by Mish Shedlock, Mish Talk:

The leading candidate in the Argentina presidential election promises dollarization.

The leading candidate in the Argentina presidential election promises dollarization.

Libertarian Javier Milei Leads Polls After Primary Shock

Reuters reports Milei Leads Polls in Argentina Election After Primary Shock

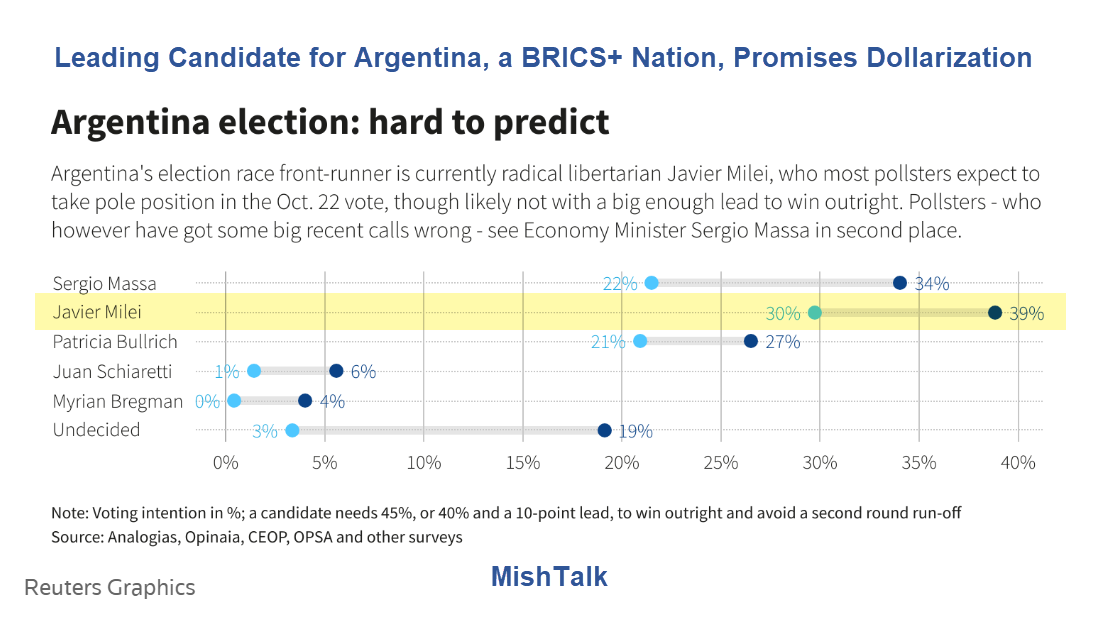

Argentina’s pollsters, caught out by the surprise win of radical libertarian Javier Milei in August’s presidential primary, now show him easing to first place in an Oct. 22 general election, likely ahead of ruling party economy chief Sergio Massa.

TRUTH LIVES on at https://sgtreport.tv/

Milei, an economist and former TV pundit, has rattled the political elite with loud, sometimes expletive-ridden critiques of his rivals, along with pledges to shutter the central bank, slash the size of the government and dollarize the economy.

“The result of the primaries was shocking, and the result of the general election will be shocking whatever its result is,” said Analogias communication director Marina Acosta, citing the race being “colored by political novelty.”

Milei, who made a name for himself as a “shock jock” TV commentator, has struck a chord with angry Argentine voters grappling with 113% inflation, a cash-strapped government, sagging economy and some four-in-ten people in poverty.

His closest competitor now appears to be Massa, part of the ruling center-left Peronist coalition, seemingly offering two opposing economic models for the embattled country.

“Milei’s and Massa’s strategies are meant to be polar opposites from the other,” said political analyst Julio Burdman from consultancy Observatorio Electoral. “They are doing that quite well, which is letting them both make gains.”

What Is Dollarization, and Why Is Argentina Considering It?

Bloomberg addresses the question What Is Dollarization, and Why Is Argentina Considering It?

- What is dollarization?

It means adopting the US dollar as the legal tender and unit of account. Full dollarization means all local currency in circulation is exchanged for greenbacks, and all assets and contracts are converted to dollars. A country can make such a move unilaterally, without consultation with the US.- Who uses the dollar besides the US?

Four sovereign nations that have abandoned their currencies to adopt the dollar are: Panama, Ecuador, Timor-Leste, El Salvador, which in 2001 effectively dropped the colon — still an official currency, but not in circulation — for the dollar. In 2021, El Salvador added Bitcoin as another legal tender.- Why would a country do this?

By adopting another currency, a country gives up the power to print more money and thus eliminates the main driver of inflation. That’s why dollarization is in part an act of political capitulation: It acknowledges a loss of faith in the ability of elected and appointed officials to maintain a sustainable fiscal policy.- Why is dollarization a topic in Argentina?

It’s been proposed by Javier Milei, a libertarian economist and flamboyant populist who has emerged as the leading candidate in Argentina’s presidential campaign. (The first-round vote is Oct. 22.) Dollarization is one of his campaign pledges aimed at putting a lid on inflation that’s running at more than 110% a year. “The peso melts like ice in the Sahara Desert,” Milei often says of the currency’s rapid depreciation.- What’s the downside?

The biggest problem associated with dollarization is the loss of an independent monetary policy. Countries that adopt the greenback can’t adjust interest rates to regulate the supply of money in response to changing economic conditions. That function is essentially outsourced to the US Federal Reserve, which sets rates according to the needs of the US economy. At times, that can mean misaligned priorities. At present, for instance, Argentina’s economy is expected to contract by more than 2% in 2023, according to a Bloomberg survey, while the Fed is maintaining a tight monetary policy to fight inflation. Also, dollarization does not, by itself, impose fiscal discipline on government leaders; it merely eliminates the ability to avoid default by printing money.

There are more points in the Bloomberg article. I put a spotlight on five of them.

Six New Countries to Join BRICS, Including Argentina

At the 15th annual BRICS summit, which concluded August 24, the group agreed to admit six new nations: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, United Arab Emirates.

BRICS is acronym that stands for Brazil, Russia, India, China, and South Africa.

Despite the preposterous hype about “new global order”, a Gold-Backed-BRICS currency, and dollar avoidance, the only result was adding another six nations to the block that have little in common.