by Dr. Joseph Mercola, Mercola:

STORY AT-A-GLANCE

- In an interview with Whitney Webb, finance guru Catherine Austin Fitts discusses how central bank digital currencies (CBDCs) will consolidate control of the financial system

- Corporate media pushes the idea that you must put all your money with major banks to keep it safe, but this is a dangerous move

- The big banks the media are trying to drive consumers to are engaged in criminal activities and allowed to operate above the law

- When you have small, local banks and credit unions flourishing, it translates into healthy small businesses and small farms in the community

- The most important thing you need to do to prepare financially is get yourself out of the control grid

TRUTH LIVES on at https://sgtreport.tv/

The recent U.S. banking crisis is no longer making headlines — but it’s about to enter an even more troubling phase, according to finance guru Catherine Austin Fitts — publisher of The Solari Report.1

In an interview with Whitney Webb, host of Unlimited Hangout, Fitts discusses how central bank digital currencies (CBDCs) will consolidate control of the financial system — ultimately leading to control of the world population. Webb says:2

“Essentially, it seems that the current calm on the surface has allowed the powers that be, or rather the financial powers that be, to kick the can down the road, giving them time to line things up so they can control and manage the situation once chaos and panic return.

Yet, regardless of if, and when, another crisis rears its head, the aftermath is likely to be seen as an opportunity by the powers that be to roll out or dramatically advance the long-awaited central bank digital currency, or CBDC paradigm.”

A Dangerous Push to Consolidate Banking Deposits

When Silicon Valley Bank (SVB), the 16th largest in the U.S.,3 collapsed in March 2023, Fitts believes it was due to a predatory run, a takedown. “It really did look like a combination of short sellers and an engineered run,” she says. “Normally, one of the functions of the central bank is to help a bank in that position. But what we saw, in fact, was lead banks in New York Fed that own and control the New York Fed, engineering the run.”4

This highlights the risks inherent even in large banks, where the majority of the problems lie, Fitts says. Yet, the corporate media pushes the idea that you must put all your money with the major banks to keep it safe. “That is very dangerous,” Fitts says.5

“There is a real push to consolidate the banking deposits … We saw the pandemic shutdown lots of small business, which really harms the resiliency in the economy. It didn’t have to happen … it was Disaster Capitalism. It was economic warfare. And now we’re seeing a push to shut down or drain the small banks.

And let me explain. There is nothing more important to the health of local economy than having lots and lots of small banks and credit unions and savings banks. These are a critical component of what creates and builds economy in the local area.”6

When you have small, local banks and credit unions flourishing, it translates into healthy small businesses and small farms in the community. Again, we see that building and maintaining your local community connections are key to resilience financially and otherwise. But these local ties are under attack.

Why Every State Needs a Sovereign Bank

The big banks the media are trying to drive consumers too are deemed “too big to fail.” In reality, however, “The big banks are literally being allowed to break the law and get away with it,” Fitts explains … “So, don’t let the media scare you out of your good local bank and head into a criminal bank. Don’t do that.”7

Powerful banks and organizations worldwide enjoy unrestricted privileges and layers of immunity. As investigative journalist Corey Lynn put it:8

“Together, the BIS [Bank for International Settlements], Central Banks, UN, OAS [Organization of American States], and the other international organizations and banks enjoying immunities and privileges, are a powerhouse that has the ability to move undetected, behind closed doors, with no transparency or accountability, and move their agendas forward with little to no legal ramifications.

While people go about their days putting their children to bed, sending them off to school, getting themselves to work, and cooking a family dinner, these masterminds are plotting out everyone’s future in a gradual manner that most don’t recognize as the global takeover that it is.”

