by Peter Schiff, Schiff Gold:

In 5 days, the COMEX has seen 4,190 contracts open and stand for immediate delivery. This is the strongest start to a month going back at least 2 years, which includes the start of the war in Ukraine and the February 2021 Reddit silver squeeze.

In the latest Comex update, I mentioned that:

Gold has started a bit slow. This shouldn’t be a surprise though as the game in gold continues to be net new contracts.

As the chart below shows, total delivery volume remains a bit below the trend. However, the delivery month just got started.

TRUTH LIVES on at https://sgtreport.tv/

Figure: 1 Recent like-month delivery volume

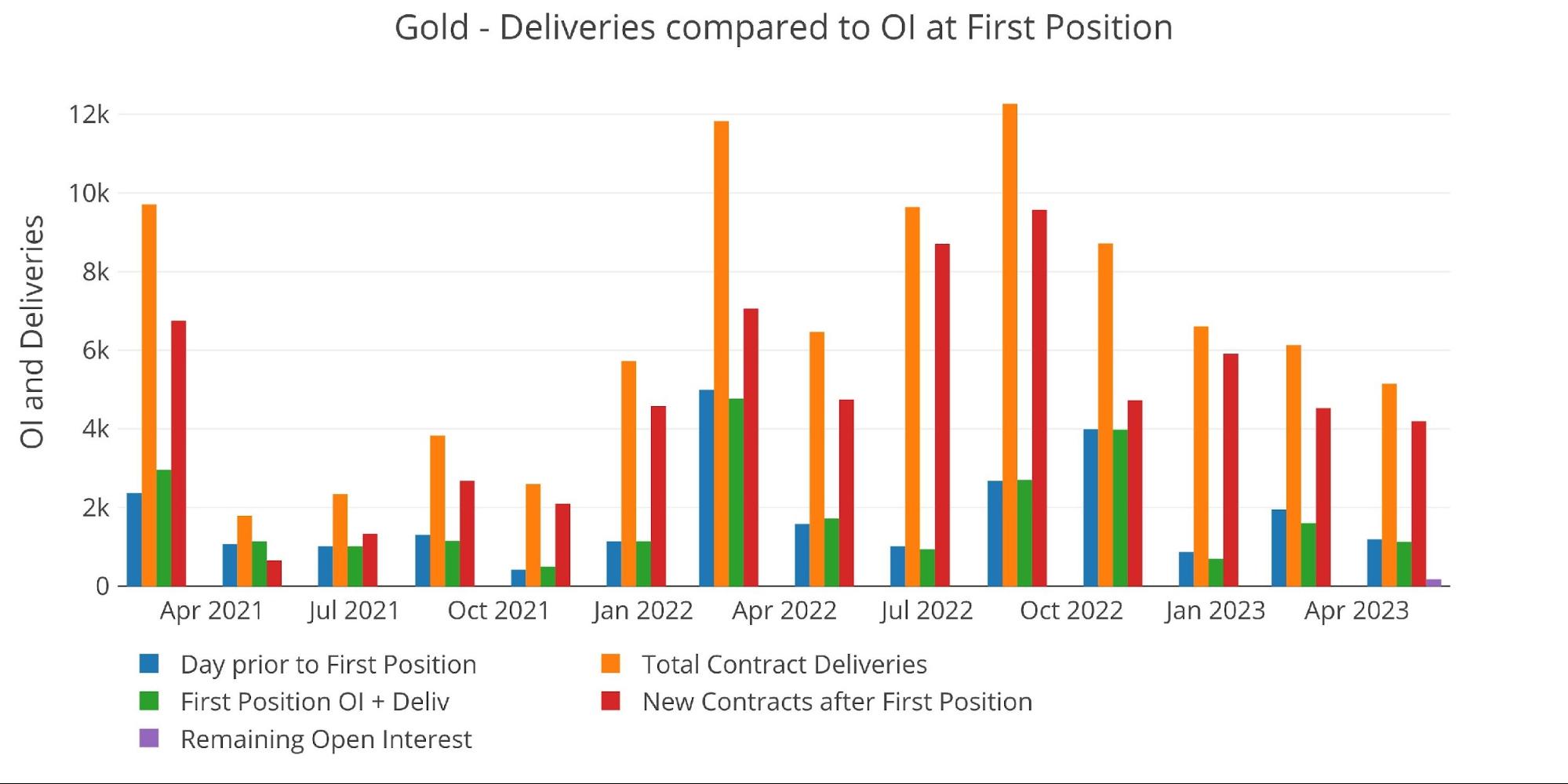

It’s important to take a look at net new contracts. Net new contracts are contracts that open after the delivery month begins and stand for immediate delivery. They can be seen by the red bars below. Net new contracts suggest strong and immediate demand for physical metal.

