by Wolf Richter, Wolf Street:

Trillions whooshing by so fast they’re hard to see.

Trillions whooshing by so fast they’re hard to see.

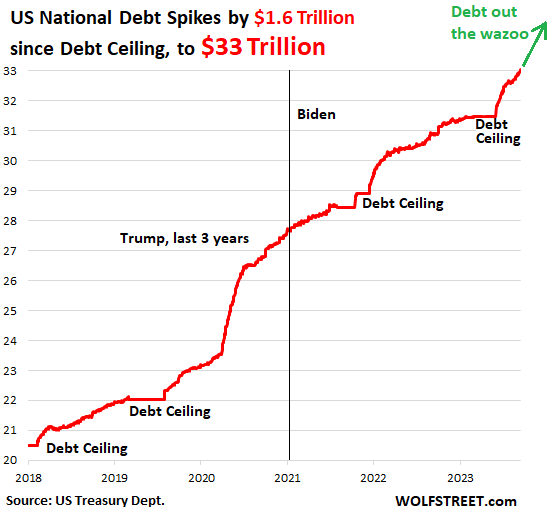

The total US national debt spiked by $1.58 trillion since the debt ceiling was lifted, and by $2.16 trillion from a year ago, to $33.04 trillion, according to the Treasury Department’s figures this afternoon.

A stunning amount of new debt that is getting piled on in a stunningly short amount of time, even as the economy has been growing at decent rates! Congratulations, America

TRUTH LIVES on at https://sgtreport.tv/

This $33.03 trillion of debt is composed of two piles of Treasury securities:

$6.8 trillion of nonmarketable Treasury securities. They’re not traded in the market; they’re held by US government pension funds, the Social Security Trust Fund, etc. And a portion of it is held directly by Americans in form of the popular I-bonds and the less popular EE savings bonds. This balance has remained roughly unchanged since the debt ceiling and is up by $210 billion year-over-year.

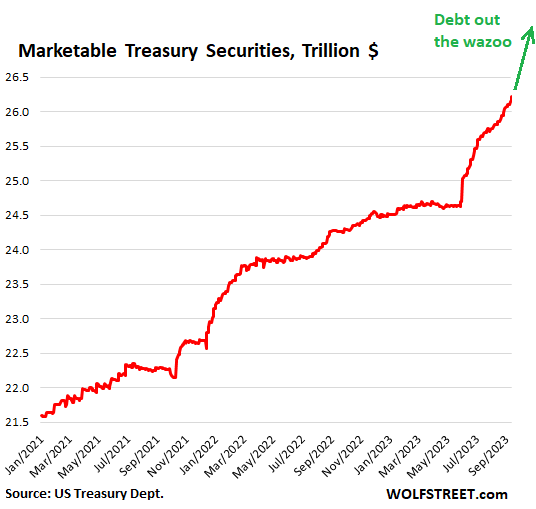

$26.2 trillion in marketable securities. They’re held and traded by the global public, from regular folks to big funds and financial institutions, including central banks. The Fed is now down to $4.98 trillion, after having unloaded $783 billion under QT.

Marketable securities outstanding have spiked by $1.51 trillion since the debt ceiling was lifted on June 2, a huge amount of additional issuance in three-and-a-half months, and by $1.9 trillion year-over-year.

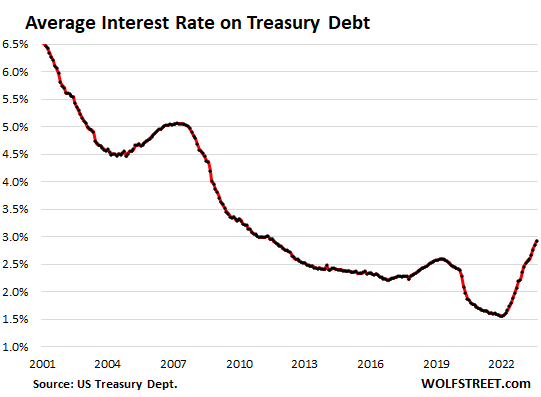

The average interest rate rose to the highest since 2011. The newly issued Treasury securities to fund the new deficits and to replace maturing securities come with higher interest rates than the securities issued years ago that are now maturing and need to be replaced.

So the average interest rate paid on all interest-bearing Treasury securities rose to 2.92% at the end of August, according to the Treasury Department, the highest average rate since 2011. But wait… since 2011, the debt has more than doubled – it surged by 120% since September 2011.

But this average rate is still cheap, given that T-bills now yield about 5.5%, the two-year yield is over 5.0%, and the 10-year yield is at 4.3%:

This $2.2 trillion added debt over the past 12 months reflects the current tsunami of deficit-spending. Deficit spending is stimulative for the economy, so this is great news for economic growth – if that’s all you look at – but this additional demand also adds fuel to inflation, and the debt pileup is an intractable horror show for the future.

If the government runs those kinds of deficits where the debt spikes by $2.2 trillion in 12 months, what will the debt do if there ever is an economic downturn, when deficits typically blow out further as outlays rise and tax receipts plunge? That was a rhetorical question.

We Made it! Government Debt Spikes past $33 Trillion: +$1.6 Trillion since Debt Ceiling, +$2.2 Trillion from Year Ago

We Made it! Government Debt Spikes past $33 Trillion: +$1.6 Trillion since Debt Ceiling, +$2.2 Trillion from Year Ago