by Pam Martens and Russ Martens, Wall St On Parade:

A group of academics have conducted a study that found that during the fastest pace of Fed interest rate hikes in 40 years, the majority of U.S. banks failed to hedge their interest rate risk. The report’s findings include the following:

“Over three quarters of all reporting banks report no material use of interest rate swaps.”

“Only 6% of aggregate assets in the U.S. banking system are hedged by interest rate swaps.”

“Banks with the most fragile funding – i.e., those with highest uninsured leverage — sold or reduced their hedges during the monetary tightening. This allowed them to record accounting profits but exposed them to further rate increases. These actions are reminiscent of classic gambling for resurrection: if interest rates had decreased, equity would have reaped the profits, but if rates increased, then debtors and the FDIC would absorb the losses.”

TRUTH LIVES on at https://sgtreport.tv/

The use of the phrase “classic gambling” to describe 75 percent of the U.S. banking system by highly credentialed academics might be something that the U.S. Senate Banking Committee might want to hold a hearing about with some sense of urgency.

Not to put too fine a point on it, but this is the year in which banking regulators were left scratching their heads at the dizzying speed at which multiple banks collapsed. In the span of seven weeks this spring, running from March 10 to May 1, the second, third, and fourth largest bank failures in U.S. history occurred. In order of size, those were: First Republic Bank (May 1), Silicon Valley Bank (March 10) and Signature Bank (March 12). The largest bank failure in U.S. history, Washington Mutual, occurred in 2008 during the financial crisis.

An equally disturbing finding in the report is that the very largest banks in the U.S. – the ones that pose systemic risk to both the banking system and the U.S. economy – only hedge “one third of their securities.” The report notes that “Overall, largest banks rely on hedging most, but these hedges leave the vast majority of interest rate risk unhedged.”

The researchers write the following regarding the collapse of Silicon Valley Bank:

“One might conjecture that banks more exposed to solvency runs would have larger incentives to avoid further asset value declines and thus avoid failure, so they might want to increase their hedging activities. Instead, we find that banks with higher uninsured leverage (higher share of uninsured deposit funding) sold or reduced their hedges during 2022. Because of reduced hedges, these banks went on to suffer larger losses when interest rates increased further. A case study of the recently failed Silicon Valley Bank (SVB) is illustrative. SVB hedged about 12% of all [of their own] securities at the end of 2021. By the end of 2022, they hedged only 0.4% of all [of their own] securities. During this period, the duration of their assets increased by almost two years. So, every additional percentage point increase in the policy rate led to a two-percentage point larger decrease in asset values than it would have in 2021. Reduction in hedges by the banks with more fragile funding is suggestive of gambling for resurrection. Selling profitable hedges allows weak banks to increase current accounting earnings. At the same time these banks have taken a large risk, which is profitable for bank shareholders on the upside, but the losses are borne by the FDIC on the downside.”

Shareholders eventually pay the piper as well. The publicly-traded parent company of Silicon Valley Bank, SVP Financial Group, has gone from a share price of more than $300 in February to a closing share price of 5 cents yesterday. For more on how this federally-insured bank was operated, see our report: Silicon Valley Bank Was a Wall Street IPO Pipeline in Drag as a Federally-Insured Bank; FHLB of San Francisco Was Quietly Bailing It Out.

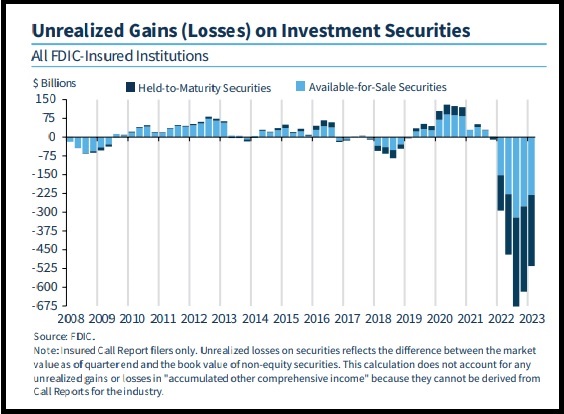

As a result of this lack of hedging, according to the FDIC’s quarterly report for the quarter ending March 31, 2023, unrealized losses on securities at U.S. banks stood at the staggering sum of $515.5 billion.

The study on hedging is titled: Limited Hedging and Gambling for Resurrection by U.S. Banks During the 2022 Monetary Tightening? Its authors are Erica Jiang, Assistant Professor of Finance and Business Economics at USC Marshall School of Business; Gregor Matvos, Chair in Finance at the Kellogg School of Management, Northwestern University; Tomasz Piskorski, Professor of Real Estate in the Finance Division at Columbia Business School; and Amit Seru, Professor of Finance at Stanford Graduate School of Business.

Read More @ WallStOnParade.com