by David Haggith, Gold Seek:

Wolf Richter is calling it a “bond bloodbath,” which he says is happening because delusions about the Fed’s fight with inflation are finally giving way. Reality struck home in the latest retail report that showed high increases in retail sales that were in good part due to high increases in inflation. (If you didn’t read The Daily Doom editorial about that yesterday, I highly recommend you do because this is a pivotal moment on the biggest issue that will bring down the economy: “Bonds Bust!”) The bond bubble is the biggest bubble in the “Everything Bubble” that the Fed inflated, so its breaking will bring down the entire “Everything Bubble.”

TRUTH LIVES on at https://sgtreport.tv/

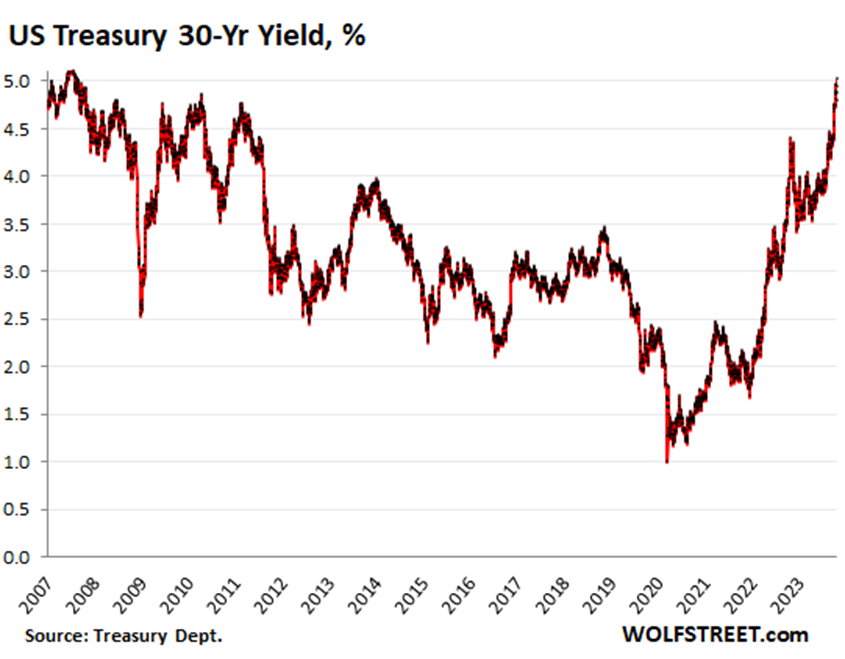

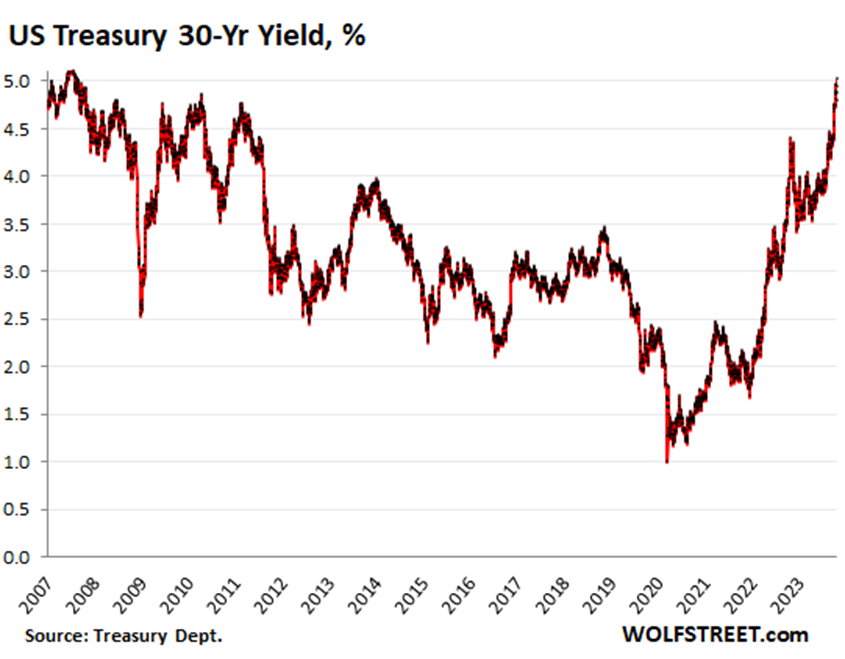

These long-term yields above 5% are an indication that a form of normalcy is gradually being forced upon the bond market by the resurgence of inflation, and by the belated realization that this inflation isn’t just going away on its own somehow. This is a huge regime change, after years of the Fed’s QE and interest rate repression, and all prior assumptions are out the window.