Meanwhile, in order for globalists to ultimately gain control — via centralized financial transactions, centralized control of food and centralized control of politics — the banking system must be consolidated. Fitts explains:9

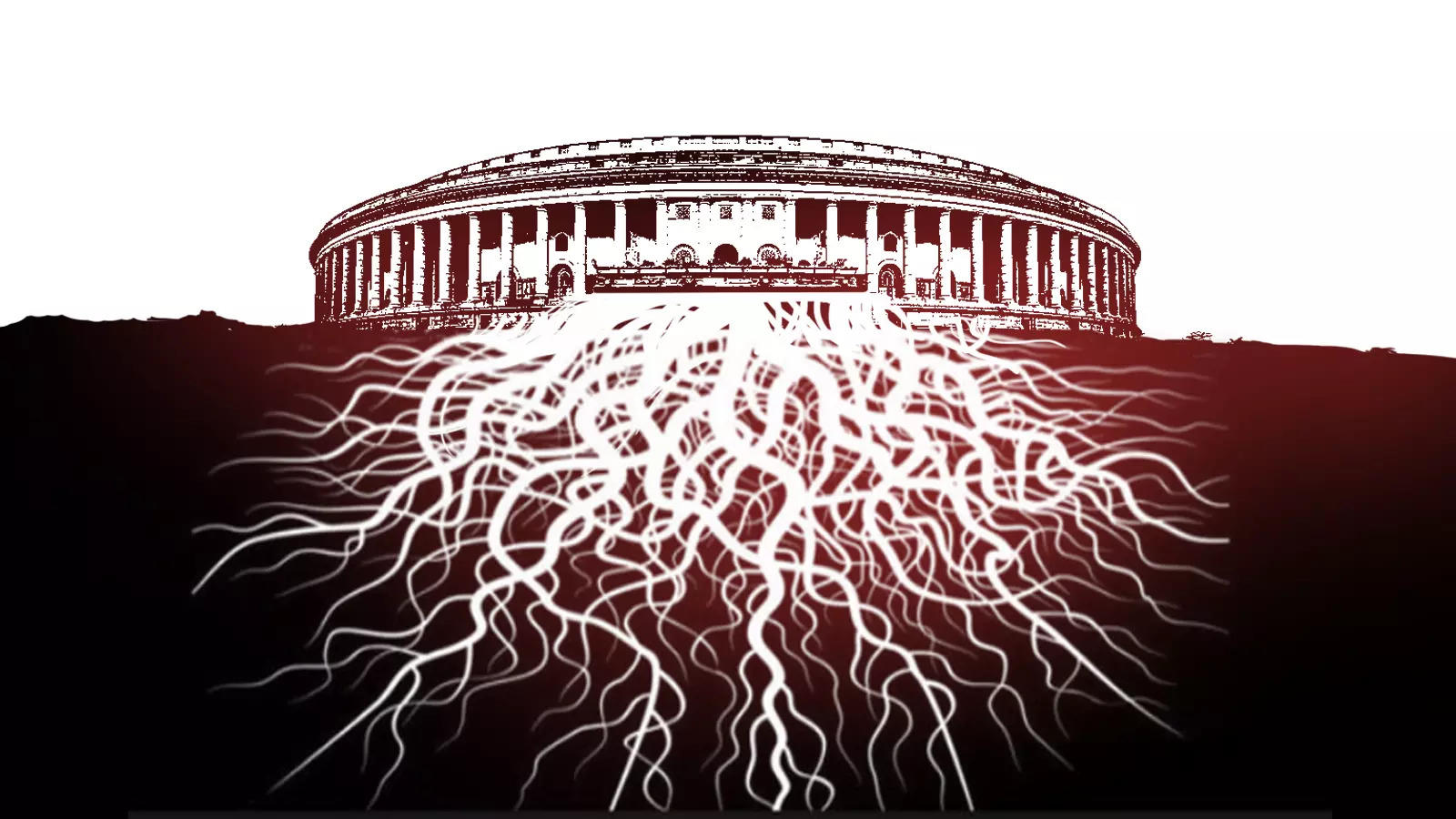

“If we have 4,000 banks, most of which are community banks and credit unions, savings banks, those banks … along with small businesses and farms, are the bedrock of democracy. And again, and again, we’ve seen the Fed try to institute policies, and the small bankers rear their head and just start screaming.

