by Brian Shilhavy, Health Impact News:

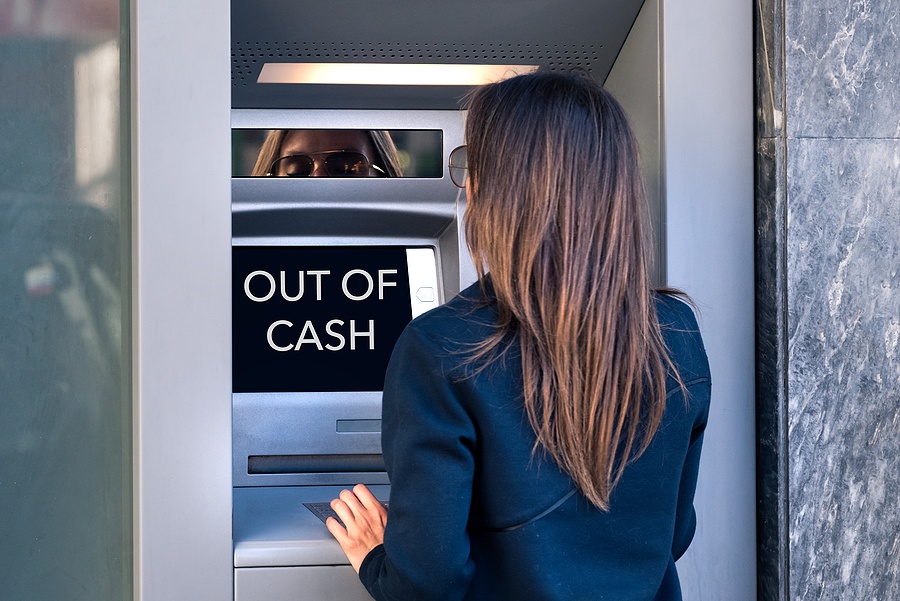

While we have not seen a total collapse of the worldwide financial system yet, bank runs that began in 2022 with the collapse of FTX and the $billions that were lost when depositors were not able to withdraw their funds, continue to happen here in 2023, although they do not get headline news coverage.

Last week, Pam Martens, writing for Wallstreet on Parade, reported that bank runs were happening at Silvergate Bank, a U.S. FDIC insured bank.

TRUTH LIVES on at https://sgtreport.tv/

Silvergate, a Federally Insured Bank, Just Blew Up from Ties to Crypto

The one thing a depositor never wants to hear from a bank that is holding his or her life savings is that it has doubts about its “ability to continue as a going concern.” Unfortunately, those very words appeared in a filing made yesterday by Silvergate Capital with the Securities and Exchange Commission – which pretty much guarantees that the ongoing run on deposits at Silvergate will continue with an added sense of urgency.

Silvergate Capital is the owner of the federally-insured and taxpayer-backstopped bank, Silvergate Bank, which decided several years back that it would be a cool idea to become the go-to depository bank for crypto companies. One of those outfits was Sam Bankman-Fried’s now collapsed house of fraud. Accounts at Silvergate Bank included Bankman-Fried’s crypto exchange, FTX; his hedge fund, Alameda Research, which prosecutors say looted his FTX crypto exchange customers; and North Dimension, a fake company promoting itself as an online seller of mobile phones, when it was actually laundering money for Sam Bankman-Fried’s crypto enterprises, according to federal prosecutors.

Once the word got out about Silvergate’s ties to FTX and Bankman-Fried, a bank run ensued. (Full article.)

Credit Suisse, the second largest bank in Switzerland, which saw bank runs begin last fall, continues to see a mass exodus of depositors as its stock continues to fall here in 2023.

Credit Suisse Tanks to New Intraday Lows as Wall Street Mega Banks Mysteriously Shake Off the Contagion Effect

The shares of Credit Suisse can’t find a bottom. They plunged to a new intraday low this morning in Europe to trade at the equivalent of $2.79 – down over 6 percent from their previous close.

Sparking the continued exodus out of Credit Suisse shares is the growing concern that the exodus of client assets from Credit Suisse has not found a floor.

Reuters is reporting this morning that the Swiss financial regulator, FINMA, is investigating remarks made by Credit Suisse Group Chairman Axel Lehmann to the media in early December, which suggested that client asset outflows had stabilized.

Simple math indicated they had not. (Full article.)

It was also reported last week that Blackstone had defaulted on a $562 million bond, and was blocking investors from cashing out their investments at its $71 billion real estate income trust (BREIT).

Blackstone Defaults On $562MM CMBS As It Keeps Blocking Investor Withdrawals From $71BN REIT

Now that soaring rates have burst the commercial real estate bubble, the carnage is coming fast and furious.

This morning Bloomberg reports that Wall Street’s largest commercial real estate landlord, private equity giant Blackstone, has defaulted on a €531 million ($562 million) bond backed by a portfolio of offices and stores owned by Sponda Oy, a Finnish landlord it acquired in 2018.

While the PE firm had sought an extension from holders of the securitized notes to allow time to dispose of assets and repay the debt, the surge in market volatility triggered by the war in Ukraine and rising interest rates interrupted the sales process and bondholders voted against a further extension, the Bloomberg sources said.

And since the security has now matured and has not been repaid, loan servicer Mount Street has determined that an event of default has occurred, according to a statement Thursday. The loan will now be transferred to a special servicer.

“This debt relates to a small portion of the Sponda portfolio,” a Blackstone representative said in an emailed statement. “We are disappointed that the servicer has not advanced our proposal, which reflects our best efforts and we believe would deliver the best outcome for note holders. We continue to have full confidence in the core Sponda portfolio and its management team, whose priority remains delivering high-quality retail and office assets.”

And while Blackstone is understandably trying to minimize the news, the PE firm clearly continues to scramble to stabilize the bleeding in its massive real estate portfolio and on Wednesday it said that it had blocked investors from cashing out their investments at its $71 billion real estate income trust (BREIT), as the private equity firm continues to grapple with a flurry of redemption requests. (Full article.)

Unfortunately, this is probably just the tip of the iceberg in terms of bank failures and bank runs that await depositors, and I am not the only one saying that, as the U.S. and many European countries are now preparing for bank runs.

Read More @ HealthImpactNews.com