by Pam Martens and Russ Martens, Wall St On Parade:

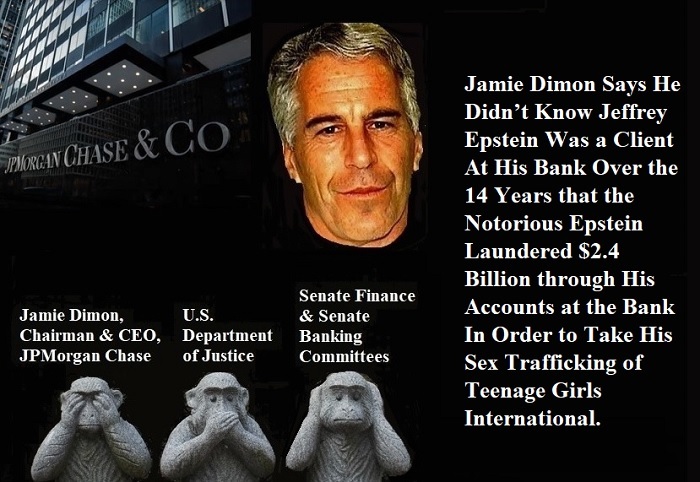

Jamie Dimon is between a rock and a hard place. He is either going to have to convince a jury come October that he was left in the dark by the bank’s general counsel, his compliance and money laundering executives, and the heads of his investment bank and asset and wealth division about the fact that notorious child molester Jeffrey Epstein was a client at the bank for more than a decade – which would make Dimon sound so isolated as to be unfit to be running the bank – or Dimon is going to have to admit that he lied under oath in his federal court deposition. Neither is a comfortable proposition to be facing for a jury trial currently scheduled for October 23.

TRUTH LIVES on at https://sgtreport.tv/

JPMorgan Chase is currently facing off against three federal lawsuits before Judge Jed Rakoff in the Southern District of New York that charge the bank with facilitating Epstein’s sex trafficking operation, which included dozens of underage school girls. One lawsuit was brought by Epstein’s victims; another by the Attorney General of the U.S. Virgin Islands where Epstein owned an island compound; and a third by shareholders of the bank, which name the bank, Dimon, another bank executive and specific Board Members as defendants.

It is the lawsuit brought by the Attorney General of the U.S. Virgin Islands that is currently scheduled for trial on October 23 that poses a significant amount of legal peril for Dimon. That lawsuit alleges that JPMorgan Chase not only “facilitated” Epstein’s crimes against women and girls but “actively participated in Epstein’s sex trafficking venture.”

According to the transcript of Dimon’s deposition conducted on May 26, his position is this:

“I don’t recall knowing anything about Jeffrey Epstein until the stories broke sometime in 2019. And I was surprised that I didn’t even — had never even heard of the guy, pretty much, and how involved he was with so many people.”

Dimon’s reference to stories breaking in 2019 is because the U.S. Department of Justice, which had cut Epstein a notorious sweetheart deal in 2007 that provided him a non prosecution agreement and allowed him to plead to two counts of procuring prostitution (instead of multiple counts of rape and sexual assaults of underage schoolgirls) finally got around to bringing federal sex trafficking charges against Epstein in 2019 – after Epstein and his wealthy pals had raped and sexually assaulted hundreds of other girls.

The details of that 2007-2008 sweetheart deal had been making headlines for years – headlines that Dimon somehow missed, despite testifying in his deposition that he read multiple newspapers daily. In addition to newspaper headlines, bestselling author, James Patterson’s book, “Filthy Rich,” covering Epstein’s sexual assaults of young girls had been released in 2016 and Julie Brown’s blockbuster series on Epstein’s crimes in the Miami Herald in 2018 had caused a viral media storm. But Dimon somehow missed it all.

Dimon’s general counsel from 2007 to 2015 was Stephen Cutler, the former Director of the Division of Enforcement at the Securities and Exchange Commission. Cutler stepped down as General Counsel in 2015 to become Vice Chairman at JPMorgan Chase and a senior advisor to Dimon and the bank’s Board of Directors. He served in that position until 2018 when he left the bank to join the law firm Simpson Thacher & Bartlett. It is almost inconceivable that in all those years Cutler would not have brought the reputational risk that Epstein posed to the bank to the attention of Dimon or the Board.

According to emails obtained by the U.S. Virgin Islands in discovery, Cutler was aware of Epstein’s history and the existence of his accounts at the bank from at least 2011. Cutler reported directly to Dimon and his office was located next door to Dimon’s office. The emails show that Cutler was against keeping Epstein as a client. It is only common sense that someone higher up than Cutler would have had to overrule him. That suggests some interference by Dimon or the Board of Directors to keep Epstein and his accounts at the bank.

Read More @ WallStOnParade.com