by Ronan Manly, BullionStar:

Readers of these pages will be familiar that in addition to holding its gold bars in a HSBC vault in London, the SPDR Gold Trust (GLD), the world’s largest gold-backed ETF, at times also holds some of its gold bars in the vaults of the ‘Bank of England’ in London.

This is because while HSBC bank plc is the gold custodian of the SPDR Gold Trust (responsible for the storage and safekeeping of GLD’s gold bars), the Bank of England is one of the GLD’s gold storage sub-custodians. This ability of HSBC to use sub-custodians is an arrangement defined in the “Allocated Precious Metal Account Agreement” between HSBC (the custodian) and the Bank of New York Mellon (the Trustee of the SPDR Gold Trust).*

TRUTH LIVES on at https://sgtreport.tv/

Note that from 30 November 2022, JP Morgan has also been appointed as a second gold custodian of the SPDR Gold Trust (GLD), and JP Morgan also now has its own ‘Allocated Precious Metal Account Agreement’ with Bank of New York Mellon.

However, the discussion here relates to the SPDR Gold Trust (GLD), its Sponsor (World Gold Trust Services), its custodian HSBC, and one of its sub-custodians- the ‘Bank of England’, prior to JP Morgan being appointed as the second custodian of GLD.

2020 – 70 tonnes of GLD gold at the Bank of England

Below you will see that there are plenty of examples of the Bank of England being used as a sub-custodian of gold bars of the SPDR Gold Trust. For example, over the 4 month period between 15 April 2020 and 13 August 2020, GLD held a substantial amount of gold at the Bank of England, in fact up to 70 tonnes of GLD gold was being stored at the Bank of England at one point during that 4 month period in 2020, and GLD gold may have been churning out of the Bank of England vaults into the HSBC vaults all of that time.

All of which is documented in the following BullionStar articles:

13 May 2020 “Amid London gold turmoil, HSBC taps Bank of England for GLD gold bars”

14 August 2020 “GLD continues to source gold at the Bank of England, at an escalating rate”

10 December 2020 “GLD 10-K omits BoE gold holdings data, GLD CFO left 1 day before financial year-end”

The reason that GLD’s use of sub-custodians is public knowledge (and which enables such articles as these to be written), is that GLD, as a US stock-exchange listed Trust, legally requires the Sponsor of the SPDR Gold Trust (World Gold Trust Services, a Manhattan based fully-owned subsidiary of the World Gold Council) to file quarterly (10-Q) and annual (10-K) reports with the US Securities and Exchange Commission (SEC).

The 10-Q reports are signed off by the Chief Financial Officer (CFO) of World Gold Trust Services (the GLD Sponsor). The Sponsor in essence manages and promotes the Trust. The 10-K (annual) reports are signed off by the CFO and CEO World Gold Trust Services, and also by the board members of World Gold Trust Services.

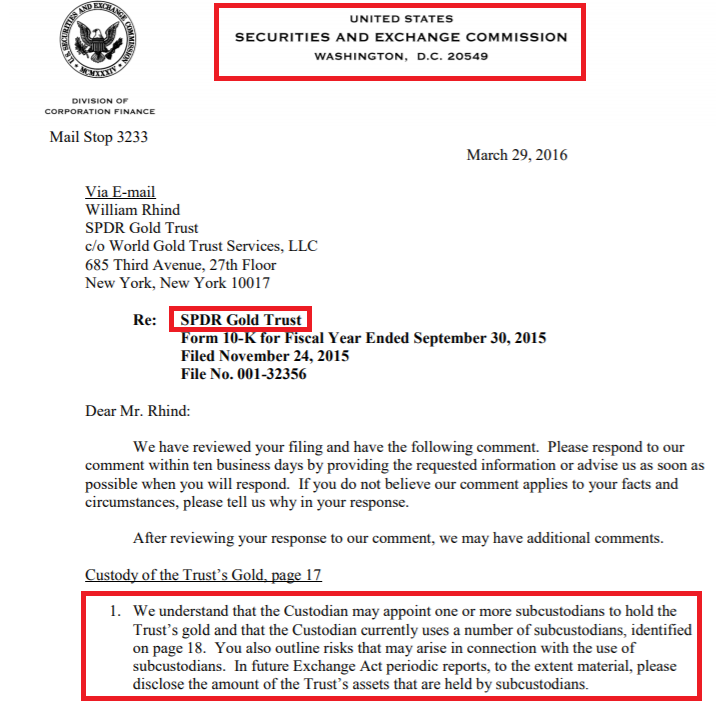

SEC Letter to GLD Sponsor – 2016

The GLD Sponsor is also required by the SEC to specifically state how much of the GLD gold is being held by a sub-custodian during any reporting period (quarterly and annual). The SEC even reminded the Sponsor of this obligation on 29 March 2016 when it wrote a letter to World Gold Trust Services pointing out the fact that the Sponsor is obligated to report gold held by sub-custodians. As per the SEC letter:

“We understand that the Custodian may appoint one or more subcustodians to hold the Trust’s gold and that the Custodian currently uses a number of subcustodians, identified on page 18.

You also outline risks that may arise in connection with the use of subcustodians.

