from ZeroHedge:

It’s become almost like clockwork: every two weeks we get some news that send Credit Suisse stock to new all time lows.

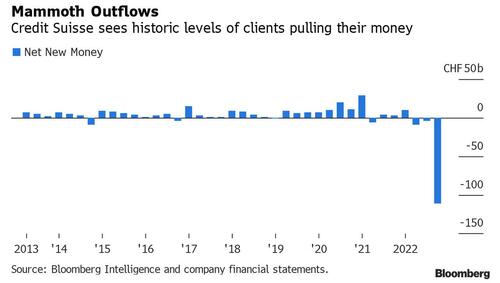

At the beginning of February, the stock of the second largest Swiss bank plunged after it reported its losses would unexpectedly continue well into 2023 if not 2024, and that the bank run revealed at the end of 2022 was much worse than the bank had previously admitted, prompting some analysts to call it “staggering.”

TRUTH LIVES on at https://sgtreport.tv/

Then, two weeks later in mid-February, the stock plunged again after a report that regulators were probing if Axel Lehmann, the Chairman of the embattled bank, had lied about the full extent of the bank run in hopes of “stabilizing” outflows.

Fast forward another two weeks to today, as CS stock craters 7% to a fresh all-time low, after reports from Reuters and Bloomberg that in hopes of reversing the seemingly endless bank run – and who can blame depositors from pulling their money from a company whose stock is less than $3 from zero – Credit Suisse is now offering aggressively higher deposit rates to attract new funds from wealthy clients in Asia.

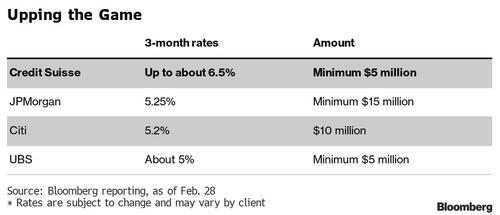

Citing sources, Reuters notes that the Swiss bank is offering a 6.5% annual rate on new three-month deposits of $5 million or above – and a rate as high as 7% for one-year deposits – far above matched maturity Bills, and suggesting that to attract a client, the bank is forced to eat a loss. The hope, of course, is that after it attracts enough new clients, the bank will then be able to quietly lower the rates and make the new accounts profitable, however as the various DeFi blow ups of 2022 showed, it never quite works out that way.

“The banking sector has been responding to global rate hikes with higher rates and Credit Suisse is fully focused on providing our clients with differentiated advice and competitive solutions,” a Credit Suisse spokesperson said.

Credit Suisse’s generous offers are not only well above risk-free rates, but also about 100 to 200 basis points higher than those of major rivals in the region such as JPMorgan, UBS and Citi Group.

Hilariously, the new deposit rates are higher than Credit Suisse’s lending rates in Asia, a Reuters source said, adding that “it raises concerns about how the business can sustain such a funding gap.” Spoiler alert: it can’t, and as explained above, the bank is willing to eat a short-term loss in hopes of attracting enough sticky money before it flees again once the teaser rates are cut. Sure enough, another source said the offers are valid until the end of this quarter and only apply to new cash deposits, not to existing portfolios.

Asked about the lender’s pricing to win back money during Credit Suisse’s earnings call last month, CEO Ullrich Koerner said the bank is trying to be “competitive” like many rivals: “But we are not buying assets, just to be clear, because that would not be very smart going forward,” he said, which is ironic because buying assets – and at a very high price – is precisely what he is doing… and it’s not working: the bank’s assets managed for wealthy clients, excluding the Swiss bank, tumbled to 540.5 billion Swiss francs ($574 billion) at the end of December, from 742.6 billion francs a year ago, contributing to a second consecutive annual loss, according to Bloomberg.

The bigger problem for CS is that while it may eventually stem the liquidity bleed – if only temporarily – with such sleight of accounting hand, it is facing a far more ominous talent bleed as at least a dozen private bankers at the managing director-level and above have left Credit Suisse in Singapore and Hong Kong since September, or are planning to leave according to Bloomberg. Worse, some senior bankers that left handled at least $1 billion in client assets, “and are likely to take at least a quarter of the funds they manage to their new employers, rising to as much as 60% in some cases, according to people familiar with the hires.”