by Peter Schiff, Schiff Gold:

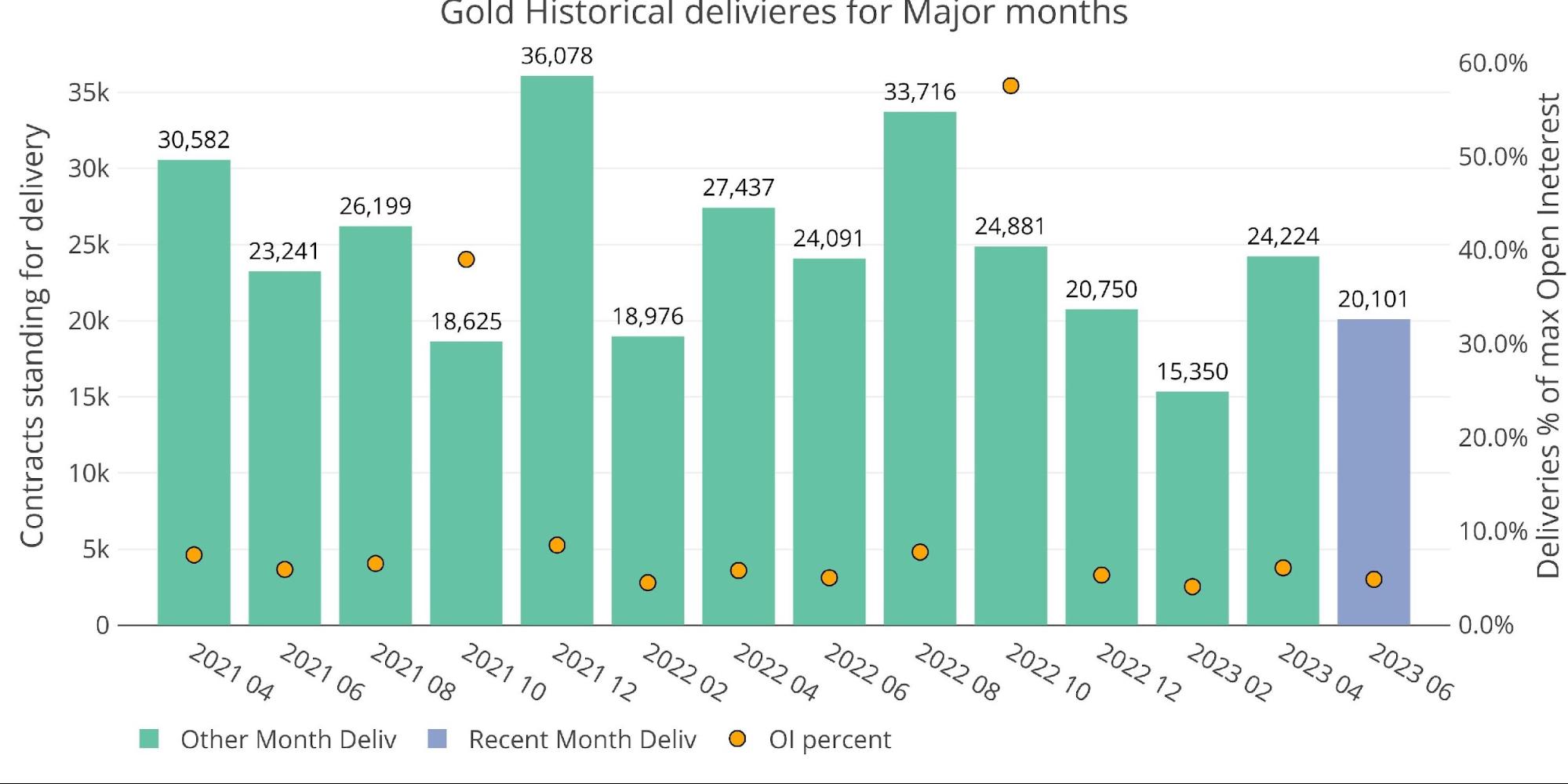

Gold is wrapping up June which came in fairly strong with 20,101 contracts being delivered. There are still 583 contracts open that have not been delivered, but the majority of the contracts have completed.

