by Craig Hemke, Sprott Money:

If you’re a regular reader of these columns, you may recall we first alerted you to this new price manipulation tool last year. You’re also likely to find it unsurprising that the bullion banks continue to abuse the “Trade At Settlement” system in 2023.

I suppose we could begin this post with links to all the articles we wrote on this subject in early 2022. However, that might be overkill. Instead, here’s a link to the final instalment, published by Sprott Money on May 17, 2022. If you have the time, please read that article. It describes for you what Trade At Settlement is, what types of trades are most likely placed using it, and why the bullion banks would seize upon this arcane procedure in order to propagate their ongoing price management schemes.

TRUTH LIVES on at https://sgtreport.tv/

What you need to know is that this TAS abuse continues unabated in 2023. EVERY month where a front/delivery month contract is about to go “off the board” and into “delivery”, the total volume of TAS trades will surge beginning on or about the 7th day of the month. For example, in the days before the Apr23 COMEX gold went off the board in late March, TAS trades surged to an average daily volume of 31,536 contracts during the five-day period of Tuesday, March 7 to Monday, March 13. Prior to March 7 and following the 13th, total TAS volume was at its regular average of about 1,500 contracts per day.

But this is not just a COMEX gold phenomenon. The Banks use it in silver too. The most recent front month for COMEX silver was the May23 contract. In the days leading up to that contract going off the board in late April, silver TAS volume surged to a daily average of 4,442 contracts between Monday, April 10 and Friday, April 14. Outside of this five-day surge of volume, the normal daily TAS volume in COMEX silver is about 800 contracts.

