by Mish Shedlock, Mish Talk:

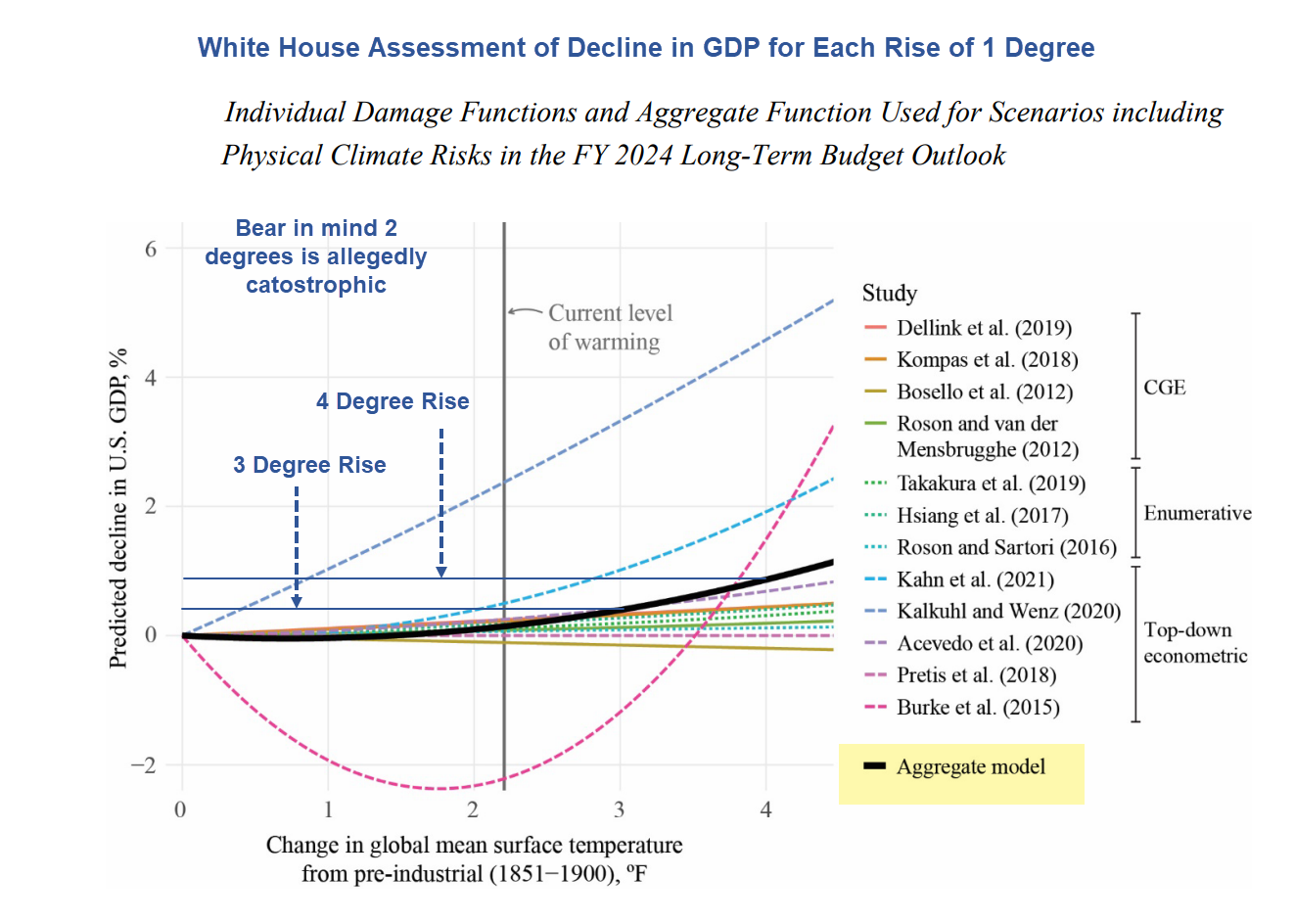

Despite endless fearmongering in numerous places, a study by the White House Council of Economic Advisors shows climate change will have little impact on GDP.

Transition Risks of Climate Change on Macroeconomic Forecasting

We are told by the Biden Administration, the UN, AOC, and all the Grettas of the world that a rise in global temperatures in excess of 1.5 degrees would be catastrophic.

