by Wolf Richter, Wolf Street:

The Fed’s QT is happening for the first time simultaneously with the refilling of the TGA. Both draw liquidity from markets.

The Fed’s QT is happening for the first time simultaneously with the refilling of the TGA. Both draw liquidity from markets.

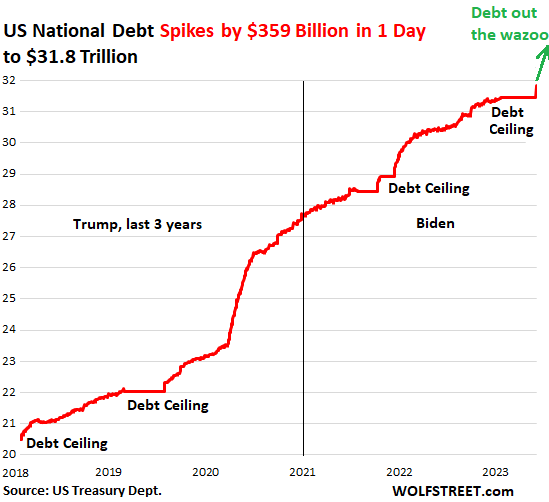

The Debt Ceiling Charade ended over the weekend when President Biden signed the “Fiscal Responsibility Act of 2023,” that suspends the debt ceiling through early 2025. A US default was “averted.” The ending of the charade is always known in advance: Congress will agree on a deal at the last minute, and the President will sign it, as it has been done for the 80th times since 1960. But the process of getting there can make you nervous. Then, after the Debt Ceiling Charade is over, we get a huge spike in the debt.

TRUTH LIVES on at https://sgtreport.tv/

So the U.S. national debt spiked by $359 billion in one single day, the first working day after the debt ceiling was suspended, to $31.83 trillion, as of yesterday evening, reported this evening by the Treasury Department.

And that was just the beginning, there will be more hair-raising single-day spikes of the debt over the next few days:

Savers’ favorite “I bonds” are nonmarketable Treasury securities. The Treasuries securities held by government pension funds, the Social Security Trust Fund, etc. are nonmarketable. Nonmarketable Treasury securities jumped by $28 billion yesterday, reported today, to $6.79 trillion.

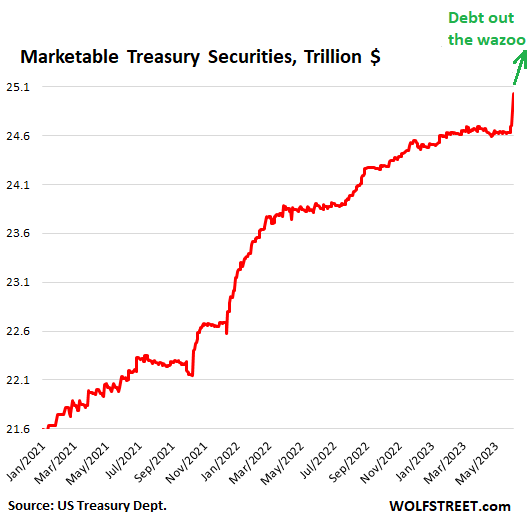

And marketable Treasury securities spiked by $330 billion yesterday, reported today. The chart below shows the shorter view of marketable Treasury securities for more detail. The Treasury Department is now issuing a flood of Treasury bills (with a maturity date in one year or less) and Cash Management bills, on top of the bonds and notes, to replenish its checking account. So this was the first leg of it:

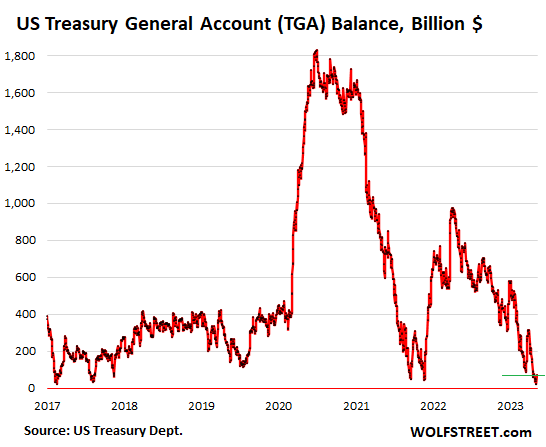

The government’s checking account, the TGA at the New York Fed, had fallen to a closing balance of $23 billion on Thursday and Friday last week. The out-of-money day would have been sometime this week.

During prior debt ceiling charades, the TGA balance had fallen into a similar range before the debt ceiling was lifted or suspended. This $23 billion was a very thin cash cushion, given the huge amounts of money that flow through the TGA on a daily basis: Into it from tax receipts and issuance of new securities, and out of it to pay off maturing securities and meet regular outlays.

The TGA balance jumped by $48 billion on Monday, reported today, to $71 billion. That increase was so small that it is hard to discern in the chart. But it was the first step in bringing it back to a normal-ish level. Massive bond issuance will be required in the near future, along with tax receipts, to:

- Pay off maturing securities

- Fund the ongoing blistering budget deficit.

- Replenish the TGA.

As you can see in the TGA, the gigantic bond issuance in the spring and summer of 2020 to pay for the stimulus packages and other stuff wasn’t all spent in 2020. The year ended with $1.6 trillion in the TGA, after having peaked at $1.8 trillion in July. The TGA was subsequently drawn down to near-nothing during the two debt-ceiling charades in late 2021.

This drawdown of over $1.5 trillion over the 12 months from the end of 2020 through late 2021 moved $1.5 trillion in cash from the bank (the Fed) directly to the markets. This was a huge amount of liquidity to spill into the markets – it was a portion of the QE liquidity that the Fed created and that was absorbed by the Treasury department when it issued trillions of dollars in bonds in 2020, and that was then released in 2021. This mega-shot of liquidity explains in part the hot performance of the markets in 2021.

Then, from late 2021 through May 2022, as the TGA was being replenished, it absorbed nearly $1 trillion, and markets tanked.

Then came the drawdown, throwing this $1 trillion back into the market, from May 2022 through last week, and eventually markets rose sharply. This $1 trillion in temporary liquidity injection counteracted to some extent the Fed’s QT that was phased in last summer.