by Pam Martens and Russ Martens, Wall St On Parade:

Last year, newspapers across America were buzzing with the enticing yields available on U.S. savings bonds, Treasury bills and Treasury notes. It’s now apparent that millions of Americans got the message to move out of the meager yields being offered on savings accounts and money market at their bank and move to the free accounts and government-backed instruments offered by TreasuryDirect.gov. Investors, small and large, can buy directly from the U.S. Treasury at this site.

TRUTH LIVES on at https://sgtreport.tv/

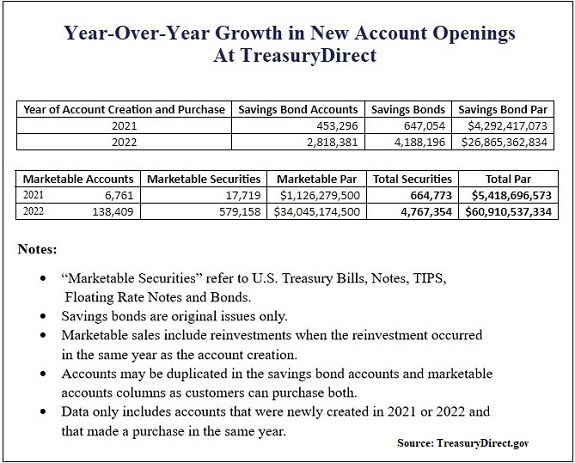

According to data provided by TreasuryDirect, new account openings in 2022 surged to a total of 2,956,790 from a total of 460,057 in 2021 – an increase of 543 percent in one year. Even more impressive, the total par value of the savings bonds and Treasury securities purchased in those accounts went from $9,711,113,646 in 2021 to $87,775,900,168 in 2022 – an 804 percent increase. (See chart below using data from TreasuryDirect.)

According to a screen shot we took and published on February 7 of this year, two of the largest banks in the U.S., JPMorgan Chase and Bank of America, were offering a preposterously low 0.01 annual percentage rate (APR) on their savings accounts on that date, according to BankRate.com. That’s after the Federal Reserve had been raising short rates over 11 months at the fastest pace in decades.

On that same date, February 7, 2023, the six-month U.S. Treasury Bill closed with a yield of 4.87 percent. It’s pretty easy to see why tens of billions of dollars of deposits are on the move in the U.S.

If Wall Street mega banks were relying on the inertia of Americans to protect them from having to offer competitive yields, it appears that they have misjudged the savvy of yield-hungry Americans who are desperately trying to keep up with inflationary pressures.

TreasuryDirect.gov describes itself and its offerings as follows:

“TreasuryDirect.gov is the one and only place to buy and redeem U.S. savings bonds and other securities directly from the U.S. Treasury! Your investments are backed by the full faith and credit of the United States government…

“TreasuryDirect accounts offer Series I and EE Savings Bonds, Treasury Bills, Notes, Bonds, Inflation-Protected Securities (TIPS), and Floating Rate Notes, all in electronic form, and all in one convenient account…

“You can: Purchase any amount of savings bonds from $25 to $10,000 per series — in penny increments. View your account online 24 hours a day, 7 days a week. Deposit the funds into your designated checking or savings account when you redeem your bonds…

“The most important thing to remember about purchasing marketable bills, notes, bonds, Floating Rate Notes, or TIPS is that the limits are set for each auction, not by year. The limit for noncompetitive purchases is $10 million for each security type and term, for each auction.”

TreasuryDirect.gov provides a two-minute video showing the ease with which one can open a TreasuryDirect account.

Read More @ WallStOnParade.com