by Ronan Manly, BullionStar:

Over the last few years, those in the precious metals investor community who believed that precious metals prices were being manipulated felt vindicated following a series of prosecutions of leading investment banks and their traders by US authorities such as the Department of Justice (DoJ), and Federal Bureau of Investigation (FBI), not least the successful convictions of precious metals traders who worked for JP Morgan.

TRUTH LIVES on at https://sgtreport.tv/

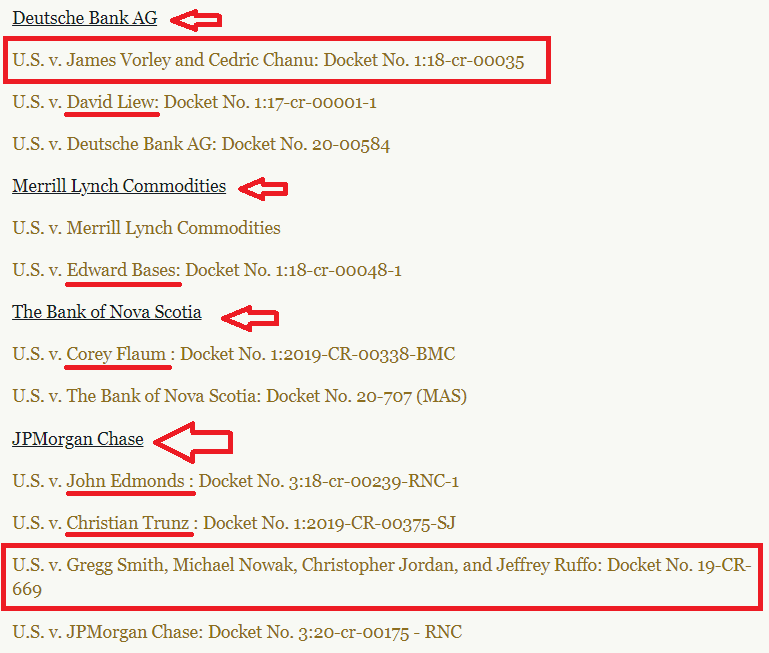

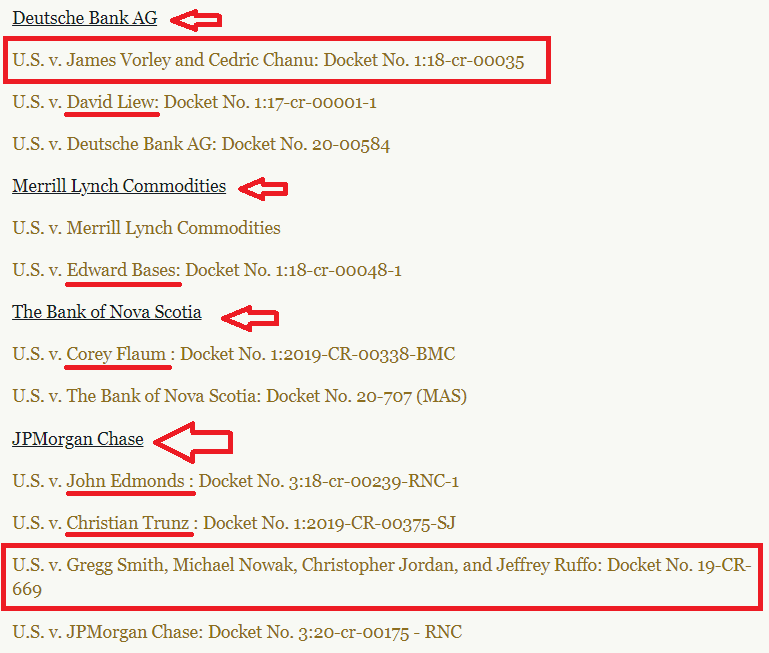

These trader convictions included:

- A successful US criminal trial prosecution by a federal jury of Michael Nowak (former head of JP Morgan’s precious metals trading desk), and Gregg Smith (former JP Morgan precious metals trader) in August 2022.