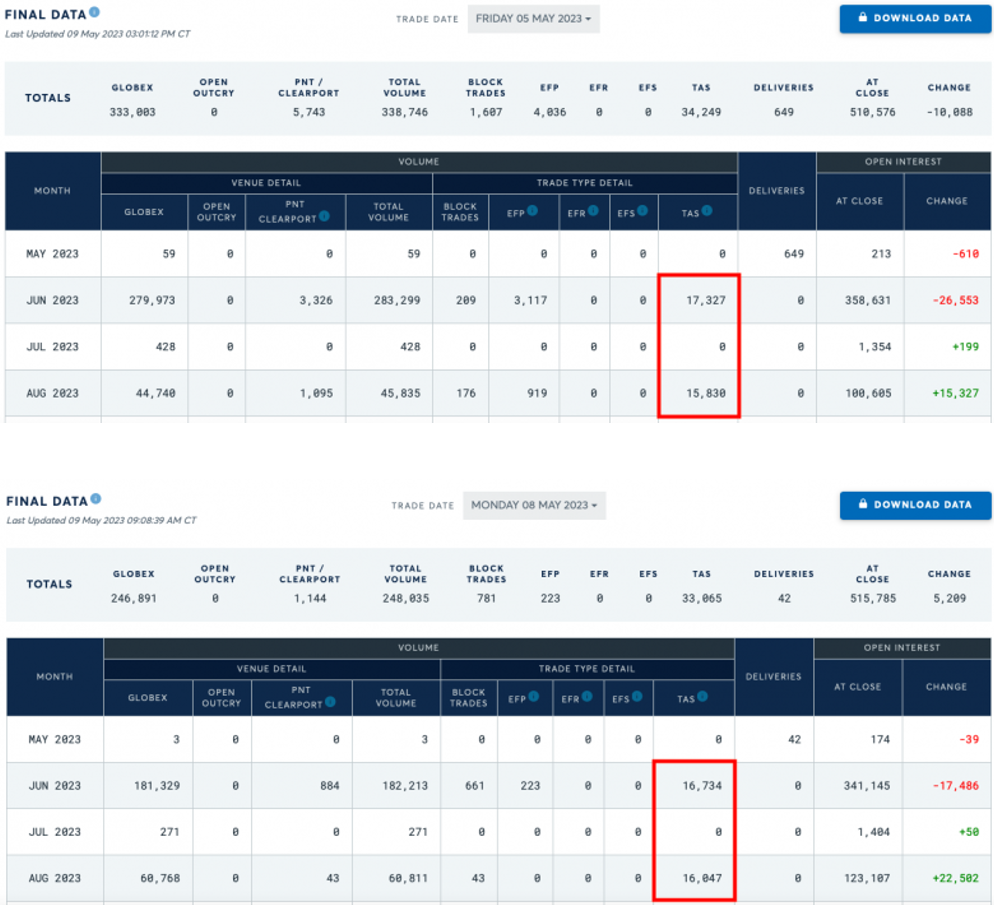

The current front months are Jun23 in COMEX gold and Jul23 for COMEX silver. Knowing this, we’d expect a new surge in TAS trades for COMEX gold this month, and that’s exactly what is happening. The surge began on Friday, May 5, with 34,249 TAS trades posted, and continued Monday, May 8, with another 33,065. History shows that this surge will continue through Thursday, May 11, and then TAS volume will go back to “normal” on Friday, May 12.

So what the heck is going on here?

As discussed in all those links from last year, we can deduce that this TAS volume comes from the initiation of new spread trades where a Bank goes long the soon-to-expire contract and short the next front month on the COMEX calendar. Given that this trade would be price insensitive, it’s no concern as to time and execution, so the Trade At Settlement price works just fine for the Bank placing the trade.

And you can see this below on the daily volume charts for Friday, the 5th and Monday, the 8th. Note that there are almost equal amounts of TAS volume for Jun23 and Aug23. In my opinion, the spread trade is most likely LONG the Jun23 and SHORT the Aug23.

Ultimately, the question becomes “why”. Why would The Bank trading desks, or any other party, continually and regularly make these trades? In a word, PROFIT! And how do they profit? The simplest two explanations are:

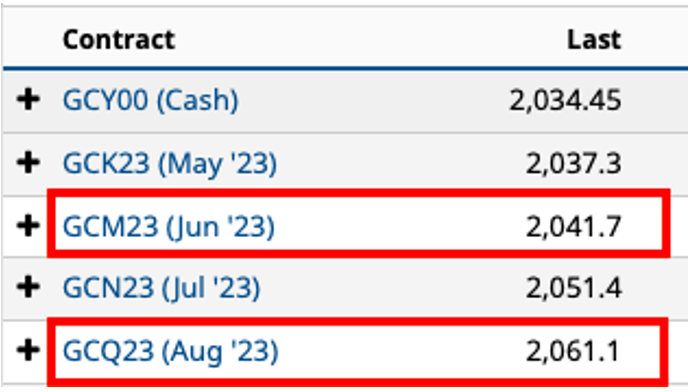

- To arbitrage and capture the spread and narrowing contango between the current, soon-to-expire front month and the next-in-line contract. As you can see below, that current spread is nearly $20 per contract.

- As TBTF institutions, the bullion banks have infinitely deep pockets to cover infinitely high margin costs. This allows them the luxury of “legging out” these accumulated spread trades. At any moment, a Bank desk might dump all or part of that Jun23 long side, leaving just the Aug23 short position. Having then managed/manipulated price lower by dumping the long, the Bank desk can then cover and buy back the Aug23 short—most likely at a sizable profit.

What does this mean for price?

Often, price rallies early in the month as these TAS spreads are placed, only to fall later in the month as the spreads are legged out.

Finally, please don’t take this commentary as the sole explanation for price movements and manipulations on COMEX. This TAS abuse is simply one tool, and since I’m just a tinfoil hat gold bug, I could be all wet and dead wrong in this analysis. However, you should be aware that price management/manipulation efforts by the bullion banks continue to this day, regardless of the accumulated fines, prosecutions, and convictions. This does NOT mean that prices can’t go higher over time. They undoubtedly will. However, the Bank trading desks are likely to continue managing price to their benefit every step of the way.