by Wolf Richter, Wolf Street:

Massive gyrations on the balance sheet after FDIC’s take-down of First Republic, sale of its assets to JP Morgan, and FDIC’s loan to JPM.

Massive gyrations on the balance sheet after FDIC’s take-down of First Republic, sale of its assets to JP Morgan, and FDIC’s loan to JPM.

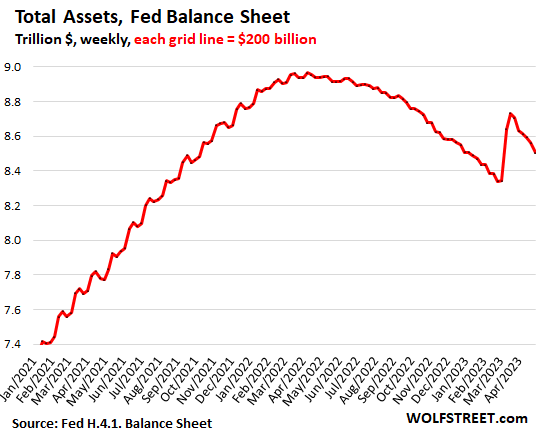

Today we were served a special spectacle on the Federal Reserve’s weekly balance sheet. Total assets dropped by $59 billion in the week, and by $230 billion in the six weeks since peak bank bailout, to $8.50 trillion, as QT continued on track with a big Treasury securities roll-off, and as First Republic, the FDIC, and JP Morgan were splattered all over this balance sheet.

TRUTH LIVES on at https://sgtreport.tv/

Looking at total assets with a magnifying glass to see the details of the banking crisis:

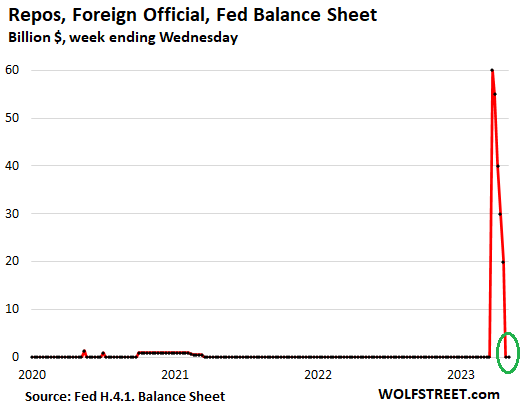

Repos with “foreign official” counterparties: paid off in the prior week. This was likely the program that the Swiss National Bank used to provide dollar-liquidity support for the take-under of Credit Suisse by UBS.

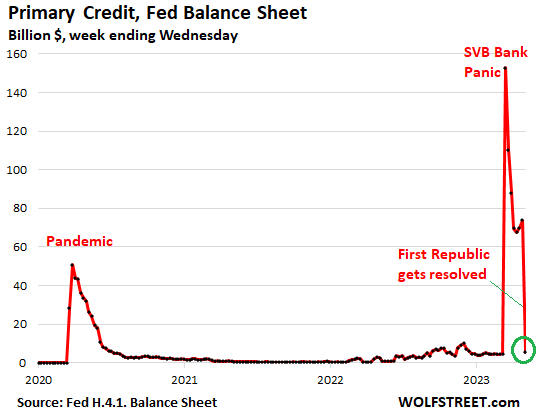

Discount Window (“Primary Credit”): -$68 billion in the week, to just $5 billion.

Since the rate hike yesterday, the Fed charges banks 5.25% to borrow at the Discount Window. Banks also have to post collateral, valued at “fair market value.” This is expensive money for banks that can normally borrow from depositors for a lot less without having to post collateral. It’s where they go when they need a lender-of-last-resort. And when they don’t need it anymore, they pay off those loans.

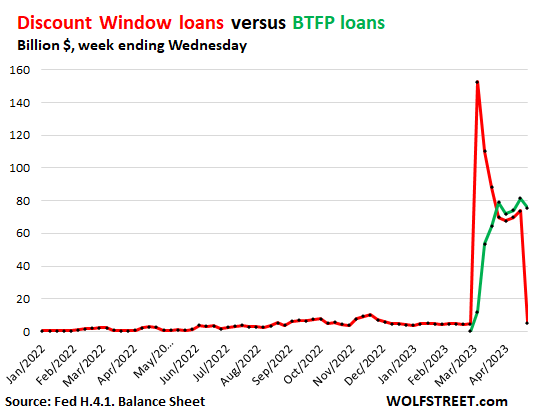

Bank Term Funding Program (BTFP): -$6 billion in the week to $76 billion. Under this program, rolled out on March 13, banks can borrow for up to one year, at a fixed rate, pegged to the one-year overnight index swap rate plus 10 basis points. Banks have to post collateral, but valued “at par.”

Because the BTFP is somewhat less punitive than the Discount Window and provides for one-year funding, there had been a shift in April from the Discount Window to the BTFP. And so we put them on the same chart to see the flows between them.

First Republic’s borrowings at the Discount Window and at the BTFP were paid off after the FDIC resolved First Republic over the weekend and then sold the assets to JP Morgan, which also agreed to take on the deposits and other liabilities. And this is in part what we can see here.

This chart shows both, the loans at the Discount Window (red), which plunged to just $5 billion, and the loans at the BTFP (green), which dropped to $76 billion:

Are you ready for the fun part? Loans to FDIC: +$58 billion in the week, to $228 billion. When JP Morgan acquired the assets of First Republic from the FDIC, it paid the FDIC $182 billion for those assets. The payment came in different forms (we walked through all this in detail here):

- $10.6 billion in cash.

- $92.4 billion by taking on the deposits (liabilities) that are owed the depositors of First Republic.

- $28 billion by taking on the advances First Republic had gotten from Federal Home Loan Banks (FHLB), and which JPM now has to pay off.

- $50 billion loan from the FDIC.

Note the last item. So to boil this down to an example: When you buy a car from a Ford dealer for $50,000, and you pay $2,000 cash down and the dealer arranges a loan through Ford Credit for the remaining balance of $48,000, you will pay $50,000 for the vehicle plus interest over time.

This is kinda what JPM did. It paid some cash down ($10.6 billion), plus it paid a bunch by assuming liabilities that it will have to pay over time to depositors and the FHLB; and it took out a $50 billion loan from the FDIC that JPM will have to pay off over five years.

But just like Ford dealers, the FDIC isn’t sitting on a pile of cash that it can lend out. It seems it went to the Fed and borrowed the $50 billion that it lent to JPM, which then used the cash to pay off the $28 billion in advances by the FHLB and the $30 billion that 11 big banks, including JPM, had put on deposit at First Republic in March to prop it up.