One thing to notice is that Net New Contracts were negative this month for the first time since February 2022. Essentially, after the contract started to deliver, certain contract holders were incentivized to cash settle instead of take delivery.

TRUTH LIVES on at https://sgtreport.tv/

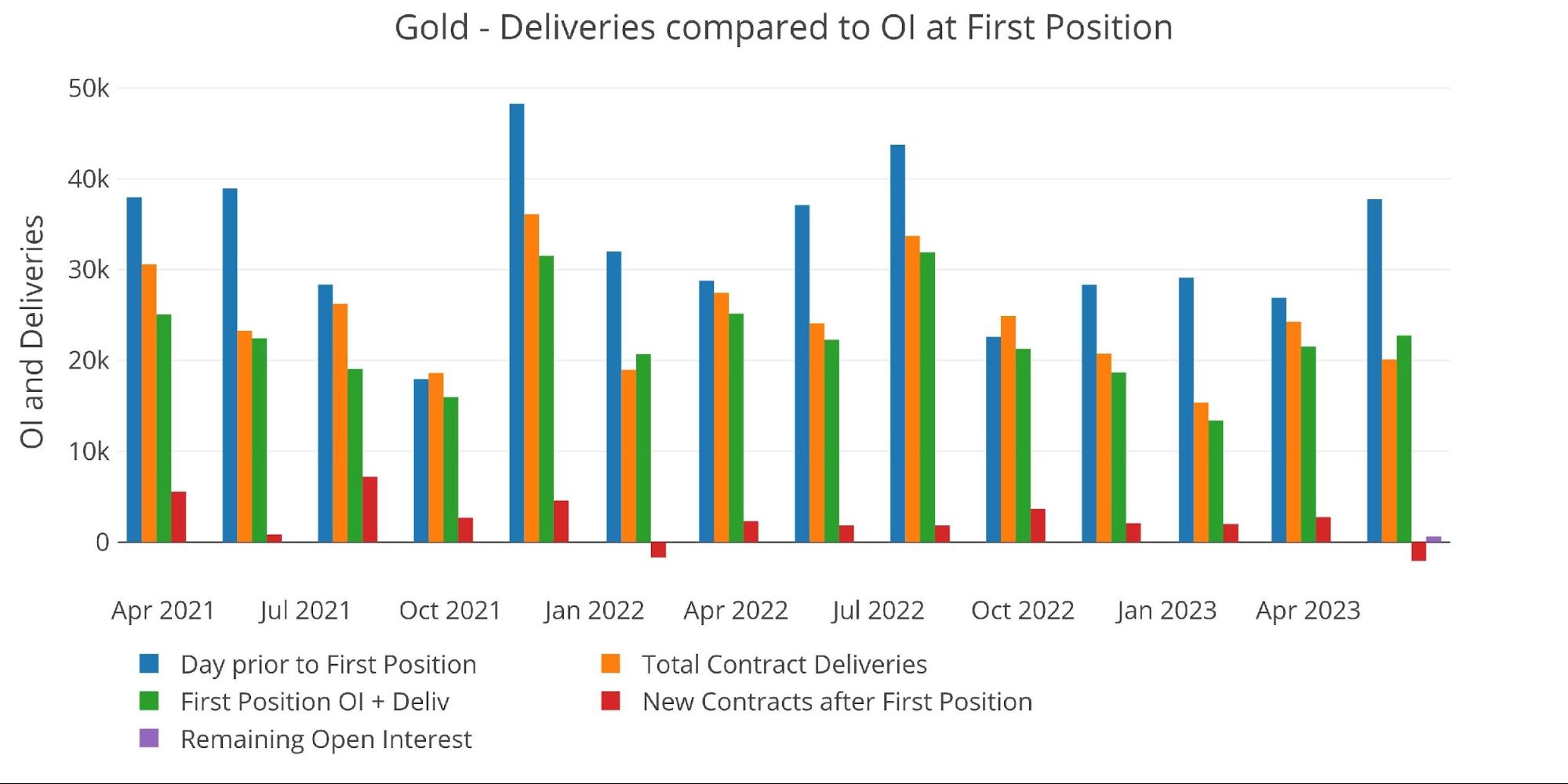

