by Peter Schiff, Schiff Gold:

Silver delivery from the COMEX was low in April, but there is more to the story.

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock/inventory data at the Comex to show the physical movement of metal into and out of Comex vaults.

TRUTH LIVES on at https://sgtreport.tv/

Gold: Recent Delivery Month

Gold is wrapping up April, which is a major delivery month. Deliveries of 23.7k exceeded the last two major months of December and February.

Figure: 1 Recent like-month delivery volume

Higher delivery volume was probable based on how the delivery period got started. As shown below by the green bars, the contract entered the delivery period with quite high OI.

Figure: 2 24-month delivery and first notice

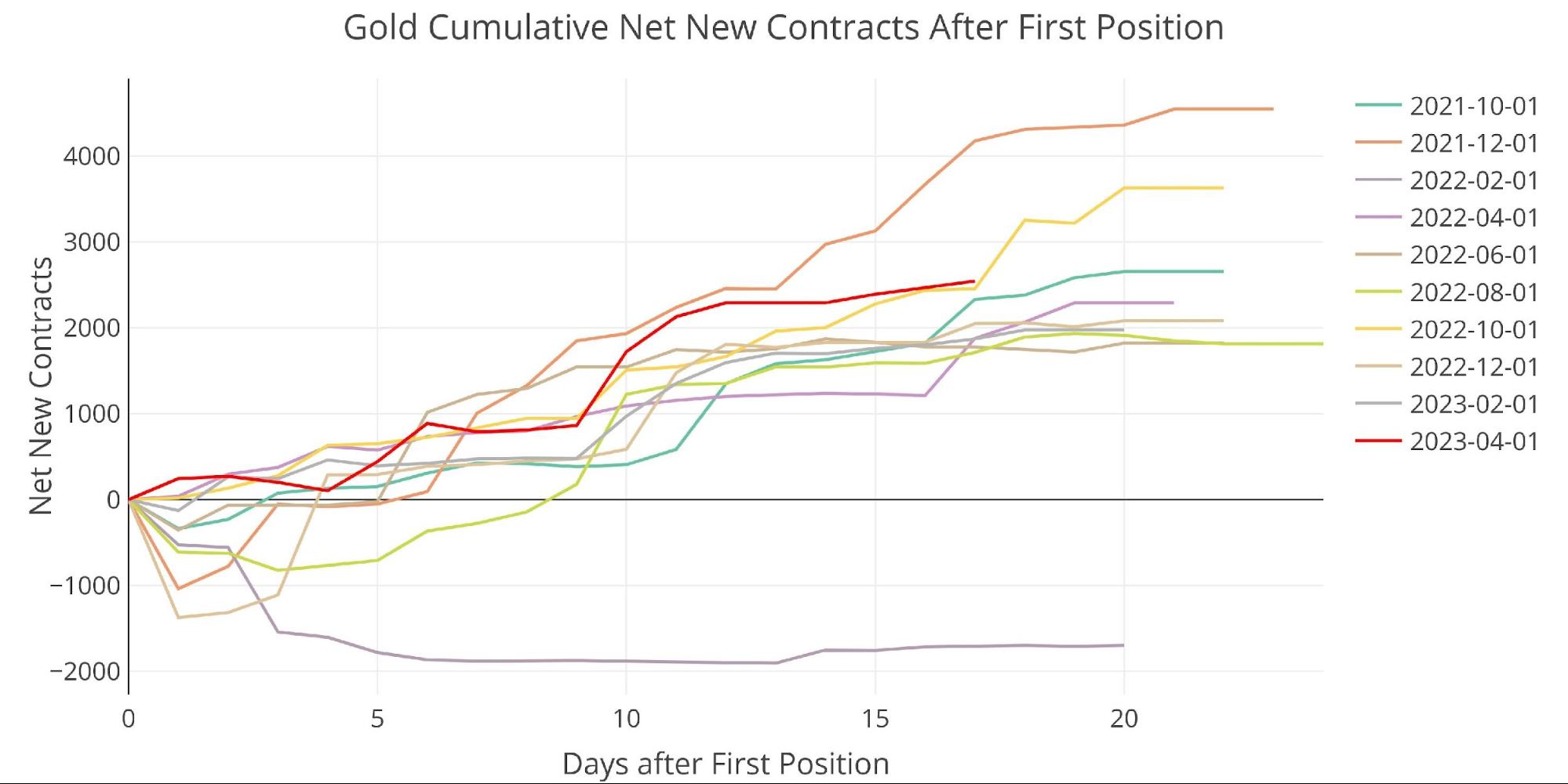

As shown below, net new contracts have played a role as well. During the month, there were more net new contracts than any month since December 2021 (pink line). October 2022 will likely exceed the latest month once the month closes (yellow line). October 2022 saw an uncharacteristic late-month surge in net new contracts.

