from 21st Century Wire:

Don’t look now, but the thing everyone has been talking about and anticipating for years – has finally begun. And it’s happening a lot faster than many thought it would.

The story should be familiar to any decent student of 20th century geopolitics: following World War Two, newly-minted US-controlled multilateral institutions like the UN, World Bank, IMF and WTO – all joined forces to help buttress US dollar hegemony around the world, solidifying America’s “unipolar moment.” And it worked.

TRUTH LIVES on at https://sgtreport.tv/

That was then.

De-dollarisation is happening now – a trend is largely being driven by US and NATO allies’ failed policy of punishing countries with sanctions. Hence, massive dollar reserves are becoming too risky for truly soveriegn country to keep on hand.

And so it begins…

Peter C. Earle from AIER reports…

Last week, China and Brazil reached an agreement to settle trades in one anothers’ currencies. Over the past 15 years, China has replaced the United States as the main trading partner of resource-rich Brazil, and as such that shift may have been inevitable. But within the context of recent circumstances, this appears to be another in a series of recent blows to the central role of the dollar in global trade.

As the world’s reserve currency, the US dollar is essentially the default currency in international trade and a global unit of account. Because of that, every central bank, Treasury/exchequer, and major firm on Earth keeps a large portion of their foreign exchange holdings in US dollars. And because holders of dollars seek returns on those balances, the ubiquity of dollars drives a substantial portion of the demand for US government bonds in world financial markets.

The switch from dollars to a yuan-real settlement basis in Chinese-Brazilian trade is only the latest in a growing trend. Discussions of a more politically neutral reserve currency have gone on for decades. The profound economic disruption experienced by Iran, and more recently Russia, after being evicted from dollar-based trading systems like SWIFT, however, have led many nations to consider imminent contingency plans. India and Malaysia, for example, have recently begun using the Indian Rupee to settle certain trades, and there have been perennial warnings about Saudi Arabia and other energy exporters moving away from the dollar. On that note, China also recently executed a test trade for natural gas with France settled in yuan.

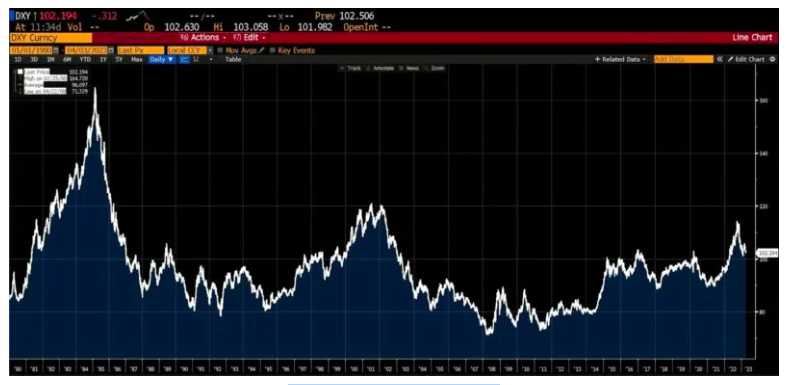

DXY Index: 1980 – present (Source: Bloomberg)

DXY Index: 1980 – present (Source: Bloomberg)

It’s not just the conscription of the dollar in economic warfare, but increasingly error-fraught monetary policy regimes that are driving various interests away from the greenback. The monetary policy response to the 2008 financial crisis saw the dollar’s value whipped around unpredictably, and the response to the outbreak of COVID was even more frenetic. The massively expansionary response to the pandemic in 2020 was followed by an initially dismissive posture toward the outbreak of inflation, which reached four-decade highs before an aggressive contractionary shift in policy that destabilized precarious financial institutions was implemented.

Read More @ 21stCenturyWire.com