Here you can see how steep the rise in bond yields has been since the Fed started tightening and particularly since the bond market started waking up now that inflation is rising again:

Richter comments on the same things I’ve been harping about:

It seems, the long-term Treasury market is gradually coming out of its delusion about inflation and normalizing interest rates after having spent 18 months believing in the hype about a Fed pivot and rate cuts to something like 0% that would be forced on the Fed by a steep recession, with lots of forever-QE to follow, or whatever.

Delusion ends hard when the denial breaks up, and the Fed’s financial demolition is accomplishing that destruction now. If it doesn’t, inflation will do the job for it.

While the Fed will tighten us into a steep recession, the slide into this second plunge since last year’s dip will be especially steep because it will not likely come until the Fed tightens hard enough and long enough to break the “Everything Bubble.” That will plunge us rapidly into recession in an all-out panic because people who have been investing based on such enormous delusions panic when they finally realize that, like Wile E. Coyote, they’ve run out past the edge of a mighty high cliff.

The crash of the Big Bond Bubble was inevitable because of the Fed’s QT and the Fed’s raising of interest rates and the government’s massive addiction to endless and enormous deficits, requiring massive new bond issuances. It’s just how supply and demand works:

This deficit-spending by the government has to be funded by piling enormous amounts of Treasury securities on the market that need to find buyers. Yield solves all demand problems by rising until demand emerges. And that’s in part what we’re seeing now. All of this is happening as the Fed is unloading its balance sheet at record pace, having already shed over $1 trillion in securities in a little over a year.

Market forces are taking over in determining bond yields now that the Fed is backing out as a buyer of that debt and the government is going deeper in as an issuer of new debt.

Higher yields mean lower prices. So this return to normalcy has been dishing out huge losses to investors who’d bought long-term bond funds or long-term bonds in the era of QE. Investors that own these way-under-water 30-year bonds outright can choose to hold the bonds to maturity at around 2050, when they will get face value back, and collect 1.5% or 1.8% coupon interest along the way.

Bond funds are breaking:

But investors that bought during QE are in a world of hurt. The iShares 20+ Year Treasury Bond ETF [TLT], which focuses on Treasury bonds with a remaining maturity of 20 years or more, fell another 1.6% today at the moment and has plunged by 51% from the peak in August 2020, which had marked the peak of the 40-year bond bull market that had turned into the biggest bond bubble ever (data via YCharts).

The unwinding of so much overindulgence in debt has raised mortgage rates to nearly 8%, which today’s headlines say is taking demand for mortgages down to its lowest level since 1995, back in a whole different millennium of housing. As I wrote about recently, this has, Richter says, put the housing market in a deep freeze.

Housing market in deep freeze.

Mortgage applications to purchase a home have been on a steady collapse-track and in the last reporting week slid another 6% from the prior week to hit a new multi-decade low, and are 48% below the same week in 2019

(You can read my full take on that here: “The Deeper Dive: The US Housing Market Has Frozen Over.”)

So, as the Big Bond Bubble bursts, the housing market tanks because mortgage rates are pegged off those bond rates. The demolition of the bond bubble takes housing down with it. With bond funds going bust and housing going deep underwater again, and bank reserves getting squeezed by the devaluing of their bonds, who can believe we won’t see more bank busts like those we already saw this year as these new yields on bonds rise even higher under free-market control, taking bond prices down lower? And with all that assured as the simple math of supply-and-demand, who can believe that will not finish off the bear market in stocks that began when the Fed started tightening by taking it down to its true low as everything around it breaks?