TRUTH LIVES on at https://sgtreport.tv/

With that in mind, please consider a White Paper on the Transition Risks of Climate Change on Macroeconomic Forecasting by Biden’s Council of Economic Advisors and the Office of Management and Budget (OMB)

Climate-related financial risks relevant to the macroeconomic projections in the President’s Budget are composed of two types (Carney 2015): physical risks associated with the effects of climate change on economic outcomes (for instance, capital destruction in extreme events or reduced labor, capital, or land productivity in hotter temperatures) and transition risks associated with the transition to a zero-carbon economy (for example, the costs of mitigation policy or sudden changes in the valuation of assets, such as energy infrastructure with accelerated depreciation). Both have economic implications for important macroeconomic variables related to labor, trade, capital services, and productivity.

This White Paper outlines methodologies and considerations for integrating climate risks into the U.S. Government’s forecasts of macroeconomic conditions. Currently, the Long-Term Budget Outlook captures the fiscal effects of climate change by accounting for estimates of how climate damages affect longer-run GDP growth and how these changes in GDP growth, in turn, affect estimates of Federal revenues and spending.

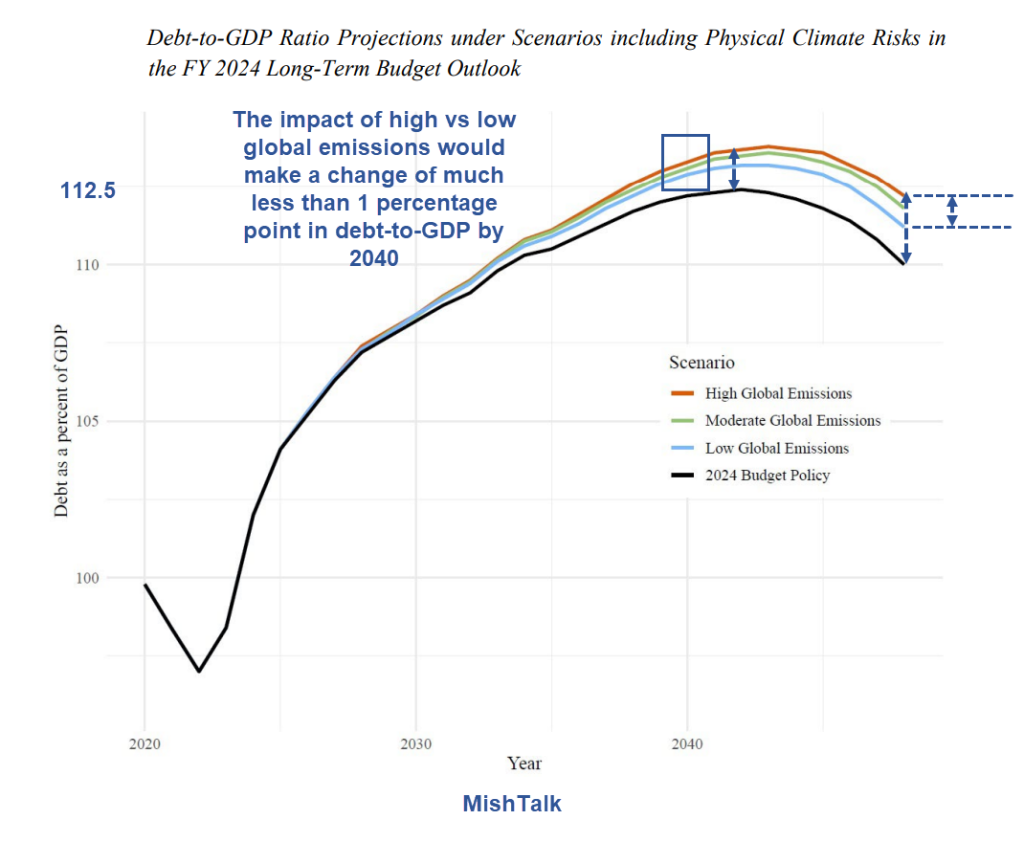

The long-term budget outlook (LTBO) provides projections of fiscal indicators such as the deficit and debt-to-GDP ratio over the next 25 years. These projections depend on long-run economic projections that are likely to be affected by climate change. In FY 2023, the President’s Budget included a single estimate of the effects of physical climate risks: changes to the debt-to-GDP ratio implied by impacts to GDP under a high-emissions, high-warming scenario.