They can’t do it, politically. So, you know, there’s no doubt if you want to go to the tight central control … you’ve got to kill the small banks.”

One way to stop this is for every state to have a sovereign bank to handle the state’s deposits. “Many states used to have a sovereign bank … for a variety of reasons, they went away,” Fitts says. “Most state and local governments are highly dependent on big out-of-state banks, which is not a healthy situation, politically anyway.”10

At the Solari Report, Richard Werner wrote a memo about why a sovereign state bank would be great for Tennessee11 — but the principles can be applied across the U.S. It describes how the health of the local economy depends on small financial institutions. Werner explains, in part:12

“The goal of SBT [State Bank of Tennessee] is to ensure that the State of Tennessee can better act in the interests of its citizens, better fulfill its constitutional duties, and provide for a resilient and strong economy and financial system.

SBT will not compete with smaller local banks for loan and deposit market shares, but will act to support them in a number of ways, including loan participations and purchases, while mutually benefiting from expanded liquidity in state-level short-term money markets.

Small and medium-sized enterprises account for the vast majority of jobs in Tennessee (as elsewhere) and research has demonstrated that their prosperity and capacity for job creation, innovation, and expansion depends to a significant extent on the availability and capacity of small local banks. Small firms and small banks depend on each other in a symbiotic relationship.”

Fight Back Against Surveillance and Mind Control

In order to gain control of the financial system, the globalists must be careful to hide their true intentions at first — lest people come out with their pitchforks. This involves the rollout of digital passports under the guise of keeping the population healthy and safe. In short, they’re using the health care system as one of their power tools. Fitts says:13

“The clever thing they’ve done is — until they can get total control of transactions — they’re using health care as the way to build control. So, they don’t have complete control of the financial system, and they don’t want to be obvious that it’s the financial system, because then everybody’s gonna go after the central bankers. So, they’ve been very clever about using health care to engineer their economic warfare and play their games. It’s very clever.”

This is also where you start to see Silicon Valley, Big Tech and the National Security State fused together. “They’re essentially the same thing,” Webb explains,14 and they’re pushing for wearable technologies, nanotechnologies and other forms of technology that may one day have the ability to modulate your central nervous system — all under the guise of health care and all without informed consent.

“If you can’t imagine living your life without the smartphone,” Webb says, “then you’ve essentially already been enslaved by the system … it’s really the carrot to try and herd people into the corral of digital enslavement.”15 At the Solari Report, Fitts details mind control tactics being used on young people and children, which too much screen time and tech overuse.16 She adds:17

“I think the No. 1 obstacle between us and preserving freedom is surveillance and mind control technology. And essentially, there is a real push, including smartphones are a big part of it, to get us to resonate with the cell towers instead of with life, what I would call the divine intelligence.

… I think what they’re trying to do is essentially control our electromagnetic body … Some people call it the aura … as well as our intelligence and our ability to share intelligence with others.”

It’s important to be aware of small details in your daily life that ultimately leave you with less power. Take the calculator on your cellphone, for example. Since it’s always right there, you don’t have to do mental math anymore. Soon, your ability to do math problems in your head isn’t as good as it used to be. “And the more of these handy tools and apps on the smartphone, [the more] we become dependent on that for these abilities,” Webb says.18

How to Prepare Financially

The most important thing you need to do to prepare financially is “get yourself out of the control grid,” Fitts says.19 She recommends thinking small and spreading your cash around in different places, including outside of the banking and brokerage system. Keep cash on hand in your home, stored in a fireproof safe or two; cash can also be stored in a depository, a local bank and a safe deposit box at a local bank — or all of them.

CBDCs are an integral part of this coming social control system. By removing paper currency and replacing it with CBDCs, your ability to engage in transactions can be turned on and off. To fight back against CBDCs, Fitts recommends using cash as much as possible — and not frequenting shops that don’t accept it.20