from ZeroHedge:

As Bloomberg’s Garfield Reynolds writes in the aftermath of last night’s unexpected Chinese rate cut, while the nation’s economic struggles were (finally) severe enough for the authorities to respond with their biggest interest-rate cut since the pandemic, it will be nowhere near powerful enough to help spark a turnaround.

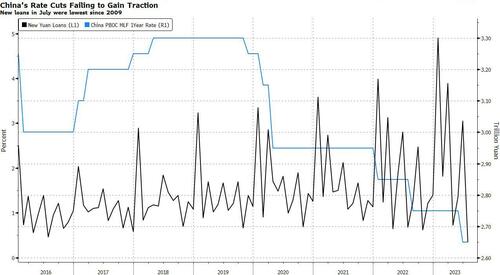

For a start, Reynolds writes, that scope “is rather less impressive when you realize the reduction in the rate on one-year PBOC loans — or medium-term lending facility — was all of 15 basis points. Most central banks faced with the sort of slowdown China is facing might well decide to cut by three times as much or more.”

TRUTH LIVES on at https://sgtreport.tv/

The real difficulty for China is that previous reductions haven’t done all that much to galvanize lending in order to stimulate activity; after all as we have discussed previously, one can’t fix a lack of demand problem with more supply (one can , however, create asset bubbles).

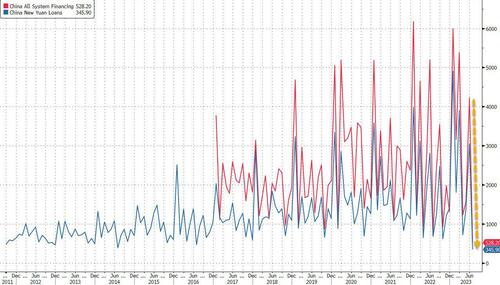

Furthermore, as we observed on Sunday, China’s new loans tumbled in July to the lowest since 2009…

…. and the PBOC’s ever-increasing interest-rate benchmarks were all at multi-year lows even before this month’s reduction.

Part of the reason for the lack of demand is the ongoing woes in the key property sector, though the situation also underscores concerns that China is tipping into a balance-sheet recession in which companies avoid fresh borrowings in order to service and pay down their existing debt.

As China slides into a Japan-style balance sheet recession and the resulting deflation – as recently discussed by Richard Ku – it is facing even bigger problems than just a garden-variety property and/or debt crisis.

Indeed, as Rabobank’s Michael Every cites the Economic Observer, a subsidiary of Xinhua News Agency, which published a newsletter titled “Finance Bureau Chiefs in the Past Half Year”, and which concluded that local government finances and the national economy are reportedly “on the verge of collapse, and the thunder will explode at any time.” To be sure, recent events ensure the coming collapse:

- Country Garden just defaulted;

- Zhongzhi Enterprise Group missed payments on high-yield investment products;

- recent bank loan data were terrible;

- and today saw industrial production 3.7% y-o-y (4.3% expected),

- retail sales 2.5% y-o-y (vs. 4.0%),

- fixed asset investment 3.4% y-o-y year-to-date (vs. 3.7%),

- property sales -8.5% y-o-y year-to-date (vs. -8.1%),

- and unemployment 5.3% vs. 5.2% (not to mention that youth unemployment which just hit all time highs, will no longer be reported for obvious reasons).

Summing it up, China “has fallen into a psycho-political funk,” says the FT, as its youth tell Soviet jokes again or say ‘let it rot’, and a high-earning Beijing worker is quoted as saving as much as he can to prepare for a property crash or a move against Taiwan.