by Wolf Richter, Wolf Street:

Market is still frozen, potential sellers sit on vacant properties, hoping this too shall pass. Cash Buyers, investors, second-home buyers pull back further.

Market is still frozen, potential sellers sit on vacant properties, hoping this too shall pass. Cash Buyers, investors, second-home buyers pull back further.

Spring selling season begins with 7% mortgage rates? In terms of closed sales, December and January usually mark the low-point of the year for the housing market, reflecting deals made over the holiday period in November and December. But the spring selling season starts now.

TRUTH LIVES on at https://sgtreport.tv/

In January, mortgage rates had dropped on hopes of a quick Fed pivot and steep rate cuts asap, yes please, with mortgage rates diving back to 3%, or whatever, but that dream is now fizzling.

The average 30-year fixed mortgage rate today rose to 6.87%, according to Mortgage News Daily. The 10-year Treasury yield is moving in on the 4% mark – currently at 3.96%. And these rates are going to dog the spring selling season.

“And this too shall pass” has been the guiding principle for potential sellers, as they’re waiting for the Fed to slash its interest rates so that mortgage rates could plunge back to 3% so that they could sell their properties for March 2022 prices. So potential sellers are not putting their vacant properties on the market unless they have to, and buyers are not buying at March 2022 prices. And the market remains essentially frozen.

For deals to be made, potential sellers need to get realistic about the price at current mortgage rates. Those that listed their properties and made a deal months ago at whatever unpalatable price, they’re now way ahead of the game.

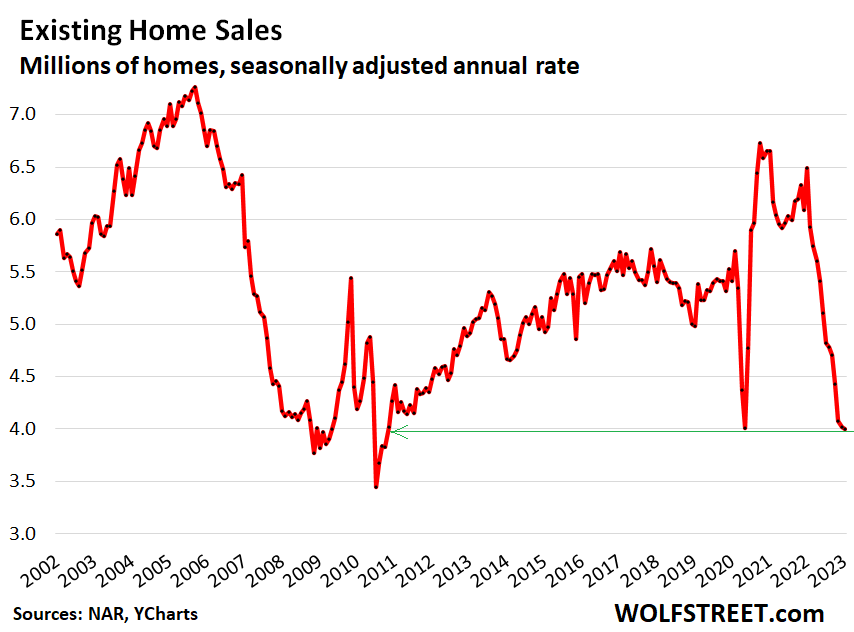

Sales of previously owned houses, condos, and co-ops fell by another 0.7% in January from December, to a seasonally adjusted annual rate of sales of 4.0 million homes, according to the National Association of Realtors today. This was the 12th month in a row of month-to-month declines on this seasonally adjusted basis. Sales dropped by 37% year-over-year, below the lockdown low of May 2020, to the lowest since 2010 during Housing Bust 1.

Actual sales in January – not seasonally adjusted, and not as annual rate – fell to 231,000 properties, down 34% from a year ago (historic data via YCharts):

Sales of single-family houses fell by 0.8% in January from December, and by 36% year-over-year, to a seasonally adjusted annual rate of 3.59 million houses.

Sales of condos and co-ops were roughly unchanged from December, but plunged by 43% from January a year ago, to a seasonally adjusted annual rate of 410,000 units.