Figure: 2 24-month delivery and first notice

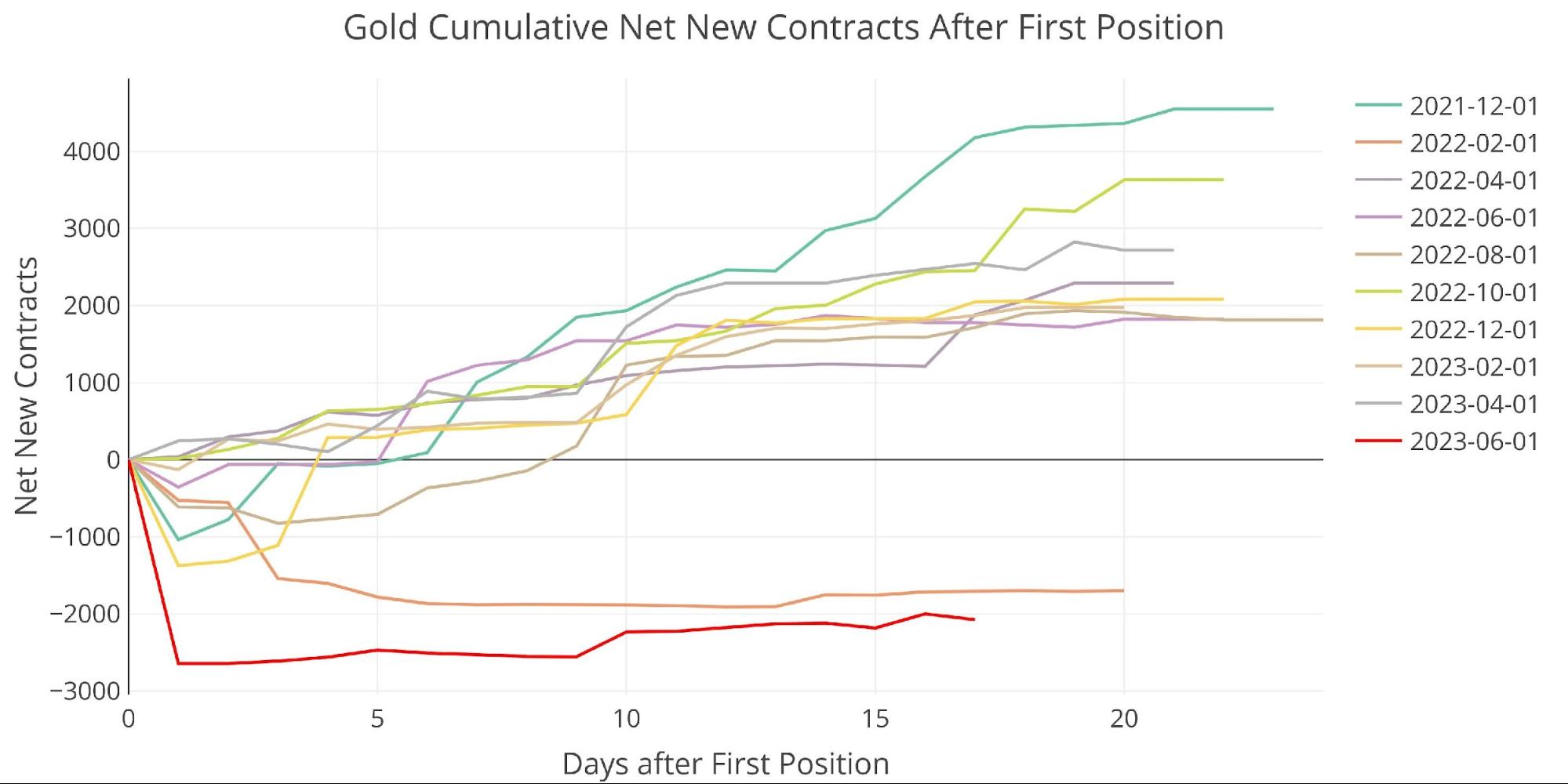

This occurred at the beginning of the delivery window as can be seen below. On the first day, 2,645 contracts cash settled. Since then, only about 600 contracts have opened for immediate delivery, which is well below average. This is a major trend divergence as seen below.

