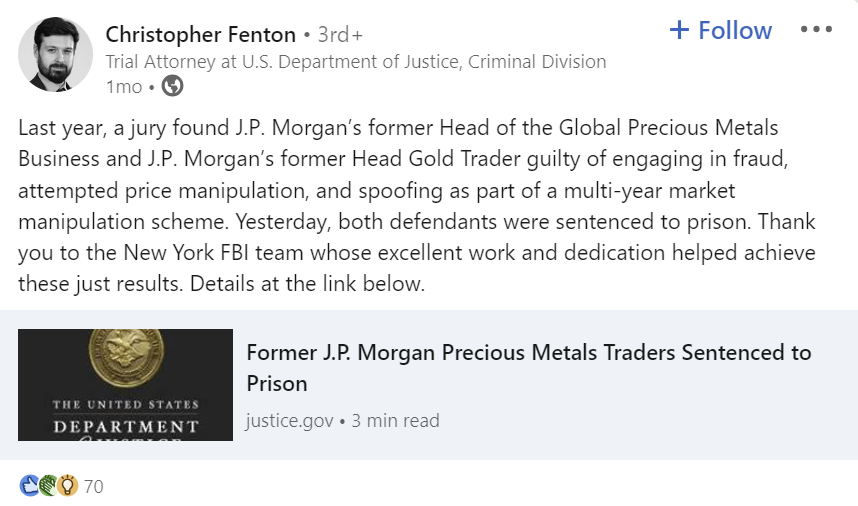

On August 22, 2023, Michael Nowak, J.P. Morgan’s former Head of Global Precious Metals, and Gregg Smith, J.P. Morgan’s former New York head gold trader, were sentenced to prison “for engaging in fraud, attempted price manipulation, and spoofing as part of a market manipulation scheme that spanned over eight years…and resulted in over $10 million in losses to market participants.”

Nowak and Smith had been convicted a year earlier on 10 August 2022 after a jury trial in Chicago found them guilty of “wire fraud affecting a financial institution, commodities fraud, attempted price manipulation, and spoofing”, with Smith being described by the DoJ’s US Assistant Attorney as “the most prolific spoofer that the government has prosecuted to date.”

The case had been investigated by the FBI New York Field Office, assisted by the Commodity Futures Trading Commission (CFTC) Division of Enforcement, overseen by the DoJ “Market Integrity & Major Frauds Unit” led by Avi Perry, and prosecuted by DoJ trial attorneys Christopher Fenton, Matthew F. Sullivan, and Lucy B. Jennings, of the DoJ’s Criminal Division’s Fraud Section.

At sentencing in August, Gregg Smith was sentenced to 2 years in prison and a $50,000 fine, with US District Judge Edmond Chang saying to Smith, “You told many lies to the market. For many years, you injected fraud into the market.”

Michael Nowak (who was also on the board of the London Bullion Market Association (LBMA) when arrested by the US Government in September 2019) was sentenced to 1 year in prison and a $35,000 fine.

Specifically, according to the successfully prosecuted DoJ case, a group of JP Morgan precious metals traders, over an 8 year period, rigged the prices of not only gold and silver on COMEX, but of platinum and palladium on NYMEX as well:

“between approximately May 2008 and August 2016, Smith and Nowak, along with other traders on the JPMorgan precious metals desk, engaged in a widespread spoofing, market manipulation, and fraud scheme” involving “tens of thousands of deceptive trading sequences for gold, silver, platinum, and palladium futures contracts traded through the New York Mercantile Exchange Inc. (NYMEX) and Commodity Exchange Inc. (COMEX), which are commodities exchanges operated by CME Group Inc.”

The scheme involved the JP Morgan criminals injecting fake orders for precious metals futures contracts (that they intended to cancel before execution). These fake orders created “false and misleading information about the genuine supply and demand for precious metals futures contracts” which then drove “prices in a direction more favorable to orders they intended to execute on the opposite side of the market.”

Indeed, according to the New York Post, “prosecutors alleged the [JP Morgan] precious metals desk made as many as 50,000 spoof trades under Nowak’s watch” and that the global precious metals desk operated as an organized criminal enterprise.

Separately, Nowak and Smith’s precious metals trading desk colleague Christopher Jordan appeared for sentencing on September 15, 2023 (also in front of US District Judge Edmond Chang), charged with fraud in connection with a spoofing scheme in the gold and silver futures markets. Jordan was sentenced to jail for 6 months for wire fraud as part of a “scheme to rig gold and silver markets in his favor”.

Separately, Nowak and Smith’s precious metals trading desk colleague Christopher Jordan appeared for sentencing on September 15, 2023 (also in front of US District Judge Edmond Chang), charged with fraud in connection with a spoofing scheme in the gold and silver futures markets. Jordan was sentenced to jail for 6 months for wire fraud as part of a “scheme to rig gold and silver markets in his favor”.

Specifically, Jordan had been a trader on JPMorgan’s precious metals desk in New York from 2006 to 2009 where he “engaged in a deceptive spoofing strategy while trading gold and silver futures contracts on the Commodity Exchange (COMEX)” injecting “thousands of spoof orders…. to move so he could then to execute orders on the opposite side of the market.”

Although Jordan had been charged by the DoJ on the same indictment as Nowak and Smith in September 2019, Jordan’s lawyers had managed to get him a separate trial, arguing that he would not get a fair trial if tried jointly with Nowak and Smith. Unfortunately for Jordan, that tactic made no difference, since he too was convicted and has now been sentenced – to 6 months in jail.