Figure: 2 24-month delivery and first notice

What’s important to note about this month, is not the total volume, but the current trajectory. Net new contracts occur throughout the delivery month, and in this month, they have absolutely exploded higher to start the delivery period. Again, it’s important to note that in just five days, the COMEX has seen 4,190 contracts open and stand for immediate delivery. As the chart below shows, this is the strongest start to a month going back at least 2 years, which includes the start of the war in Ukraine and the February 2021 Reddit silver squeeze.

Figure: 3 Cumulative Net New Contracts

Some, but not all this activity is being driven by BofA which has had delivery of 1,997 contracts.

Figure: 4 House Account Activity

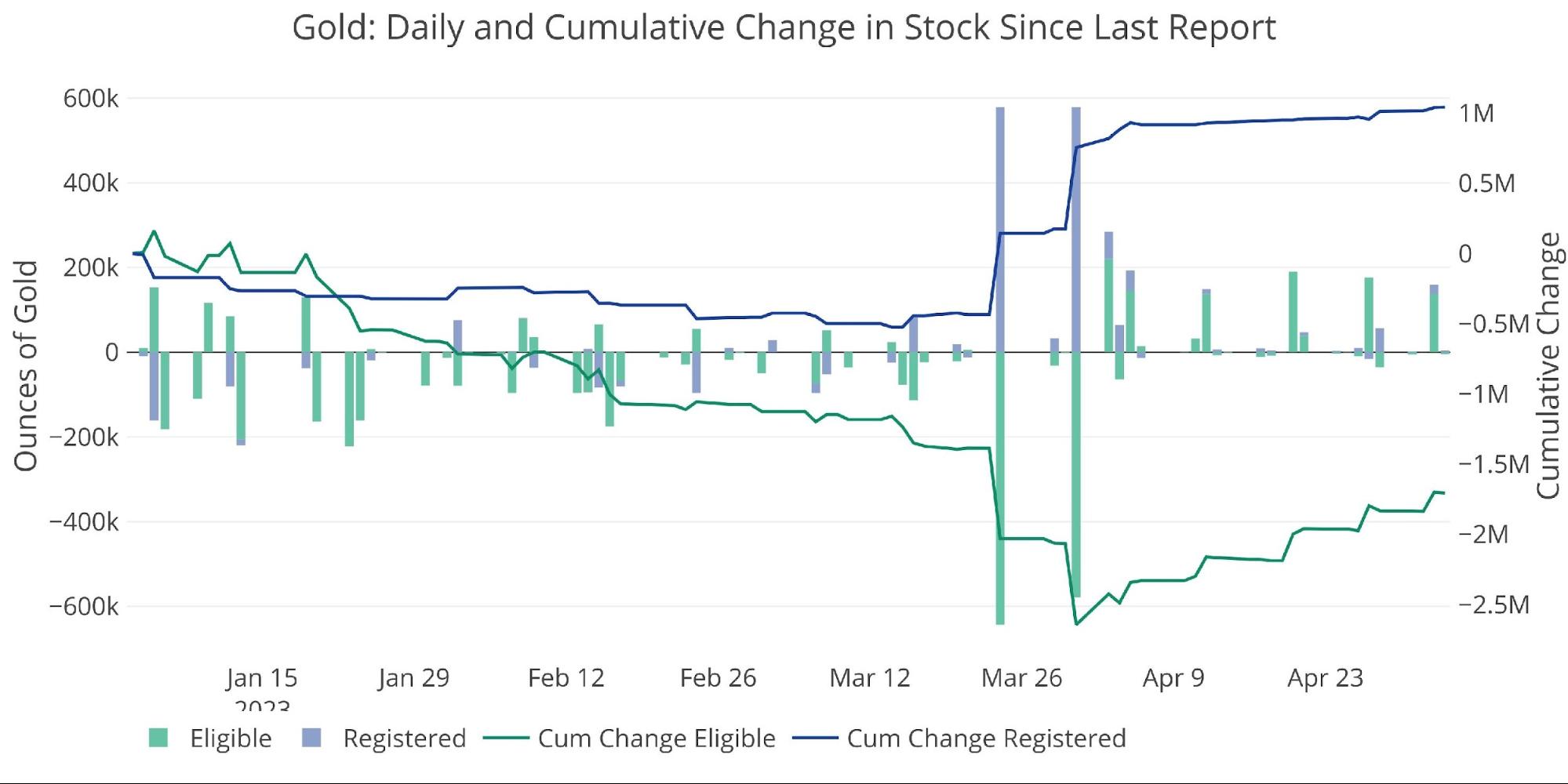

In the meantime, JP Morgan has been scrambling to restock their vaults after using a ton of their inventory to backstop gold during the last delivery window (JP Morgan is responsible for the big moves from Eligible to Registered below and also the efforts to add to Eligible).

Figure: 5 Recent Monthly Stock Change

Gold: Next Delivery Month

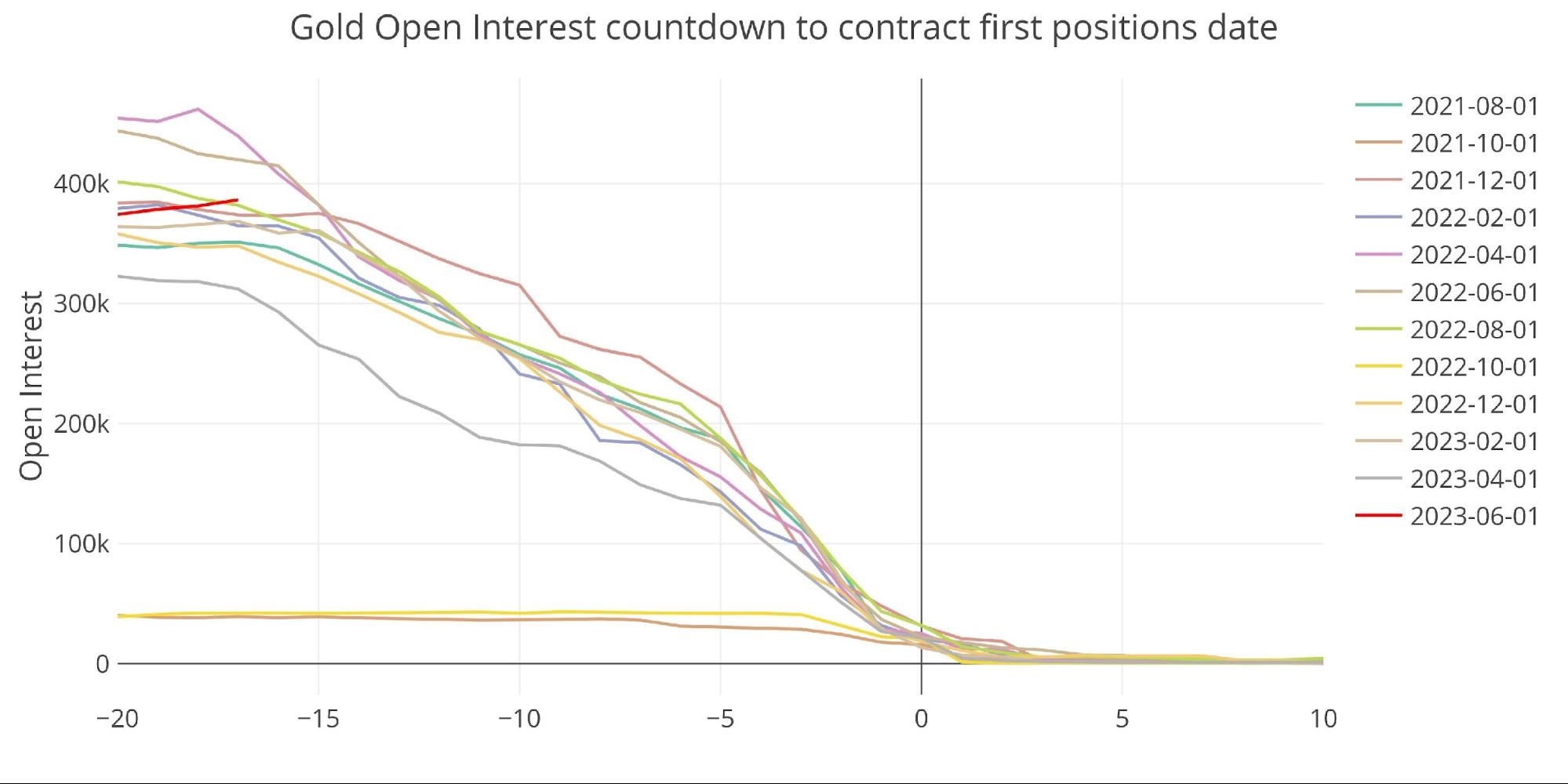

It’s too early to really get focused on the June contract, other than to mention it is above trend so far.

