by Steve St. Angelo, SRSRocco Report:

As the world hits the Energy Cliff, we are now witnessing Big Problems in the global copper industry. Not only is Chile, the world’s largest copper producer experiencing continued declines in production, but recent protests have also led to the shutdown of copper mines in Peru.

What’s happening to the King Industrial metal is the Canary in the Coal Mine for the Gold & Silver Mining Industry. I will be doing a detailed video report on this.

TRUTH LIVES on at https://sgtreport.tv/

However, I wanted to share a quick update on what is happening in the Copper Industry.

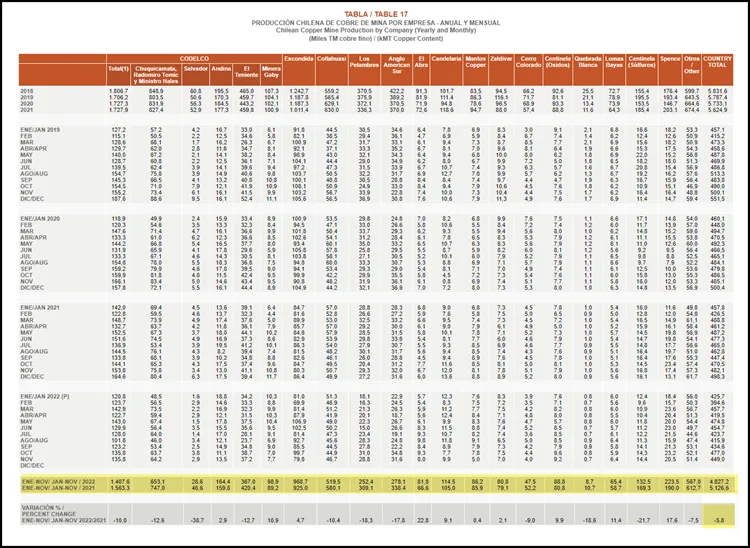

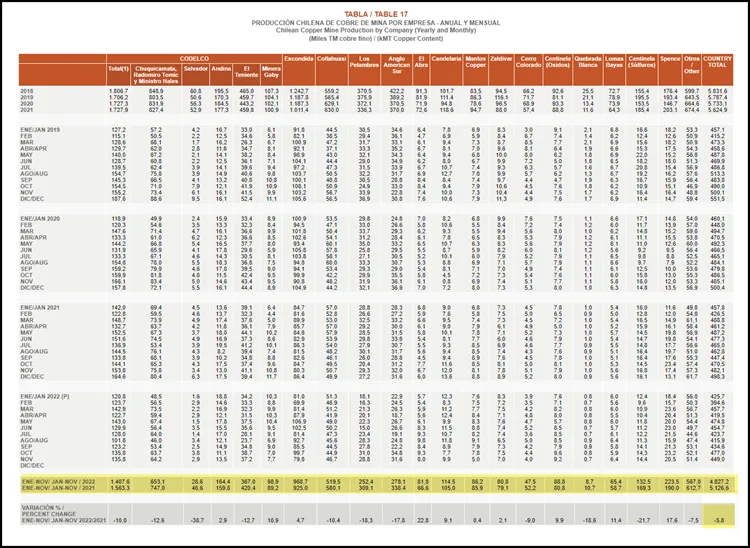

First, let’s look at Chile’s copper production as of November 2022. It’s down 5.8% versus the same eleven-month period last year!! This is a significant loss of copper production.