Change in US Debt-to-GDP vs Global Temperature Rise

Moving Too Fast (Emphasis Mine)

Meeting the Administration’s commitment to net-zero greenhouse gas emissions by 2050 will require one of the largest and fastest transformations of the U.S. energy system in history. Ultimately a carbon-free energy system could yield large benefits in the form of lower energy costs, reductions in air and water pollution, and improvements in health in addition to a stable climate. However, as we transition to this new equilibrium, many forces will have important implications for macroeconomic dynamics over the next few decades (Roy et al. 2022). The current energy infrastructure constitutes a large stock of capital. Unplanned or premature retirement of existing infrastructure (i.e., asset stranding) can create unexpected costs for asset owners (Fofrich et al. 2020). In addition, to the extent the path of the energy transition or future climate policy is uncertain, investors may under-invest in energy infrastructure generally, potentially leading to shortages and higher prices. Labor markets can exhibit frictions if the locations or skill-sets required in new jobs do not match those in declining industries, producing temporary increases in unemployment as workers take time to search for or retrain for other jobs (Hafstead et al. 2022; Greenspon and Raimi 2022; Hanson 2023). Such labor-market frictions could also delay the deployment of new energy infrastructure, which would impede the energy transition. Given the anticipated speed of the energy transition and the importance of understanding capital and labor dynamics for macroeconomic forecasting, the ability to model these dynamic frictions is highly desirable.

Risk of Moving Too Fast Highlights

- The current energy infrastructure constitutes a large stock of capital. Unplanned or premature retirement of existing infrastructure (i.e., asset stranding) can create unexpected costs for asset owners

- Investors may under-invest in energy infrastructure generally, potentially leading to shortages and higher prices.

- Labor markets can exhibit frictions if the locations or skill-sets required in new jobs do not match those in declining industries, producing temporary increases in unemployment as workers take time to search for or retrain for other jobs

- Labor-market frictions could also delay the deployment of new energy infrastructure, which would impede the energy transition.

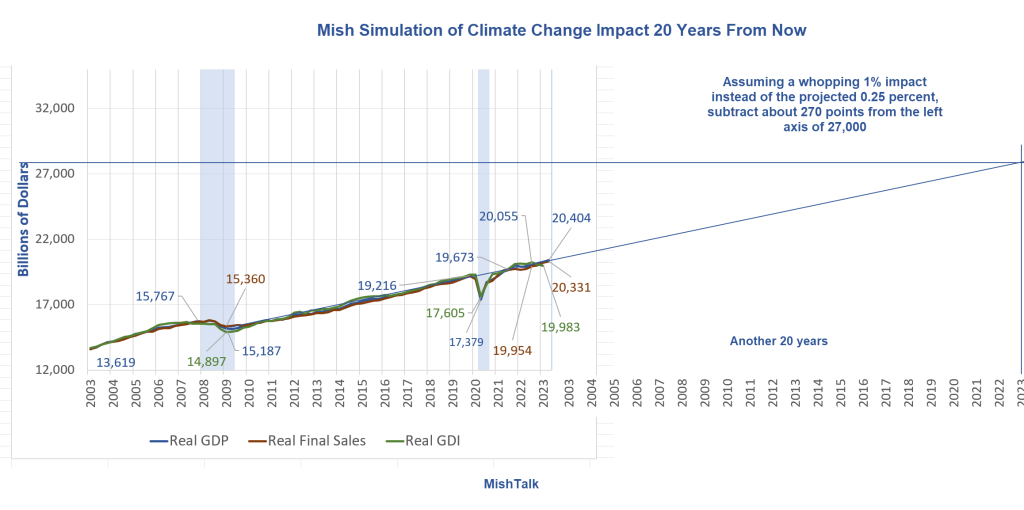

Mish Simulation of Climate Change Impact 20 Years From Now

Assume the worst, and temperatures rise two or three degrees in an amazingly fast 20 years. The White House projects the impact on GDP would be about 1 percent, if that.

That means a GDP that would otherwise be $27.00 trillion would instead be $26.73 trillion. This we are told is catastrophic.

Hoot of the Day Q&A

Q: How come this report has not received more media attention or coverage by the White House?