from ZeroHedge:

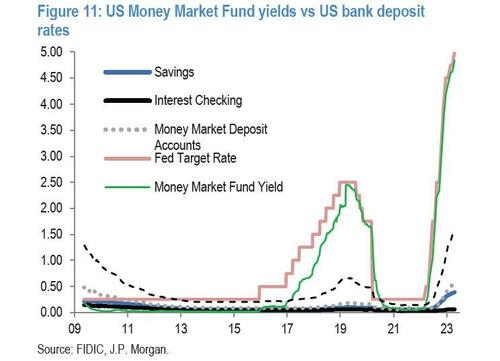

At the start of May we explained that it’s not just the Fed’s rate hikes that are behind the nascent regional bank crisis (because with Fed Funds rate at 5.25% and both T-Bills and money market funds offering similar yields, there is no way small banks can compete with these returns, prompting a bank jog (which periodically turns to a sprint) and deposit flight from both checking and saving accounts).

TRUTH LIVES on at https://sgtreport.tv/

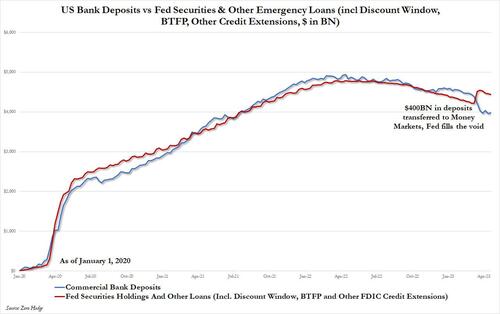

We said that the Fed’s ongoing QT is a just as pernicious threat to the viability of small/regional banks because with every dollar drained from the system as part of the Fed’s quantitative tightening, a matching deposit dollar is also destroyed, to wit:

Under an ample reserves framework, virtually all deposits are created by the Fed.

That’s why banks were forced to load up on low-yielding securities during 2000-2001 and are now getting crushed as yields soar and fixed income/loan prices plunge.

It also means that under QT as Fed reserves shrink, deposits must follow: as such deposits are either forced to shift into Bills/TSYs or are destroyed (bank failures).

Thus, the bank crisis is an inevitable side effect of Fed tightening.

Now, by now everyone knows that when it comes to banks failing (and capitalizing on it) few are as experienced as JP Morgan, aka JP Mega…