by Alasdair Macleod, GoldMoney:

It is an error to expect inflation to continue to fall in America. All financial market values in the US and elsewhere are predicated on this hope.

The misunderstanding is to assume that the widely expected recession will lead to further falls in consumer price inflation, and that therefore interest rates and bond yields will decline. These hopes are based on Keynes’s rejection of Say’s law, which simply points out there is no such thing as Keynes’s general glut because the unemployed stop producing.

TRUTH LIVES on at https://sgtreport.tv/

A further point is that banks are increasingly scared of lending risk, which is leading to a credit squeeze. This raises the question, as to how can interest rates fall when there is a growing shortage of credit?

The current economic setup for the US, the Eurozone, and the UK seems set to increase central bank credit replacing commercial bank lending, which will undermine their currencies. Additionally, government funding requirements will increase materially at a time when cross-border investment flows are threatened by financial bear markets.

The timing of a new BRICS gold-backed settlement currency and China’s determination to consolidate the BRICS and Shanghai Cooperation Organisation’s sphere of influence have the potential to offer alternatives for capital flows escaping from the collapsing finances of the western alliance led by America.

Above all, we are witnessing the death of fiat, because it is increasingly difficult to see how the current currency regime based on the dollar will survive.

Market misconceptions

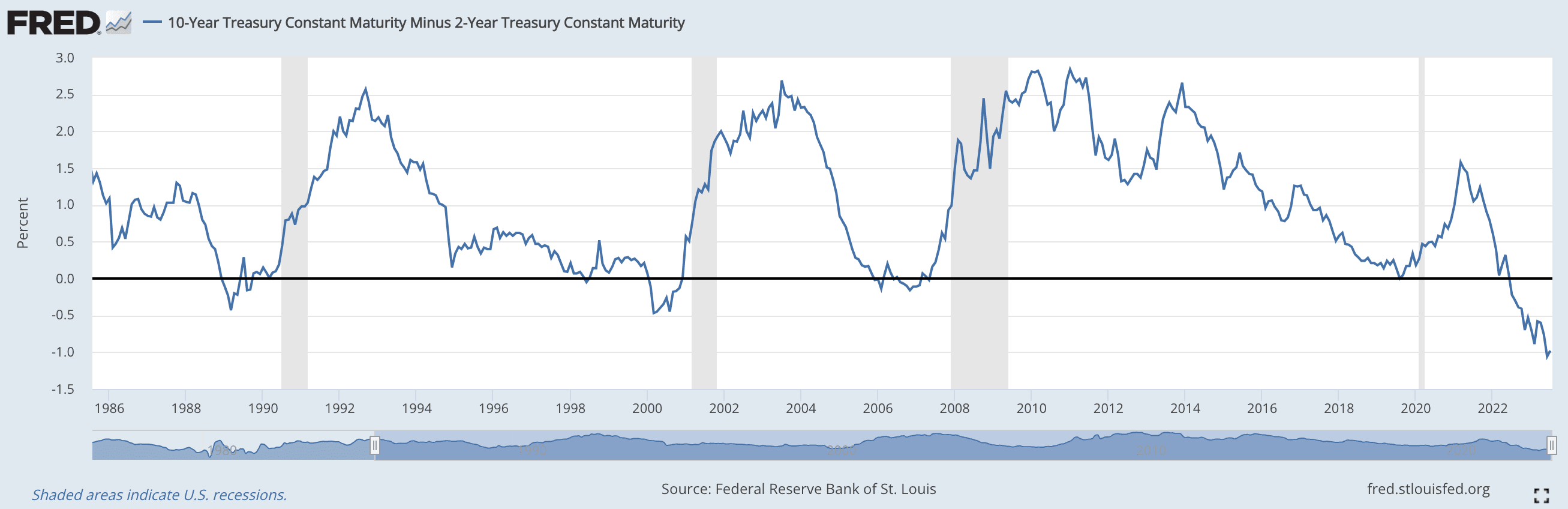

Equities and bonds are priced in the expectation that consumer price inflation will subside and that interest rates will start falling in the not too distant future. This is the underlying reason behind a negative yield curve, with 10-year bond yields yielding significantly less than 2-year maturities. And the chart below shows that this disparity is the highest it has been since the 1980s.

A negative yield curve is also associated with a recession to follow, and the chart confirms that negative yield curves are indeed followed by recessions. But the rate of price inflation will have to remain subdued, because expectations of low long-term rates must be confirmed by events. Indeed, the apparent success of monetary policy over the period covered by the chart without leading to persistent inflation has contributed to the widespread belief that official monetary policies work.

But is the wager in financial markets correct, that this credit cycle will conform with those of the last forty years and that a negative yield curve tells us that with consumer demand dropping, price inflation will subside, and short-term interest rates fall? This is the essence of the belief that bond yields along the yield curve will normalise with lower yields at the front end and that the bull market in equities will remain intact.

Sticking with the chart for the moment, you will notice that at minus 1% the negative yield on the curve far exceeds that of previous occasions, which surely must raise concerns that for once the past is not a guide to the future. Perhaps the forecast recession will be considerably worse than anything in living memory. Perhaps the long end of the yield curve is badly mispriced, being far too low. If the latter is the case, as this article will argue, the outlook for financial asset values is extremely poor.

Illustrated below, charts of the yields on 10-year bonds around the world give little comfort.

Any technical analyst would describe these charts as being in strong bull markets, merely consolidating before going higher. In the cases of Germany and the UK, the shape of the consolidation is immensely bullish. We are, of course, discussing bond yields, which means bond prices are set for further substantial falls. And if bond prices fall, equity values will fall as well. Based on the experience of the last forty years, this is the opposite of what is priced into financial markets.

That a recession will follow seems assured. The bank credit cycle is seeing to that, with money supply not growing or even contracting alarmingly in some jurisdictions. And the neo-Keynesians who make up the bulk of the establishment and investing communities believe recessions are caused by falling demand leading to a glut of unsold products. Therefore, they believe that a recession will always knock inflation on the head. And being forward looking, markets can be expected to discount falling inflation in the expectation of recession.