from ZeroHedge:

By Benjamin Picton, Senior Macro Strategist at Rabobank

Here Be Dragons

I’ve been away on holiday for the last two weeks trying my best to pay more attention to my children than I do to the markets. Mission accomplished for the most part, but it has been hard to look away while momentous shifts seem to be occurring all around us. Indeed, at the Jackson Hole symposium over the weekend, ECB President Lagarde re-upped her comments from April by suggesting that “there are plausible scenarios where we could see a fundamental change in the nature of economic interactions”, “past regularities may no longer be a good guide for how the economy works” and “there is no pre-existing playbook for the situation we are facing.” Translation: “we really don’t know if rates are high enough or not, and that isn’t really the point anyway.”

TRUTH LIVES on at https://sgtreport.tv/

So, according the second most senior central banker in the world we’re in uncharted waters, and as anyone who has ever taken an interest in the Age of Discovery will know, once you reach the edge of the known world, here be dragons.

The most obvious dragon is of course China, and its surrogates, which are making new attempts at formalizing challenger status to the G7 via the BRICS bloc. Michael Every notes:

The BRICS just expanded to allow in Argentina, Ethiopia, Egypt, Saudi Arabia, the UAE, and Iran, so with much hullabaloo we can colour in more countries, GDPs and commodities (like oil) as ‘anti-dollar’. However, Argentina is a serial defaulter with a plummeting currency, and may dollarize soon; Ethiopia is one of the world’s poorest countries, and recently brushed with civil war; Egypt has a wilting currency; Saudi Arabia and the UAE have their currencies pegged to the US dollar, and the former is haggling over a US defence deal and nuclear tech; and Iran is heavily sanctioned, again with a collapsing currency, and could be daggers drawn again with Saudi at any time. In short, the world is changing, but as the FT has pointed out, the BRICS+ (a name created by Goldman Sachs) don’t even have an official website. Meanwhile, it was the Euro, not the dollar, that saw its share of SWIFT transactions collapse to a record low in the latest data. You want to look at potential early victims of any global tectonic shifts? Look there.

This reads as a very ragtag group, with “relationships” built mainly around a common outsider status and no small dose of opportunism in seizing a perceived first-mover advantage in undermining dollar hegemony. We remain sceptical. As we’ve covered in this publication many times, the idea of commodity standard like some kind of petro-Yuan is laden with problems.

The auspices aren’t great for the new alternative multilateralism. The putative centre of the BRICS+ bloc, China, is struggling to revive its flagging growth engine while economic remedies that are taken as orthodox in the West are shunned for their perceived incompatibility with Xi Xinping thought. Markets have been waiting for months for signs of big-bang stimulus from the CCP or the PBOC, but as the WSJ reports, maybe it just ain’t coming. Chinese perceptions that Western consumerism is flabby, decadent and morally obtuse stands at odds with the need for China to fulfil the role of deficit-runner in order to get enough Yuan into the hands of the periphery. How can Argentina, Brazil, Iran and Egypt buy virtuous Chinese manufactures if they don’t have any Yuan? The answer here is that trade will continue to be conducted in dollars, one way or another.

China clearly has little appetite for further credit expansion either. The CCP has made several attempts over the years to rein-in debt levels, all of which have ultimately been abandoned in the face of a stalling economy. For the time being, Xi Xinping is resisting large-scale easing of credit conditions, urging “patience” while the economy passes through what policy-makers hope is a temporary soft patch, rather than the start of a Japan-style stagnation brought on by decades of malinvestment and speculative pump-priming of real estate assets.

The real question now is how strong the CCP and the PBOCs resolve to address burgeoning debt-levels will be in the face of economic slowdown. For an authoritarian regime whose legitimacy is built on the delivery of rapidly rising living standards, slow growth poses a potentially existential risk. The obvious retort here is that authoritarian states have no need to court popular opinion, but the speed at which the Covid-Zero policy was ultimately abandoned in the face of civil discontent should serve as an indication that the CCP is ultimately still sensitive to what the population thinks.

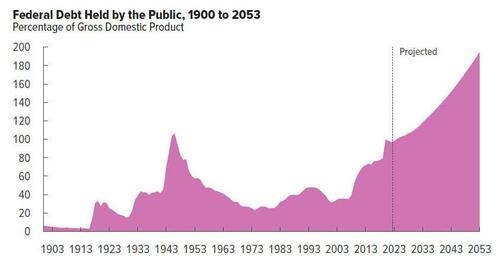

Looking back to Jackson Hole it’s fair to say that debt and popular discontent aren’t a uniquely Chinese problem. During the meeting of rich men north of Richmond (Jackson Hole is north of Richmond, I checked) a paper presented by Barry Eichengreen and Serkan Arslanap broke the bad news that “public debts will not decline significantly for the foreseeable future”, “primary surpluses of… 3 to 5 percent of GDP are very much exceptions to the rule” and that “inflation is not a sustainable route to reducing high public debts.” That all makes for sobering reading for already beleaguered millennials and Gen Z’s, who will be the can carriers for Eichengreen and Arslanap’s prognosis that “given ageing populations, governments will have to find additional finance for healthcare and pensions”.