by John Rubino, John Rubino:

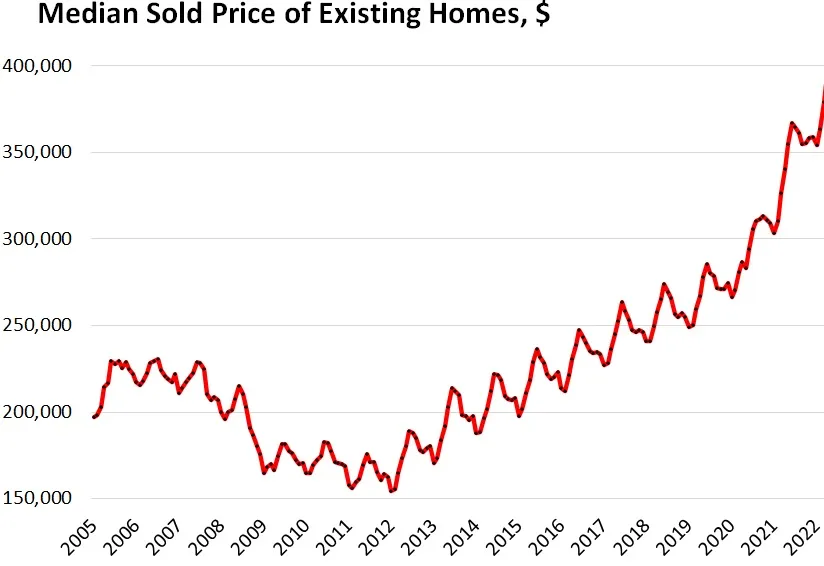

Between 2020 and 2022 houses in America’s hottest real estate markets went from unaffordable to 50% above unaffordable. Put another way, they did what would have been impossible in an economy where market forces determined interest rates and home prices.

But ours was not that kind of market. Central banks around the world had lost their collective minds and money was the cheapest it had ever been – far cheaper than it should or would be in a sane world.

TRUTH LIVES on at https://sgtreport.tv/

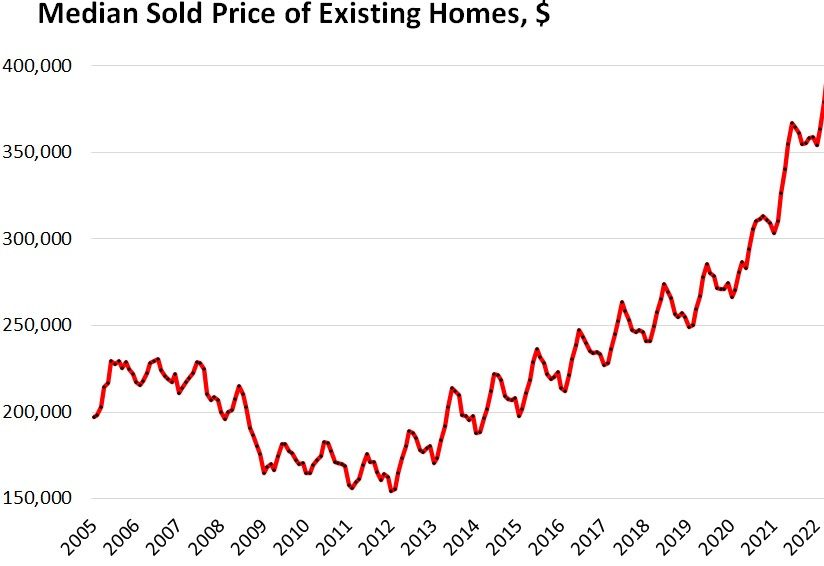

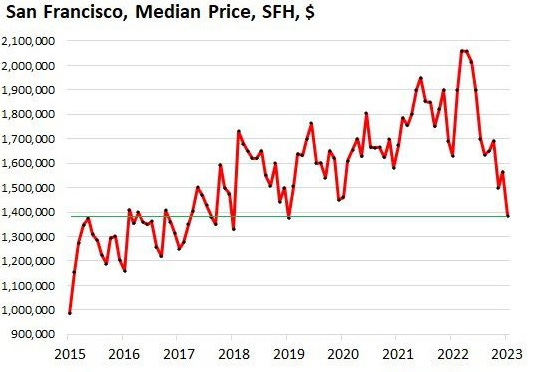

Offered 2.75% 30-year mortgages (read, shockingly low monthly payments), home buyers stampeded off the proverbial cliff en masse, paying any price, accepting any terms (no inspection, no problem!) to get houses in hot markets. And private equity predators borrowed even more cheaply and used the proceeds to outbid even the most delusional individual buyers. Prices soared not just past but far beyond the 2007 housing bubble records. The following chart* depicts a milestone in human financial lunacy.

About six months ago, the financial world woke up to find itself with the mother of all financial hangovers (in the form of 10% cost of living inflation) and decided to go off the easy money heroin cold turkey. Interest rates spiked, mortgage rates followed, and the average 30-year fixed rate more than doubled to 6.7%, with more gains apparently soon to come.