Figure: 3 Cumulative Net New Contracts

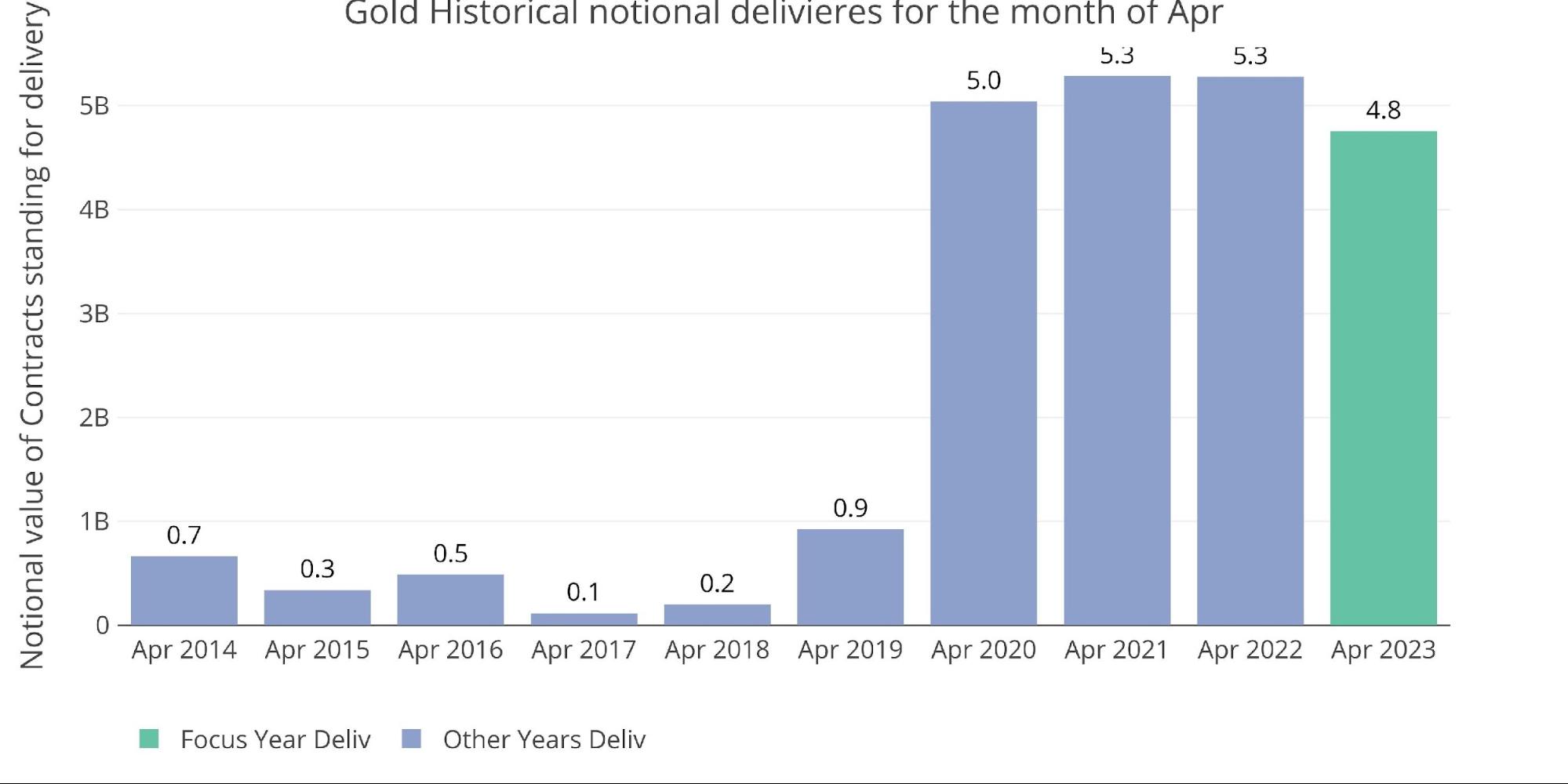

Despite the strength relative to recent months, this is actually the smallest April delivery notional volume since 2019.

