by Craig Hemke, Sprott Money:

Three weeks ago, we issued a “Crash Watch” for the global equity markets. Though the indices have traded sideways and October is almost over, the Crash Watch remains in effect and equity investors should remain on the lookout for volatility and possible Crash Warnings.

If you missed the original post from three weeks ago, here’s the link:

TRUTH LIVES on at https://sgtreport.tv/

In summary, a Crash Watch is issued when conditions become favorable for a sharp drop in equities. The ingredients are there, but they’ve yet to come together to create an actual crash. It’s a bit like the image below:

And what ingredients are currently present?

- very high nominal rates compared to the recent history of central banks’ ZIRP

- a looming economic recession in the U.S. that threatens corporate profits

- trouble in the banking sector via high interest rates and commercial real estate losses

- increasing drain of liquidity toward money market funds

- forced unwind of hyper leverage in bond market

- end of Japanese yen “carry trade” as Bank of Japan gets squeezed by higher rates

To that final bullet point, the following from Alasdair Macleod. Few people understand how important the yen carry trade is to global liquidity:

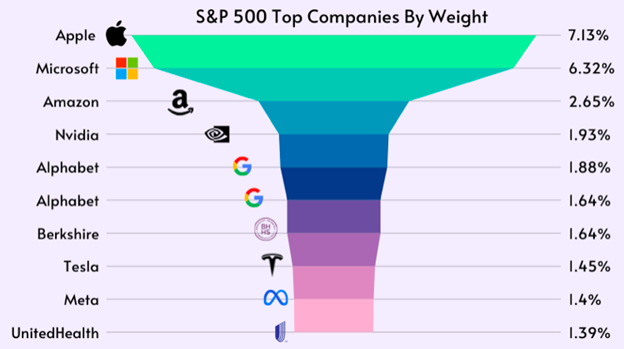

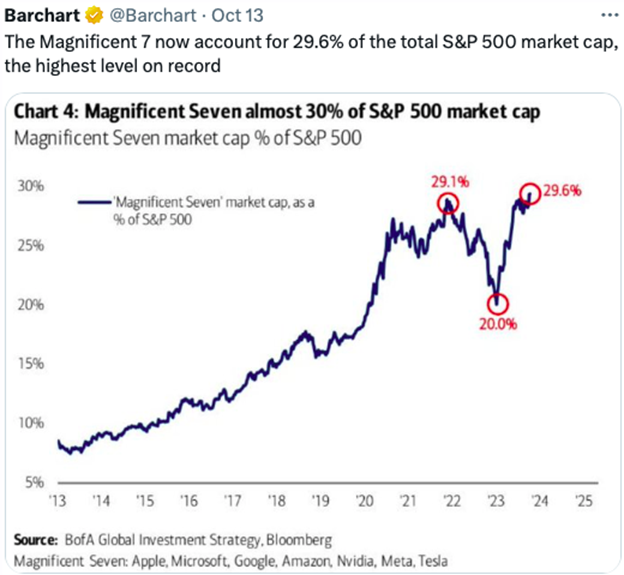

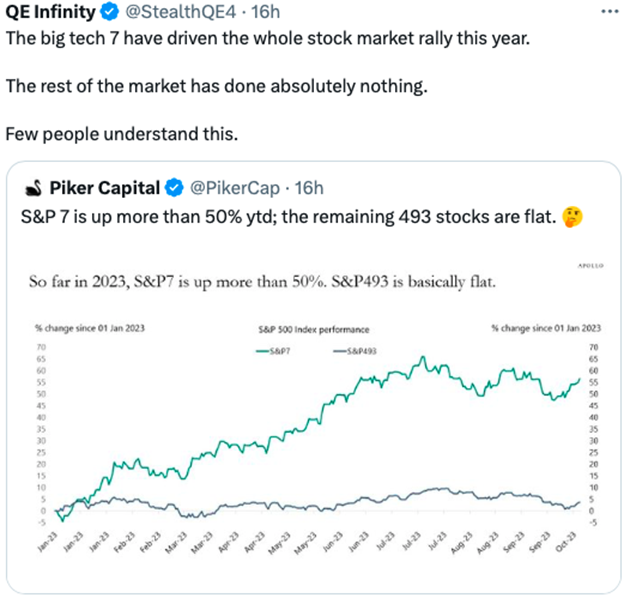

So we remain on Crash Watch. As such, let’s check the chart of the S&P 500. But first, keep in mind that this index is not equally weighted with all 500 stocks getting a 0.2% allocation. Instead, it’s heavily loaded on the top end, and this allows just a handful of stocks to have a disproportionate impact on the index as a whole.

Regardless of the weighting, on the chart below you can see that the S&P 500 index remains perilously close to taking out some important support levels. If that happens, the stampede to the exits might cause the Crash Watch to be upgraded to a Crash Warning.

On the daily chart, note that the index is in a downtrend and below its 50-day moving average. As I type this on Monday, the 23rd, it seems to be desperately trying to hold its 200-day moving average too. Watch this level very closely in the days ahead.