by Michael Maharrey, Schiff Gold:

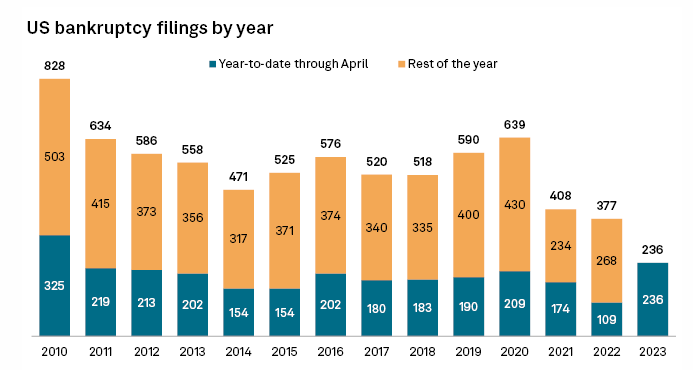

Despite all of the mainstream talk about a strong, resilient economy, corporate bankruptcies through the first four months of 2023 came in at the highest level since 2010. Meanwhile, monthly bankruptcy filings have hit numbers last seen during the peak of the pandemic.

According to data from S&P Global Market Intelligence, there were 235 corporate bankruptcy filings through April. That’s a 116.5% increase over the same period in 2022.

TRUTH LIVES on at https://sgtreport.tv/

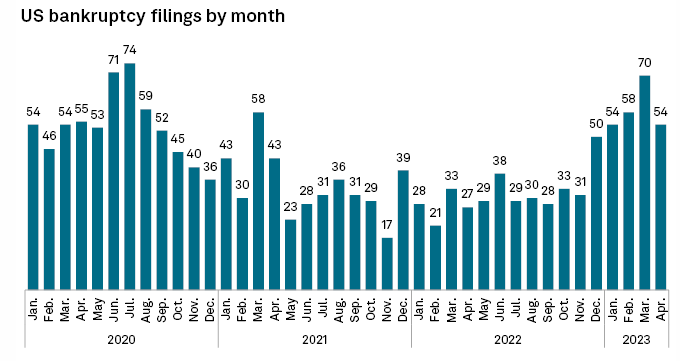

There were 70 bankruptcy filings in March alone. The last time we saw numbers that high was at the peak of the pandemic in the summer of 2020.

The number of bankruptcy filings dropped to 54 in April, but that was still at levels similar to the pandemic period.

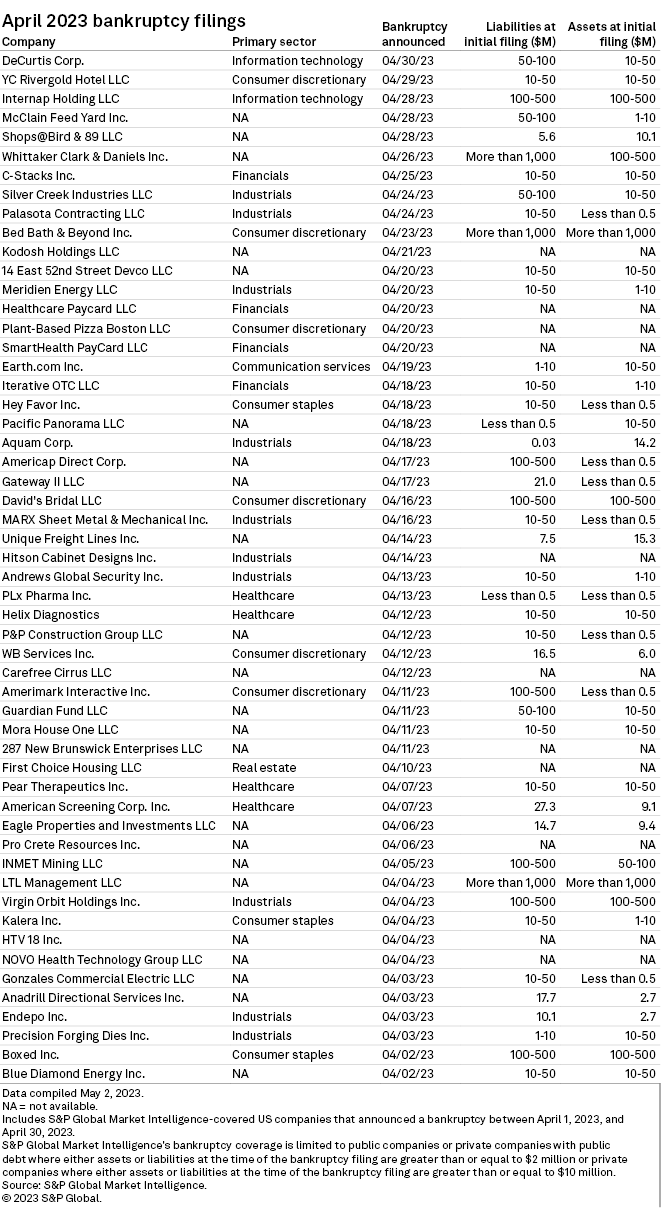

Here is the complete list of April bankruptcy filings.

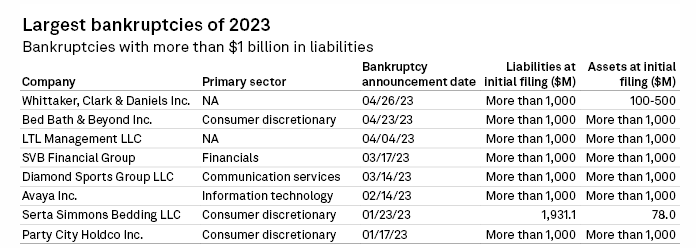

Through the first four months of 2023, eight companies had declared bankruptcy with more than $1 billion in liabilities. Six of those companies had assets over $1 billion, including Bed Bath and Beyond, Silicon Valley Bank Financial Group and Party City.

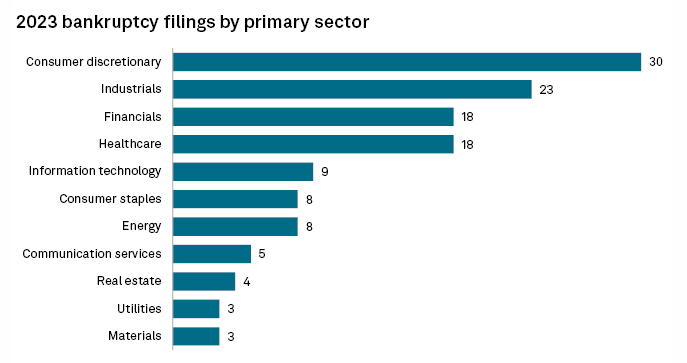

The consumer discretionary sector has been hammered particularly hard, with 30 companies in this sector going bankrupt through April.

As Investopedia describes it, “consumer discretionary” describes goods and services that consumers consider non-essential but desirable if their available income is sufficient to purchase them.

Consumers don’t have sufficient income.

Clearly, persistent price inflation has squeezed budgets and put a lid on discretionary spending.

The industrial and financial sectors have also been hit hard.

This is yet another sign that the economy isn’t nearly as strong as the mainstream pundits claim and the looming recession could be much deeper and longer than most people anticipate.