Figure: 4 Notional Deliveries

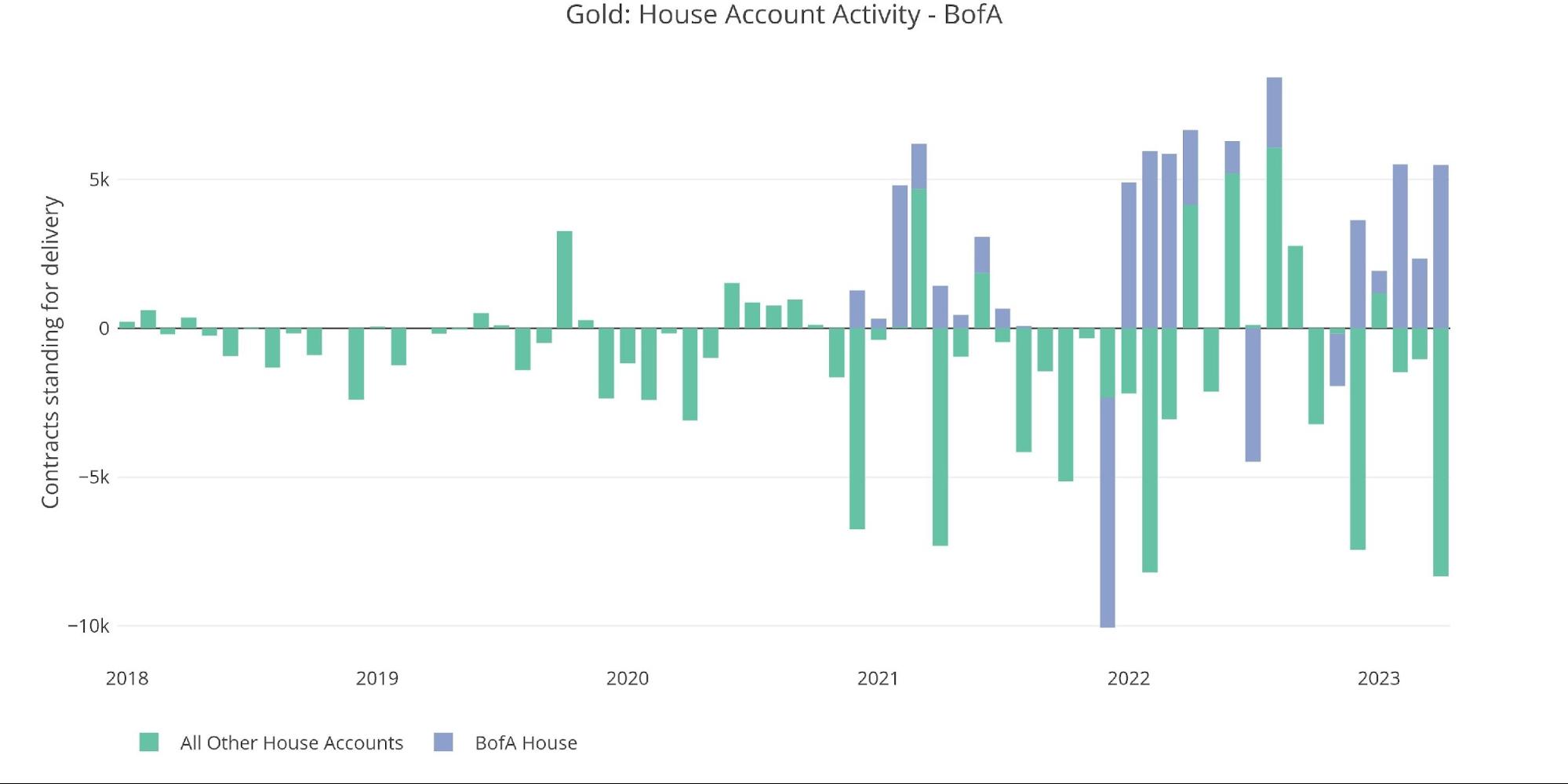

The house accounts have been very busy this month. BofA took delivery of 5,480 contracts while the non-BofA house accounts delivered a net 8,333. This is the largest ever net delivery for non-BofA house accounts. The BofA delivery volume did not set records but was near record territory. The all-time record is Feb 2022 when 5,945 contracts were delivered during the height of the Ukraine war uncertainty.

Figure: 5 House Account Activity

When looking at the physical vaults, there has been some minor effort to restock the Eligible gold. This was done by JP Morgan after they depleted almost their entire stack early in the delivery period of the current April contract.

Registered is actually up YTD by 963k ounces with Eligible down 1.96M ounces. Activity had to pick up to handle the current major month… something that was not required during the February delivery period.