Nowak was convicted for 13 counts of attempted price manipulation, commodities fraud, wire fraud, and spoofing prices in the gold, silver, platinum and palladium futures markets.

Smith was convicted of 11 counts of attempted price manipulation, commodities fraud, wire fraud, and spoofing.

The BullionStar article discussing the conviction of Nowak and Smith can be read here. To illustrate how important the news of the Nowak and Smith convictions in August 2022 was, the Assistant Director of the FBI’s Criminal Investigative Division said at the time that:

“Today’s conviction demonstrates that no matter how complex or long-running a scheme is, the FBI is committed to bringing those involved in crimes like this to justice.”

- In addition to Nowak and Smith, there was a successful US criminal trial prosecution by a federal jury of Christopher Jordan (former JP Morgan precious metals trader) in December 2022.

Jordan was convicted of convicted of wire fraud affecting a financial institution.

JP Morgan’s Michael Nowak also had the dubious distinction of being a board member of the London Bullion Market Association (LBMA) at the time that he was charged and indicted by the DoJ in September 2019.

- In addition to the trader convictions, JP Morgan (the firm) was also successfully prosecuted by the Department of Justice and forced into a resolution with the DoJ in September 2020, wherein JP Morgan entered into a deferred prosecution agreement (DPA) and “paid over $920 million in a criminal monetary penalty, criminal disgorgement, and victim compensation.” JP Morgan’s Deferred Prosecution Agreement can be seen here.

Again to illustrate the severity of what it meant for JP Morgan to agree to a SPA about precious metals market manipulation, at the time in September 2020, the Acting Assistant Attorney of the Justice Department’s Criminal Division said that:

“For over eight years, traders on JP Morgan’s precious metals and U.S. Treasuries desks engaged in separate schemes to defraud other market participants that involved thousands of instances of unlawful trading meant to enhance profits and avoid losses.”

Colleagues turned State Witnesses

While all three of Nowak, Smith and Jordan were charged on the same indictment on 16 September 2019, Jordan managed to secure a separate trial since his lawyers argued that he would not get a fair trial if tried jointly with Nowak and Smith.

According to Bloomberg Law, Jordan’s lawyers submitted a memo to the court saying that “separating the cases would ensure that Jordan gets a fair trial ‘given the complexity of the charges in this case and the disparity in evidence’ between himself and his co-defendants.”

Ironically for Jordan, a separate trial didn’t help him, and he was duly was convicted by a federal jury in December 2022, four months after Nowak and Smith had been convicted.

Helping in the prosecutions of Nowak, Smith and Jordan was the fact that a number of their ex-colleagues turned to being witnesses for the prosecution as part of their agreements to cooperate with the Government. These prosecution witnesses were the precious metals traders John Edmonds, Christian Trunz and Corey Flaum.

In November 2018, John Edmonds had pleaded guilty to commodities fraud and conspiracy to commit wire fraud, commodities fraud, commodities price manipulation and spoofing.

In July 2019, Corey Flaum had pleaded guilty to attempted commodities price manipulation.

In August 2020, Christian Trunz had pleaded guilty to conspiracy to engage in spoofing, and spoofing.

Edmonds and Trunz had worked with Nowak, Smith and Jordan on the JP Morgan precious metals trading desk. Flaum had worked with Smith when they were previously together on the Bear Stearns precious metals trading desk. Trunz, by the way, had also worked with Smith on the Bear Stearns precious metals trading desk as well as the JP Morgan precious metals trading desk.

Edmonds and Trunz therefore gave testimony to the jury on how Nowak and Smith were engaged in market manipulation at JP Morgan, while Flaum gave testimony on similar market manipulation by Smith at Bear Stearns.

Contempt for the Law

So you might think, yes, that’s great, justice has been served, but why bring this up now in April 2023?

The reason for bringing this up now, is that, wait for it … all three of Nowak, Smith and Jordan are now appealing their convictions and trying to get their convictions quashed and over-turned. Even though they were tried unanimously by jury and even though their colleagues explained that Nowak, Smith and Jordan were manipulation prices for years and years

Like the finale in a bad zombie movie, just when you think these JP Morgan precious metals traders have gone away, they keep getting up and coming back.