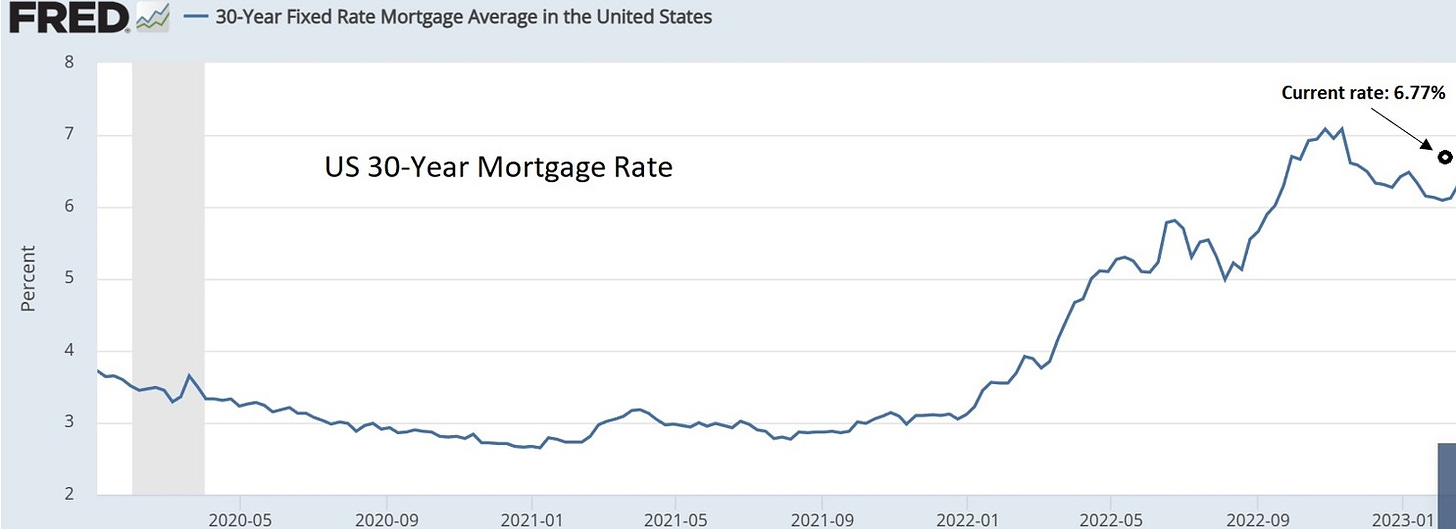

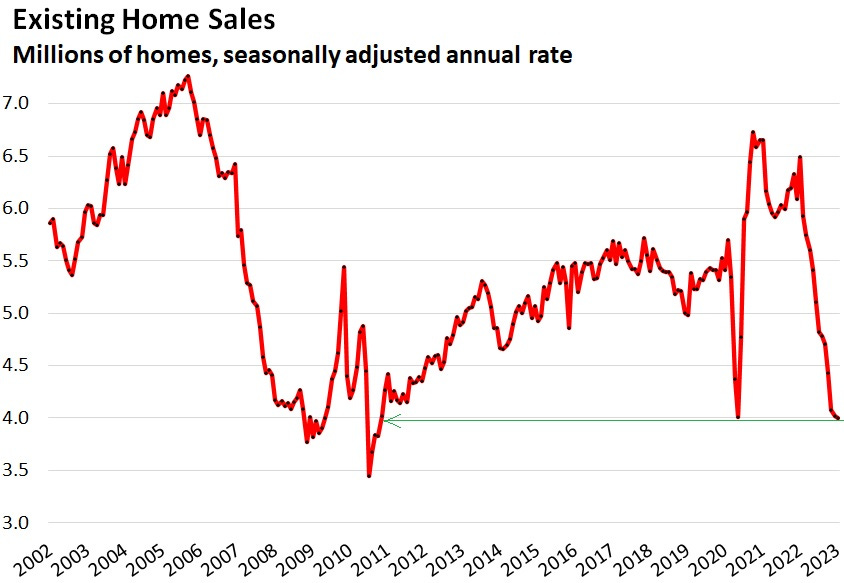

Today, even marauding private equity landlords like Blackstone can no longer raise rents enough to justify borrowing to buy more houses. Virtually no one can justify buying a house at this level, which means hardly anyone is trying. Home sales, as a result, have plunged back to Great Recession crisis levels.

Sales tend to lead prices, so expect the country as a whole to look like San Francisco by year-end:

What does this mean for the rest of the economy? Bad things, almost across the board. Housing is a big sector financially and an immense one psychologically. All those people who paid $2 million for houses now worth $1.2 million are going to pull in their horns and skip their next exotic vacation and Tesla trade-up. The economy — already suffering from tech layoffs and supply chain disruptions (not to mention all those mysterious industrial accidents) — will be without a single growth engine. The only fun part will be watching real estate hedge fund managers refusing to return their investors’ money, thus forfeiting both their credibility and their livelihoods. Small comfort, but comfort nonetheless.

Read More @ rubino.substack.com