from ZeroHedge:

Late last week, we were the first to correctly summarize what the bottom line of the so-called “debt ceiling deal” meant for the US, for future generations of Americans, and for the ridiculous melodrama gripping Washington: a -0.2% of GDP cut in nominal spending.

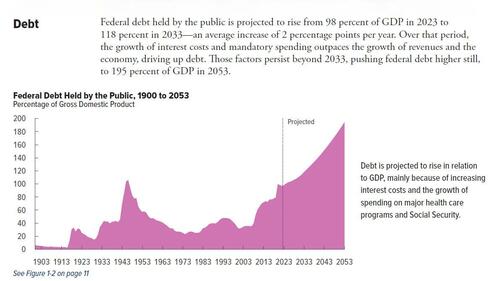

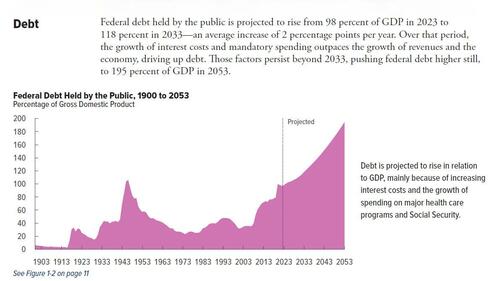

That’s right: that 0.2% cut in spending is what all the brewhaha was over, a cut which will not only push total debt to $35 trillion by the end of Biden’s term, but will not even put a dent in the long-term US debt trajectory which even the CBO has no problem as showing in its full, hyperinflationary glory.

TRUTH LIVES on at https://sgtreport.tv/

Hey @mattgaetz, the debt ceiling deal “cuts” spending by 0.2% of GDP or about $50 billion.

Is that good enough?

— zerohedge (@zerohedge) May 28, 2023

Still, to Kevin McCarthy who “negotiated” on behalf of America’s conservatives, that paltry, laughable nominal “spending reduction” was apparently something to be very proud of, as he repeatedly pointed out on his twitter feed…

It is simple:

– President Biden wanted to spend more and raise taxes.

– Republicans fought—and won—to reduce spending and stop Biden from radical overreach.The systemic reforms we set in place mark the beginning of historic change in Washington. https://t.co/rjMNsSf5oX

— Kevin McCarthy (@SpeakerMcCarthy) May 29, 2023

.. if only a closer look reveals that not all is as it seems.

In its post-mortem of the debt ceiling deal published this evening, Goldman summarizes the outcome as follows: “the spending deal looks likely to reduce spending by 0.1-0.2% of GDP yoy in 2024 and 2025, compared with a baseline in which funding grows with inflation. That said, the boost to funding Congress approved late last year for FY23 was so large (nearly 10% yoy) that overall discretionary spending is likely to be slightly higher in real terms next year despite the new caps.”

Translation: the “deal” may result in a nominal 0.1% drop in spending (just for next year, after that it ramps up again), but adjusted for inflation, spending in 2024 will be higher yet again!

Below we excerpt several highlights from the Goldman note, first focusing on the probability of the deal becoming enacted; according to Goldman, the deal is “very likely to pass both chambers of Congress in the coming week” although there are two points of uncertainty in the House.

- First, the Rules Committee will meet to vote Tuesday (May 30) afternoon/evening on the rule for debate on the debt limit bill, a necessary step before the vote on the House floor. The committee has 9 Republicans and 4 Democrats, but 2 of those Republicans (Reps. Roy and Norman) appear to oppose the bill, with the position of a third (Rep. Massie) unclear. If all three vote against and no Democrat votes in favor, the bill will fail. (Goldman thinks the Rules Committee is very likely to send the bill on to the House Floor, as a majority of the committee will vote for the package even if it takes Democratic support – it is uncommon but not unheard-of for the minority party to support the majority party’s efforts in the Rules Committee).

- Assuming Rules Committee passage on Tuesday, the House is likely to vote late on Wednesday (May 31). While it is not entirely clear how Republican and Democratic lawmakers will divide the responsibility for passing this legislation–most lawmakers likely want it to pass but few want to vote for it. As such Goldman is confident that a failed vote in the House is very unlikely. Assuming the House clears the bill Wednesday, the Senate is unlikely to vote on final passage before Friday (June 2) and procedural delays could easily push the vote into the weekend. That said, there is less uncertainty regarding support in the Senate than there is in the House, so this is more a question of timing than outcome.

… and second, why the so-called spending cuts are a joke:

The main source of budgetary savings in the deal is a two-year cap on federal discretionary spending. Congress appropriates this segment of spending annually and it accounts for around 25% of total federal spending, with slightly more than half dedicated to defense and the remainder to other “non-defense” spending (generally domestic programs outside of the major benefit programs). The Congressional Budget Office (CBO) will estimate that the spending caps in the deal will reduce discretionary spending by $1.5 trillion over the next 10 years and reduce interest expense by around $160-170bn over that period. On paper, this would reduce projected deficits over the next decade by an average of 0.4-0.5% of GDP.