Figure: 6 Open Interest Countdown

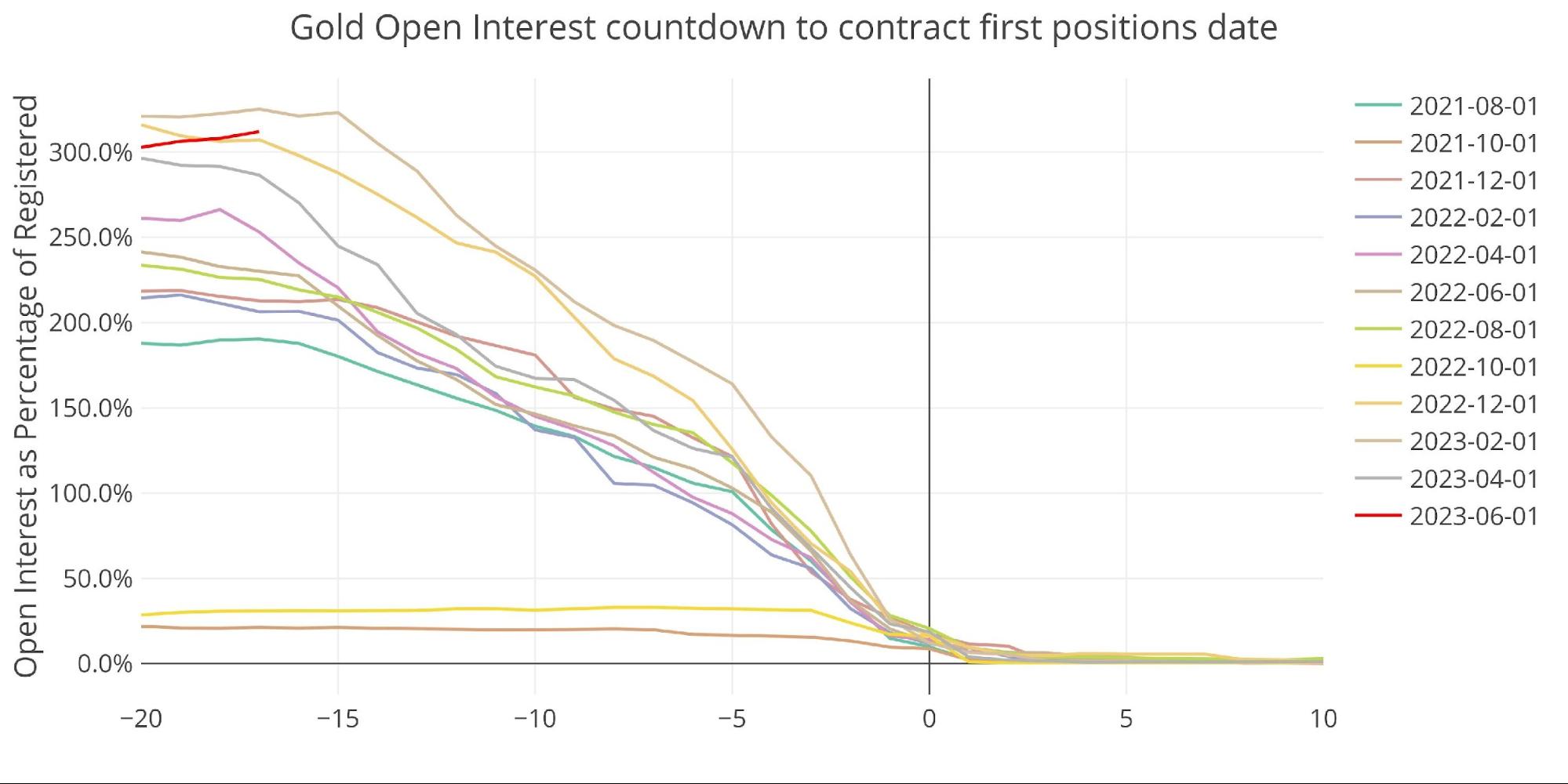

This is especially true on a relative basis.

