by Wolf Richter, Wolf Street:

Debt doesn’t matter. Until it does. And now it does.

Debt doesn’t matter. Until it does. And now it does.

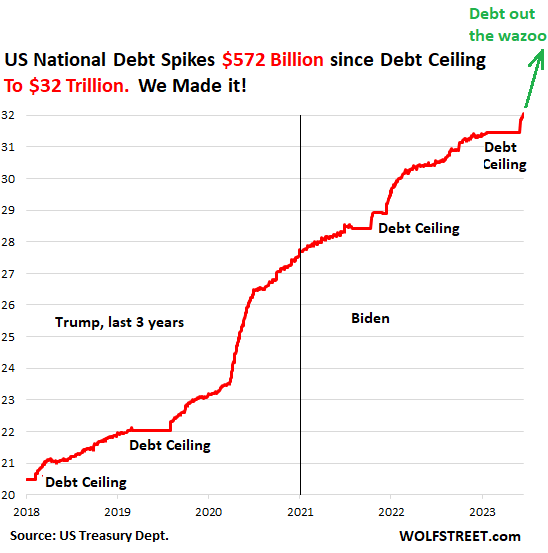

The U.S. national debt spiked by $572 billion since the debt ceiling was suspended two weeks ago after the sarcastically named “Fiscal Responsibility Act of 2023” was signed into law, the Treasury Department reported Friday evening. The total government debt now exceeds $32.0 trillion – hallelujah, we made it!

TRUTH LIVES on at https://sgtreport.tv/

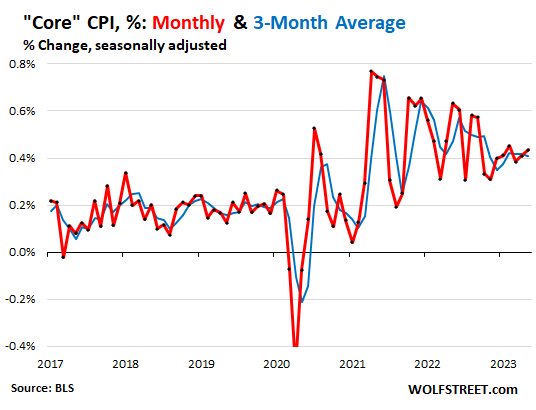

Debt doesn’t matter. Until it does. And now it does — in several ways, including interest on the debt, and fuel for inflation. Interest rates have come up because inflation started to rage in early 2021, and all this fiscal stimulus from deficit-spending is throwing fuel on the inflation fire, and so “core” inflation – inflation minus food, whose prices have ticked down, and energy whose prices have plunged – has been stubbornly stuck in the 5% range annualized for seven months, driven by inflation in services:

“Nonmarketable” Treasury securities include the “I bonds” that Americans can buy – they pay a base rate plus a rate based on CPI. The Treasuries securities held by government pension funds, the Social Security Trust Fund, etc. are nonmarketable. These nonmarketable Treasury securities jumped by $96 billion since the debt ceiling was suspended, to $6.86 trillion.

“Marketable” Treasury securities spiked by $476 billion since the debt ceiling was suspended, to $25.2 trillion. These are the securities that the government sells via auctions to the public.

The Treasury Department is now selling a flood of Treasury securities to replenish its checking account that had been drawn down to near-nothing during the debt-ceiling standoff. These securities include a large amount of Treasury bills (with a maturity date in one year or less), short-term Cash Management bills (at the last CMB auction on June 13, it sold $45 billion in 42-day CMBs), and longer-term notes and bonds, including TIPS.