by Ed Steer, Silver Seek:

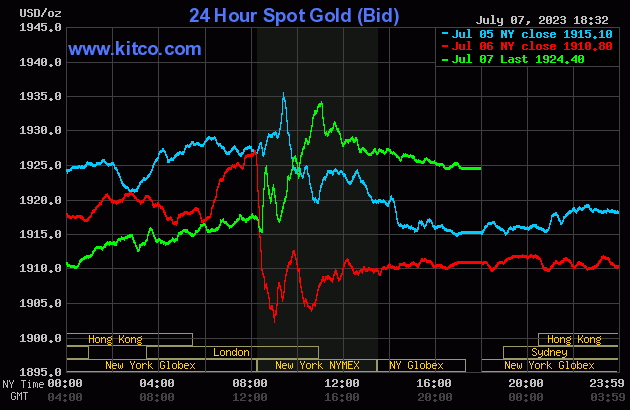

The gold price crept quietly sideways in GLOBEX trading overseas on Friday — and that lasted until around 12:30 p.m. China Standard Time on their Friday afternoon. It began to crawl higher from there until the 8:20 a.m. COMEX open in New York, where it was tapped a bit lower until the 8:30 a.m. EDT jobs number came out. It then blew higher, but ran into a DXY ‘rally’ and ‘da boyz’ five minutes later. It was sold lower for the next thirty minutes, but then away it went to the upside until a couple of minutes after the 11 a.m. EDT London close. The commercial traders of whatever stripe in New York then had the market to themselves — and they proceeded to engineer its price quietly lower until shortly before trading ended at 5:00 p.m. EDT.

TRUTH LIVES on at https://sgtreport.tv/

The low and high ticks in gold were reported as $1,915.40 and $1,941.10 in the August contract. The August/October price spread differential in gold at the close in New York yesterday was $9.70…October/December was $19.60 — and December/February was $19.90 an ounce.

Gold was closed in New York on Friday afternoon at $1,924.40 spot, up $13.60 on the day. Net volume was pretty heavy at a bit over 191,000 contracts — and there were 23,000 contracts worth of roll-over/switch volume on top of that…mostly into December, but with noticeable amounts into October and February as well.

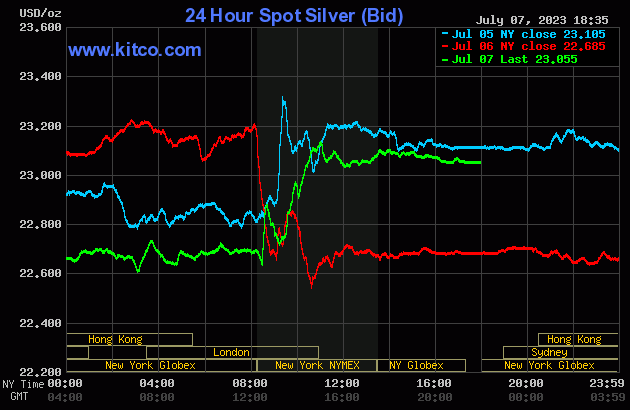

Silver’s price path was a carbon copy of gold’s, except its COMEX rally was capped at precisely 11 a.m. EDT, the London close — and although sold a bit lower after that, it wasn’t by a lot.

The low and high ticks in it were recorded by the CME Group as $22.80 and $23.365 in the September contract. The July/September price spread differential in silver at the close in New York yesterday was 19.7 cents… September/December was 32.8 cents — and December/March was 33.8 cents an ounce.

Silver was closed on Friday afternoon in New York at $23.055 spot, up 37 cents from Thursday. Surprisingly once again, net volume was very much on the lighter side at a hair over 47,000 contracts — and there were just under 1,800 contracts worth of roll-over/switch volume in this precious metal… almost all into December.

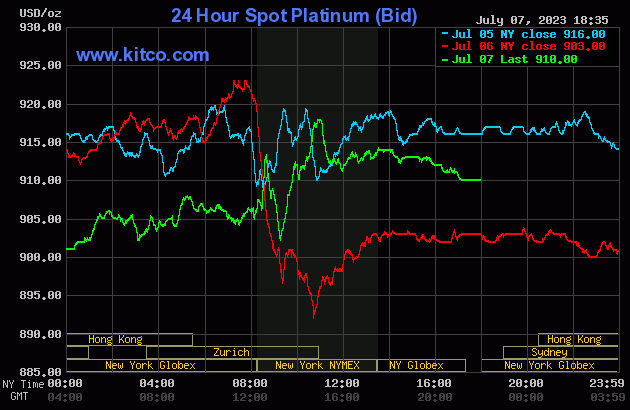

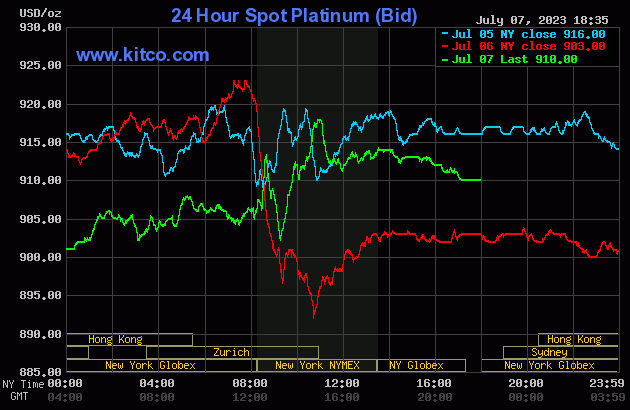

Platinum’s price path was a carbon copy of both gold and silver…including its 11 a.m. EDT Zurich close high tick. It was also engineered lower in price from there until the market closed at 5:00 p.m. EDT. Platinum was closed at $910 spot, up 7 dollars on the day.

Palladium wandered unevenly sideways until price pressure began shortly before 2 p.m. China Standard Time in GLOBEX trading on their Friday afternoon — and it was sold lower until its low tick was set minutes before 11 a.m. in Zurich. Its ensuing rally was then stopped dead it its tracks at $1,230 spot on four separate occasions during the COMEX/GLOBEX trading session in New York — and from around 3 p.m. in the very thinly-traded after-hours market it was sold quietly lower until the market closed at 5:00 p.m. EDT. Palladium was closed at $1,218 spot, up 2 bucks from Thursday — and 18 dollars off its Kitco-recorded high tick.

Silver Prices Ready to Soar! The Shocking Truth Behind Central Bank Collapse and Economic CHAOS!

Silver Prices Ready to Soar! The Shocking Truth Behind Central Bank Collapse and Economic CHAOS!