by Alasdair Macleod, Schiff Gold:

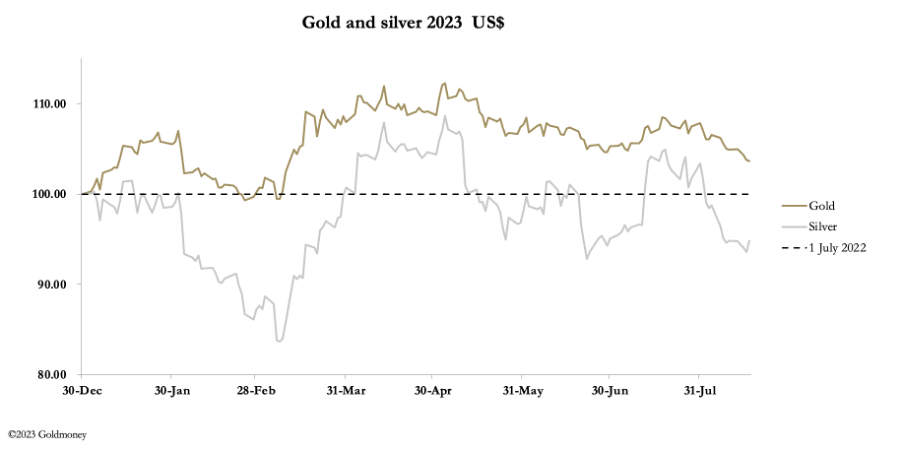

The sell-off in precious metals which started in late July continued this week, but its momentum slowed with silver even showing a modest gain on the week so far. In early European trading, gold was $1892, having traded down to $1885 yesterday, for a net fall of $19 on the week. Silver was $22.78 having traded down to $22.30 on Tuesday but is up just 10 cents from last Friday’s close. On Comex, turnover in the gold contract was subdued, but in silver it was moderate to healthy.

TRUTH LIVES on at https://sgtreport.tv/

In silver, the Commitment of Traders report for 8 August showed the Managed Money category was net short 3,781 contracts, with very low levels of longs and shorts making the balance. It seems that the trading community has withdrawn from this contract. And the Swaps unusually are sitting on net longs of 499 contracts. It is the Non-Reported category which has sold down its net long position. This is up next.

With Open Interest on Comex being low (it has been lower recently, down to 114,421 on 3 July, compared with 137,406 on Wednesday), silver is ripe for a substantial bear squeeze, when interest in gold resumes.

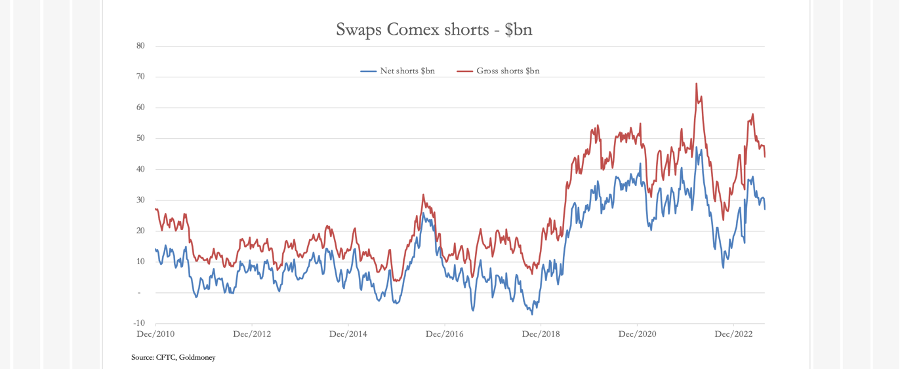

Paper markets assume two things are working against gold: a dollar which appears to have stabilised recovering from recent lows, and rising interest rates. In the last fortnight, it has become apparent that lower interest rates are even further away, and government bond yields are continuing to rise. US, Eurozone, and UK bond yields are hitting multi-year highs. For the Swaps trying to recover their shorts, this is manner from Heaven but there is some way for them to go, as the next chart illustrates.

These are comprised mostly of bullion bank trading desks, which face two problems. Senior dealers are probably on holiday, leaving their juniors with instructions not to do anything rash, and this coming week sees the BRICS summit in Johannesburg, which could have a significant impact on the gold price. Additionally, the September gold contract on Comex is approaching expiry, and they will want to control the price so that the $1900 strike options expire worthless.

In that sense, this week’s dip below $1900 can be regarded as testing the water. But the BRICS summit starts next Tuesday, and over the course of the two-day meeting, either rumours of a new trade settlement currency backed by gold will be confirmed or laid to rest. Gold backing any currency is like a Dracula to fiat currencies, and the gold/dollar relationship can be expected to react accordingly.