from ZeroHedge:

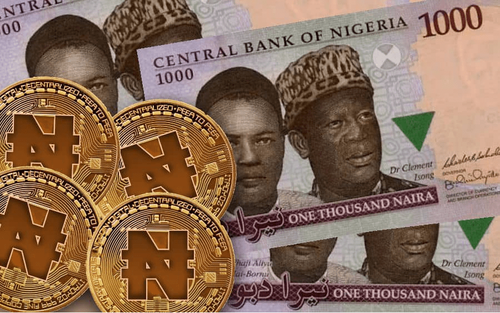

A staggering number of Nigerians love Bitcoin, but hate government cryptocurrency (CBDCs).

In April, leading cryptocurrency exchange KuCoin noted that 35% of the adult population in Nigeria – roughly 34 million adults aged 18-60, own bitcoin or other cryptocurrencies. But when it came to the country’s Central Bank Digital Currency (CBDC), the eNaira, it was a massive failure.

TRUTH LIVES on at https://sgtreport.tv/

According to Bloomberg, only 1 in 200 Nigerians use the eNaira – despite government implemented discounts and other incentives, implemented as desperate measures to increase adoption.

Now, the government is looking to boost digital payments by limiting ATM withdrawals to just 20,000 naira, or roughly US$45 per day, Bloomberg reports, citing a circular sent to lenders on Tuesday. The previous withdrawal limit was 150,000 naira (US$350).

Weekly cash withdrawals from banks are now limited (without fee) to 100,000 naira (US$225) for individuals, and 500,000 naira (US$1,125) for corporations. Any amount above this will incur a fee of 5% and 10% respectively.

The action is the latest in a string of central bank orders aimed at limiting the use of cash and expand digital currencies to help improve access to banking. In Nigeria’s largely informal economy, cash outside banks represents 85% of currency in circulation and almost 40 million adults are without a bank account.

The central bank last month announced plans to issue redesigned high value notes from mid-December to mop up excess cash and it’s given residents until the end of January to turn in their old notes. The bank also plans to mint more of the eNaira digital currency, which was launched last year but has faced slow adoption. -Bloomberg

What’s more, new rules which will take effect Jan. 9 will ban the cashing of checks above 50,000 naira (US$112) over-the-counter, and 10 million naira (US$22,480) through the banking systems. Point-of-sale cash withdrawals have been capped at 20,000 naira ($45).