Figure: 3 Cumulative Net New Contracts

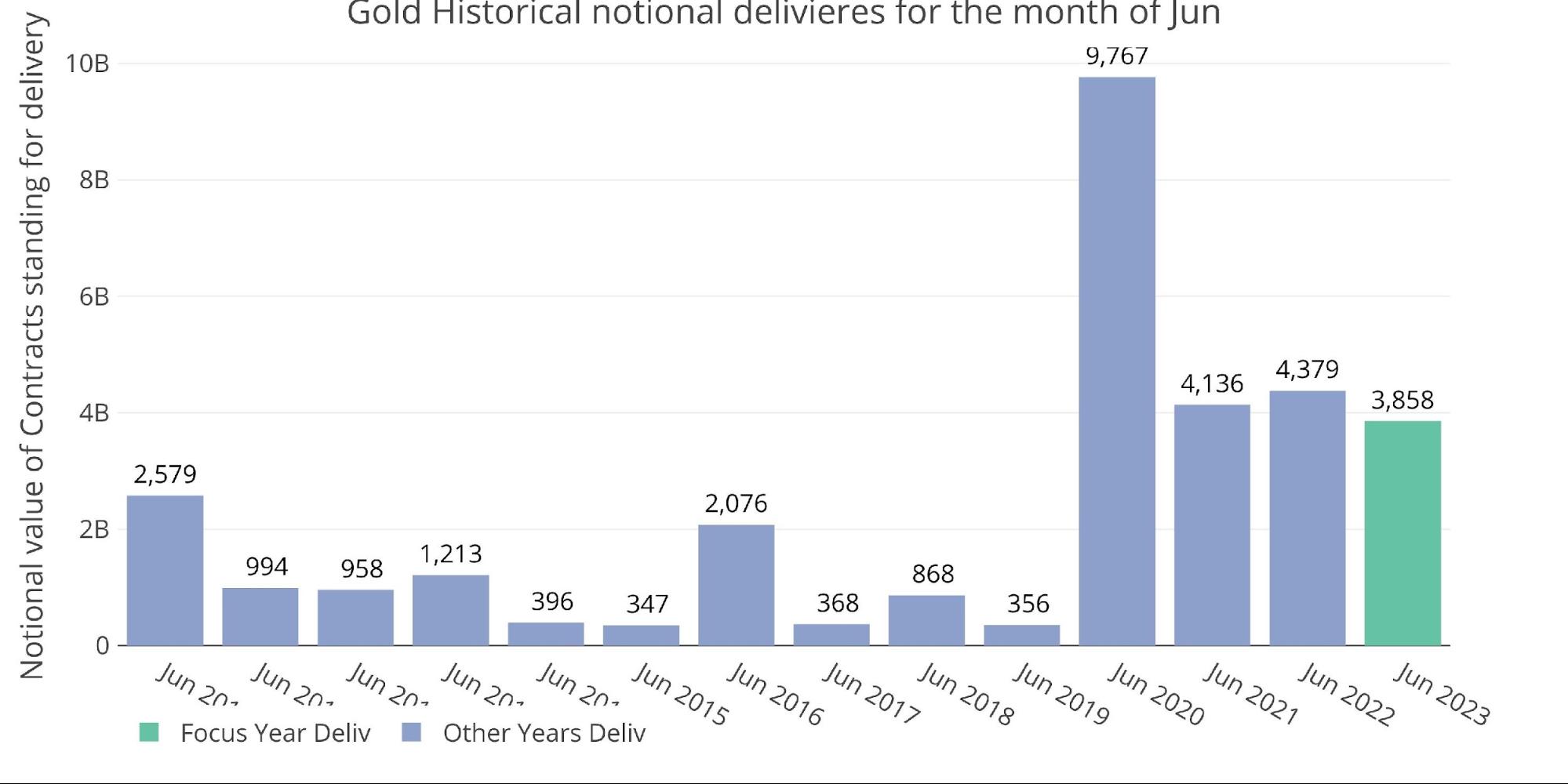

From a notional perspective, $3.8B of gold was delivered during June. This would have been a record before Covid but is actually the smallest June in the last 4 years.

