from ZeroHedge:

“The market stops panicking when central banks start panicking”

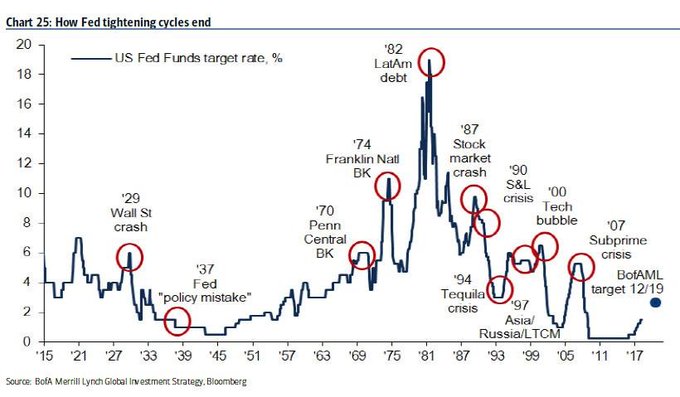

In January 2022, just around the time the Fed announced it was launching its most aggressive tightening campaign since Volcker, we warned “remember, every Fed tightening cycle ends in disaster and then, much more Fed easing”

TRUTH LIVES on at https://sgtreport.tv/

Remember, every Fed tightening cycle ends in disaster and then, much more Fed easing pic.twitter.com/zX7Dur8nLG

— zerohedge (@zerohedge) January 5, 2022

Fast forward to just over a week ago, when the Fed tightening cycle indeed ended in disaster when SIVB became the first (of many) banks to fail, triggering a chain of dominoes that culminated with today’s collapse of Credit Suisse – a systematically important bank with $600BN in assets.

And then, at 5pm, the easing officially began, because while a bunch of laughable macrotourists were arguing on FinTwit whether last week’s record surge in the Fed’s discount window was QE or wasn’t QE (answer: it didn’t matter, because as we said, it assured what comes next), the Fed finally capitulated, just as we warned over and over and over that it would…