by Chris MacIntosh, International Man:

For a while now we have said that the renewable craze is largely a side effect of ultra-cheap money and low inflation. Well, it seems the chickens are now coming home to roost. According to The Guardian:

From the article:

But relying on central bank rate rises in the current situation is folly for another reason: the reality of the climate crisis, which now greatly complicates the task of central banks and policymakers. One reason is obvious: higher interest rates considerably slow down the renewable energy transition. This happens in two ways.

TRUTH LIVES on at https://sgtreport.tv/

First, newly applied renewable energy technologies, which have relatively large front-loaded costs, are more competitive (relative to the already installed fossil fuel technologies) only when interest rates are low.

Engineering studies show that the levelized cost of electricity (LCOE) of solar photovoltaics (PV) and wind onshore will increase by 11% and 25%, respectively, if interest rates are 4-4.5% (rather than around zero). Investments in new renewable energy capacity are thus only viable if market prices allow them to earn their full LCOE.

Estimates by the International Energy Agency suggest that the LCOE of a gas-fired power plant would increase by about 4% if interest rates were to increase from 3% to 7%, whereas that of offshore wind and solar PV (utility scale) could rise by more than 30%.

Investment in renewables has fallen dramatically over the last couple of years, but is this negatively correlated to the rise in the cost of capital or just a “coincidence?”

We think that the cost of capital will continue to rise. 3.6% on the US 10-year is nothing. It could be argued that 6% is reasonable (and that only gets you back to 2000 levels). We do have to wonder what the US 10-year yield will be when oil breaks $100?

Notice how “global warming” transitioned into “climate change,” which is now increasingly called the “climate crisis.” This, folks, is NLP (neuro linguistic programming). It is also something else. Nonsense!

Hydrogen: All Expensive Talk

There has been a lot of talk about hydrogen. What it all comes down to is cost, it remains just far too expensive compared to oil and gas.

It seems that that huge move we saw in hydrogen stocks in the five years leading up to the start of 2021 was merely a symptom of the growth theme (or whatever it was). Hydrogen stocks peaked when the ARK Innovation ETF (ARKK) peaked.

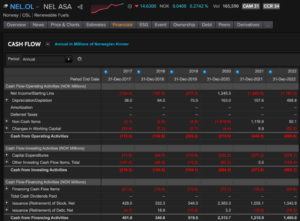

We note that hydrogen stocks continue to lose money and only exist because of continual equity capital injections. Nel is a good proxy for the industry — look at the third to last row “issuance (retirement) of stock.”

Meanwhile, Offshore Rigs Are at Discount

You could say that the offshore drilling sector is still priced as if we won’t be needing too many drilling rigs come 2030. Take a look at this:

Read More @ InternationalMan.com