by Ronan Manly, BullionStar:

Poland’s central bank, Narodowy Bank Polski (NBP), has been back buying gold again during the month of July, and in a big way.

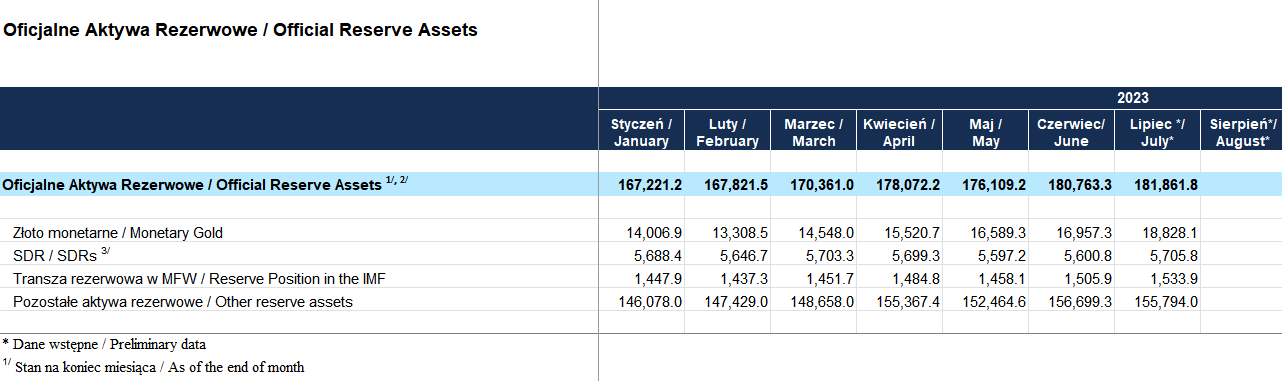

Latest “official reserve assets” data from the NBP website, and the IMF’s International Financial Statistics (IFS) database, show that at the end of July 2023, the NBP added more than 22 tonnes of monetary gold to its gold holdings compared to the end of June 2023.

TRUTH LIVES on at https://sgtreport.tv/

This means that the NBP has been buying gold for 4 consecutive months now, and over that time has added 71 tonnes of gold to its monetary gold reserves: 14.93 tonnes during April, 19.91 tonnes during May, 13.69 tonnes during June, and now another 22.39 tonnes during July.

This also means that July’s gold buying by the Polish central bank has been the largest monthly addition by the bank so far this year. Following July’s gold purchases, the NBP now holds 299.47 tonnes of gold, within a whisker of 300 tonnes.

With 300 tonnes of sovereign gold reserves, this also puts Poland into the Top 20 sovereign and supranational holders of gold worldwide, in 20th position, and in 18th position when excluding the IMF and ECB.

The gold on the Polish central bank’s balance sheet is now worth € 17 billion (at the end of July), up from € 15.65 billion (at the end of June). In US dollar terms, Poland’s gold is now worth US$ 18.83 billion (at the end of July), up from US$ 16.96 billion (at the end of June).

The July purchase of 22.4 tonnes of gold also boosts the NBP’s “Gold as a % of Total Reserve Assets” ratio from 9.4% to 10.3%, and although now in the double digits, this is still far less than the “Gold as a % of Total Reserve Assets” of most of the large gold holding central banks of European Union countries, such as Germany, France, Italy, Netherlands, Belgium, Austria, Portugal and Spain.

Predictions coming True

The July gold buying by the NBP shouldn’t come as any surprise for those that read the recent BullionStar article “Poland’s 50/50 gold buying: 50 tonnes bought over 3 months, but another 50 tonnes to go”.

That article, dated 2 August 2023, explained that the NBP has a plan to buy at least 100 tonnes of gold this year (probably in London), and then promptly fly this 100 tonnes of gold back from London to Poland. To quote:

“NBP’s 100 tonnes of gold buying is now materializing in 2023, with 48.5 tonnes already complete. Similar to 2019, the NBP is most likely buying its gold in London in the interbank market with the help of the Bank of England.

At the current rate of accumulation over April – June 2023, this means that the Polish central bank could buy another 50 tonnes between July 2023 and September 2023.”

That part of my prediction above is coming along right on schedule.

And the second part of my prediction is that the Poles will fly this newly acquired 100 tonnes of gold back to Poland (mostly to the NBP Treasury building in Poznań) using the same air cargo and security transport logistics that they did during 2019. As explained in the same article:

“Similar to 2019, and in line with what Glapiński [NBP President Adam Glapiński] said that ‘we want to buy at least another 100 tonnes of gold and keep it in Poland as well’, this additional 100 tonnes of gold will then be repatriated by air from London back to Poland, probably during the last quarter of 2023, possibly starting in October.”

The Data on July’s NBP Gold Buying

Each month, the Polish central bank, like many central banks across the world, contributes its monetary gold holdings information (in millions of troy ounces to 2 decimal places) to the International Financial Statistics (IFS) database of the international Monetary Fund (IMF). In turn, the World Gold Council (WGC) bases its central bank gold holdings data on the IFS data (for countries that contribute to the IFS).

However, this IFS data is lagged somewhat, and for example, for Poland’s July gold holdings, was only updated to the IFS database on Friday 10 August.

However, the Polish central bank directly publishes updated monetary gold holdings with a shorter lag, just one business week after month end. The NBP does this via its publication of monthly official reserve assets, which this month was published on Monday 7 August.

Looking at the July 2023 release of the NBP’s official reserve asset report (which is an Excel report – see here), we see in tab 3 (US dollar version) that the value of Poland’s monetary gold holdings was US$ 18,828.1 million at the end of July. This is a month end valuation based on the LBMA Gold Price on 31 July 2023.

For some reason, the NBP uses the ‘AM’ (morning) LBMA Gold Price for its month end valuation and not the ‘PM’ (afternoon) version, and on 31 July, the AM LBMA Gold Price (settled by a bullion bank auction of unallocated gold credit) was US$1955.55 per troy ounce.

SHOCK! Time Travel is real and here’s how it works, government has been hiding it | Redacted

SHOCK! Time Travel is real and here’s how it works, government has been hiding it | Redacted