Figure: 4 Notional Deliveries

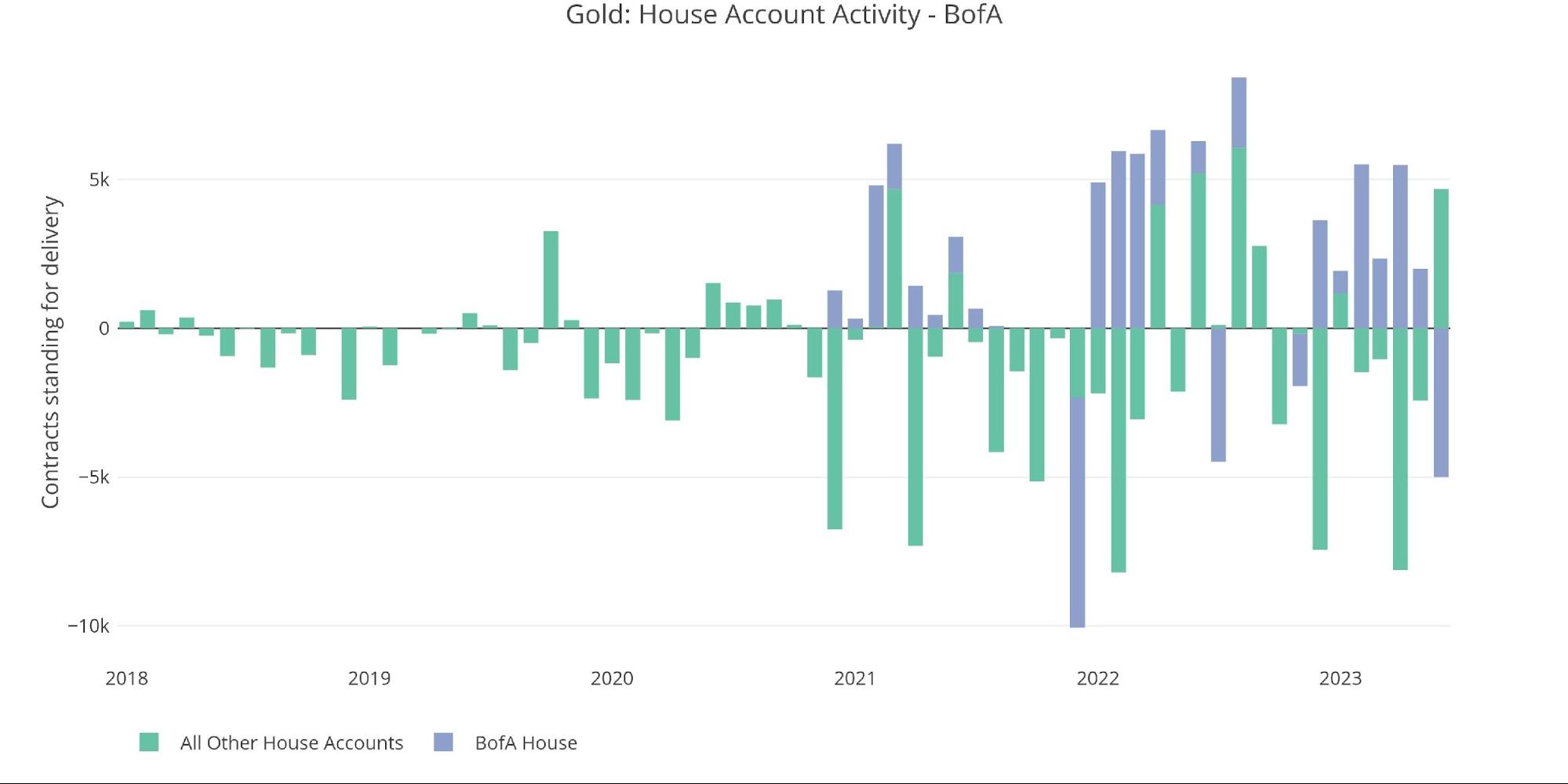

BofA has been building a stash for 6 months to potentially defend the physical market when supplies became constrained. It looks like they used some of that stash this month. BofA was responsible for delivering exactly 5k contracts. BofA continues to buy high and sell low!

Figure: 5 House Account Activity

The vaults have been a bit erratic lately. Back in April, a massive amount of metal flowed from Eligible to Registered. On two separate days, more than 500k ounces were reclassified. As the June contract approached, some of that metal actually went the other way. Throughout the June delivery period, Registered has stayed mostly flat while Eligible has continued to flow out.