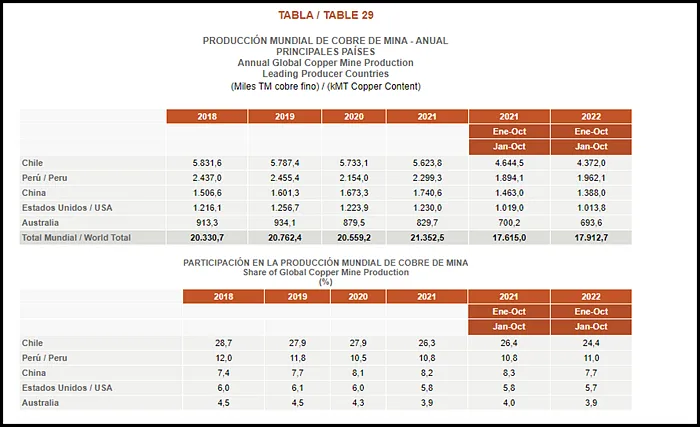

While difficult to read, this chart shows the breakdown by the company of Chile’s copper production. Chile’s copper production JAN-NOV 2022 is down a stunning 300 million metric tons versus the same period in 2021. The following chart shows the top five copper producers’ production for JAN-OCT 2022.

Even though Chile is down, the World Total for JAN-OCT 2022 is at 17.913 million tons vs. 17.615 million tons compared to the same period last year. However, four of the top five producers are showing declines, except for Peru. According to this tweet, Glencore shut down its large copper mine in Peru due to protests:

#Chile production of #copper down 5.5% in Nov.

First Quantum’s mine in Panama shut down and it produced 1.5% of the world’s #copper

Now Glencore’s Antapaccay mine ?

🚨Now small wonder the global warehouses are emptying out…it is panic buying! #PeakCopper https://t.co/ijZoB9LSqV pic.twitter.com/fCm8Gr3TlN

— StockShaman ⚒ #PeakCopper AKA Greg Shafransky (@StockShaman) January 21, 2023

I believe as the Energy Cliff spreads throughout the world, Protests, Riots, and Unrest will only increase as more of the public can’t afford Food & Energy.

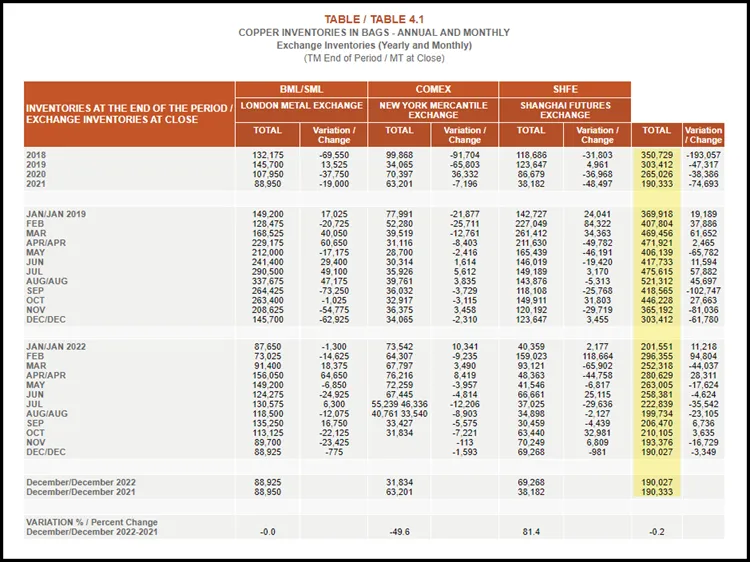

If we take a look at the Top Copper Inventory Stocks, the picture also doesn’t look good:

You can see that since 2018, Global Copper Inventories have continued to decline from 350 million tons down to 190 million. With the new Green Energy policies, copper is in demand more than ever. Thus, what happens when PANIC BUYING really kicks in?? I see the same thing happening with Gold and Silver, but that will be discussed in a Report next week.

TEASER: Metals Focus and the World Silver Survey forecast growing silver production in 2023. However, from the data I have seen, it will be a GOOD BIT less than in 2021. At some point, we will also see PANIC BUYING in silver, and it won’t be just Retail bullion buyers, but also, Large Institutions. It’s not a matter of IF, but WHEN…

Read More @ SRSRoccoReport.com