by Ed Steer, Silver Seek:

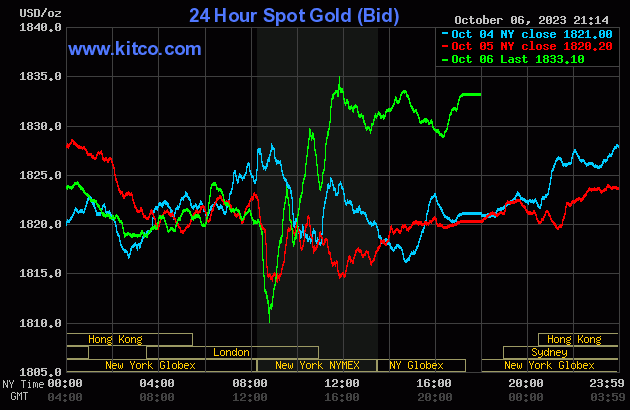

The gold price wandered quietly and unevenly higher in GLOBEX trading overseas on Friday — and that lasted until around 12:25 p.m. China Standard Time on their Friday afternoon. It then had a down/up move that ended around 11:15 a.m. in London. It was sold a bit lower from there until the jobs number hit the tape at 8:30 a.m. in New York — and gold’s low tick of the day was set about fifteen minutes later. Then away it went to the upside…running into ‘something’ twice during its rally, which was capped at 11:30 a.m. EDT in COMEX trading. It had two down/up moves after that…neither of which was allowed above its 11:50 a.m. high tick.

TRUTH LIVES on at https://sgtreport.tv/

The low and high ticks, both of which were set in COMEX trading in New York, were reported as $1,823.50 and $1,849.00 in the December contract. The October/December price spread differential in gold was $15.00…December/ February was $19.20…February/April was $18.50 — and April/June was $18.70 an ounce.

Gold was closed in New York on Friday afternoon at $1,833.10 spot, up $12.90 on the day. Net volume was extremely heavy at a bit under 214,000 contracts — and there were a bit over 17,000 contracts worth of roll-over/switch volume out of December and into future months.

Judging by the fact that another 390 gold contracts were traded in October yesterday, one has to suspect that more gold contracts were added to October deliveries.

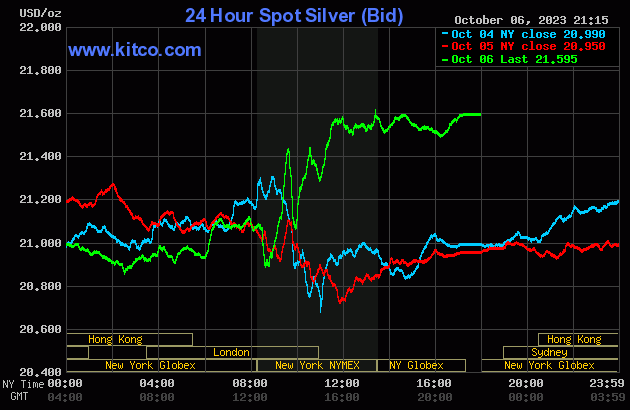

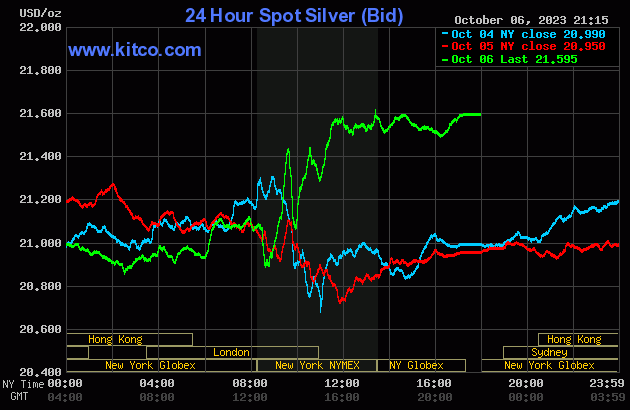

In all respects that mattered, the price action in silver was the same as gold’s…including its COMEX rally getting capped at 11:30 a.m. in New York. All its quiet rally attempts after that were turned aside as well.

The low and high ticks in silver at the close in New York on Friday were recorded by the CME Group as $20.94 and $21.78 in the December contract. The December/March price spread differential in silver at the close in New York yesterday was 32.9 cents…March/May was 23.0 cents — and May/July was 22.1 cents an ounce.

Silver was closed on Friday afternoon in New York at $21.595 spot, up 64.5 cents from Thursday. Net volume was certainly on the heavier side at a bit under 78,000 contracts — and there were a bit over 6,600 contracts worth of roll-over/switch volume out of December and into future months in this precious metal…almost all into the first three scheduled delivery months of the New Year.

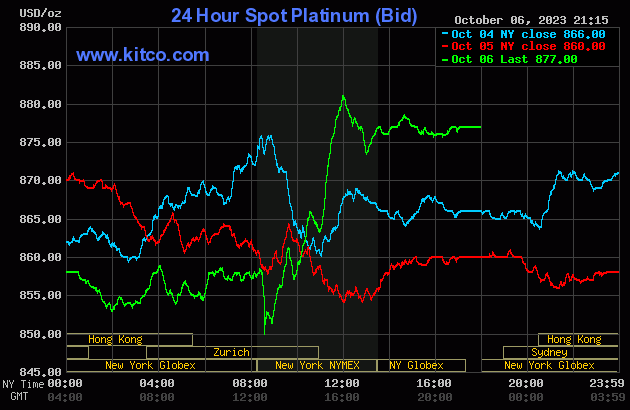

Platinum had a very broad and very uneven but quiet down/up move from the time that GLOBEX trading commenced on Thursday evening in New York — and until 8:30 a.m. EDT on Friday morning. It was blasted lower at that point — and it took off like a scalded cat moments after that. Its price was capped at precisely noon in EDT — and it was sold unevenly lower from the until the market closed at 5:00 p.m. EDT. Platinum was closed at $877 spot, up 17 dollars on the day.

The palladium price had a quiet and shallow down/up move that lasted until around noon China Standard Time on their Friday — and it was then sold lower until around 9:15 a.m. in GLOBEX trading in Zurich. Its ensuing rally was capped around 11:50 a.m. CEST — and it was sold lower anew until the 10 a.m. EDT afternoon gold fix in London. Its rally from there ran into ‘something’ around 11:45 a.m. EDT in New York — and from that juncture was sold quietly and unevenly lower until 4 p.m. in the very thinly-traded after-hours market. It didn’t do much after that. Palladium was closed at $1,134 spot, up 9 bucks from Thursday.