Figure: 7 Countdown Percent

Silver

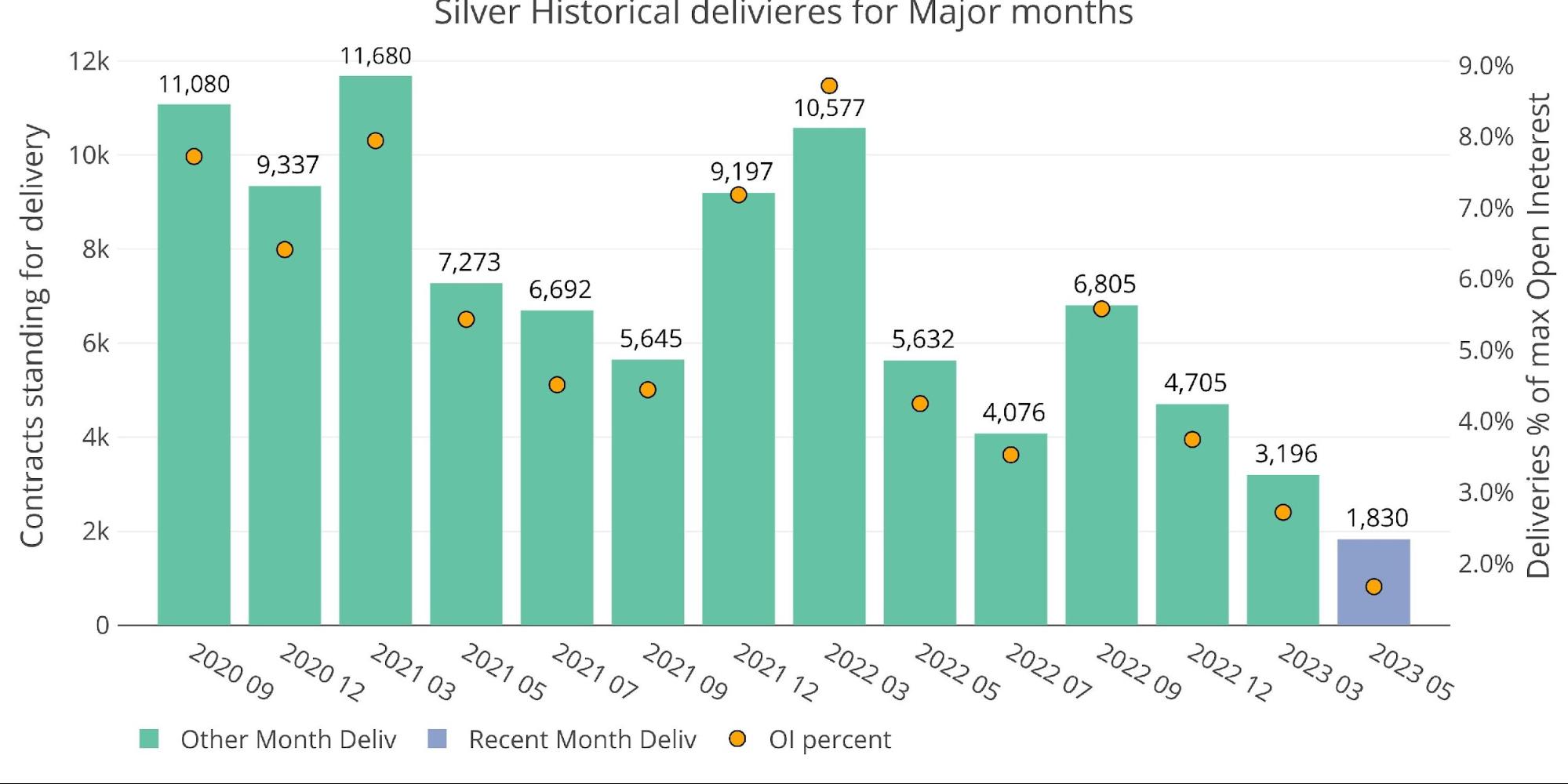

No big silver update today, as things are mostly quiet. Delivery volume remains quite suppressed (see chart below) with net new contracts slightly negative (not shown).

Figure: 8 Recent like-month delivery volume

The two charts to highlight are the house account activity, where the house accounts seem to be delivering out metal only and not restocking.

Figure: 9 House Account Activity

Second, and more importantly, is the continued drainage of metal from vaults in silver. As shown below, some metal moved from Eligible to Registered to support the delivery month, but then that metal is being immediately and entirely removed from the vaults. This is occurring even on very light delivery volume.