In future Exchange Act periodic reports, to the extent material, please disclose the amount of the Trust’s assets that are held by subcustodians.”

The SEC’s 29 March 2016 letter was addressed to William Rhind, who had been CEO of the Sponsor, but had actually resigned on 12 February 2016. The SEC Letter asked the Sponsor to be more specific about gold held with a sub-custodian, and was sent to the Sponsor because in the 10-Q reports for Q1 and Q2 of 2016, the Sponsor was being cagey with the way it explained how much gold was being held at the Bank of England.

As you can see below, the 10-Q from Q4 2015 used selective wording, only stating that GLD held no sub-custodied gold on the quarter end date.

“As at December 31, 2015, the Custodian held 20,691,044 ounces of gold on behalf of the Trust in its vault, 100% of which is allocated gold in the form of London Good Delivery gold bars with a market value of $21,979,061,920 (cost — $25,333,180,858) based on the LBMA Gold Price AM on December 31, 2015.

Subcustodians held nil ounces of gold in their vaults on behalf of the Trust…”

Source: GLD 10-Q to 31 December 2015

Following the SEC’s letter dated 29 March 2016, the Sponsor was forced to be more transparent, and for example during Q1 2016 the Sponsor then stated that the maximum amount of gold held at the Bank of England during the quarter (which was 29 tonnes):

“Results of Operations

Subcustodians held no gold on behalf of the Trust as of March 31, 2016. During the quarter ended March 31, 2016, the greatest amount of gold held by subcustodians was approximately 29 tonnes or approximately 3.8% of the Trust’s gold at such date. The Bank of England held that gold as subcustodian.”

Source: GLD 10-Q to 31 March 2016

For details of these 2015 -2016 developments, see the BullionStar article from 11 July 2016 titled “SPDR Gold Trust gold bars being held at the Bank of England”.

Still though, the GLD Sponsor reverted to its opaque and ambiguous reporting for the second quarter 10-Q, i.e. over the 3 months from April 2016 to June 2016, and merely just repeated the information that GLD held a maximum of 29 tonnes over a nine month period, but failed to say if GLD held any gold at the bank of England during April, May and June 2016:

“Results of Operations

Subcustodians held no gold on behalf of the Trust as of June 30, 2016. During the nine months ended June 30, 2016, the greatest amount of gold held by subcustodians was approximately 29 tonnes or approximately 3.8% of the Trust’s gold at such date. The Bank of England held that gold as subcustodian.”

Source: GLD 10-Q to 30 June 2016

All of which is documented in the BullionStar article from 2 August 2016, titled “GLD Sponsor dodges disclosure details of Bank of England sub-custodian in latest SEC filing”.

Why the SEC didn’t pick up on the Sponsor’s continued evasion is baffling, but at least following the SEC letter of 29 September 2016, the 10-Q and 10-K ‘Exchange Act periodic reports’ submitted to the SEC by the GLD Sponsor (World Gold Trust Services) became more informative about sub-custodian held gold than before.

Example 1:

“Gold is held by HSBC Bank plc (the “Custodian”) on behalf of the Trust. During the three month period ended December 31, 2016, no gold was held by a subcustodian.

During the year ended September 30, 2016, the only time gold was held by a subcustodian (the Bank of England) was during the period January through March and the greatest amount of gold held during such period was approximately 29 tonnes, or approximately 3.8% of the Trust’s gold at the time.”

Source: GLD 10-Q for the 3 month period to 31 December 2016

Example 2:

“2.3 Custody of Gold:

Gold is held by HSBC Bank plc, on behalf of the Trust. During the years ended September 30, 2018 and 2017, no gold was held by a subcustodian.”

Source: GLD 10-K for the year to 30 September 2018

Example 3:

“Subsequent Events:

Since April 15, 2020, gold was held by a subcustodian (the Bank of England) and the greatest amount of gold held on April 27, 2020 was approximately 45.91 tonnes or 4.4% of the Trust’s gold.”

Source: GLD 10-Q for the 3 months to 30 March 2020

Example 4:

“Gold is held by the Custodian on behalf of the Trust, 100% of which is allocated gold in the form of good delivery gold bars which includes gold held with a subcustodian (Bank of England).

The greatest amount of gold held by Bank of England during the quarter ended June 30, 2020 was approximately 2,251,607 ounces or 6.3% of the Trust’s gold on May 21, 2020.

At June 30, 2020, Bank of England held approximately 1,283,665 ounces or 3.4% of the Trust’s gold in an allocated account.

No gold was held by a subcustodian during the year ended September 30, 2019 or the six months ended March 31, 2020.”

Source: GLD 10-Q for the three months to 30 June 2020

Example 5:

“2.3. Custody of Gold”

During the year ended September 30, 2020, some gold was held with a subcustodian (the Bank of England) from April 15, 2020 to August 13, 2020.

Since August 13, 2020, subcustodians have not held any gold on behalf of the Trust. During the year ended September 30, 2019, no gold was held by a subcustodian.”

Source: GLD 10-K for the year to 30 September 2020

So you get the picture on how specific the GLD 10-Q and 10-K filings can be when the Sponsor wishes to be transparent.