by Alasdair Macleod, GoldMoney:

This article is in two parts. In Part 1 it looks at how prospects for gold should be viewed from a monetary and economic perspective, pointing out that it is gold whose purchasing power is stable, and that of fiat currencies which is not. Consequently, analysts who see gold as an investment producing a return in national currencies have made a fundamental error which will not be repeated in this article.

Part 2 covers geopolitical issues, including the failure of US policies to contain Russia and China, and the consequences for the dollar. By analysing recent developments, including how Russia has secured its own currency, the Gulf Cooperation Council’s political migration from a fossil fuel denying western alliance to a rapidly industrialising Asia, and China’s plans to replace the petrodollar with a petro-yuan crystalising, we can see that the dollar’s hegemonic role will rapidly become redundant. With about $30 trillion tied up in dollars and dollar-denominated financial assets, foreigners are bound to become substantial sellers — even panicking at times.

TRUTH LIVES on at https://sgtreport.tv/

The implications are very far reaching. This article limits its scope to big picture developments in prospect for 2023 but can be regarded as a basis for further debate.

Part 1 — The monetary perspective

Whether to forecast values for gold or fiat currencies

This is the time of year when precious metal analysts review the year past and make predictions for the year ahead. Their common approach is of investment analysis — overwhelmingly their readership is of investors seeking to make profits in their base currencies. But this approach misleads everyone, analysts included, into thinking that precious metals, particularly gold, is an investment when it is in fact money.

Most of these analysts have been educated to think gold is not money by schools and universities which have curriculums which promote macroeconomics, particularly Keynesianism. If their studies had not been corrupted in this way and they had been taught the legal distinction between money and credit instead, perhaps their approach to analysing gold would have been different. But as it is, these analysts now think that cash notes issued by a central bank is money when very clearly it has counterparty risk, minimal though that usually is, and it is accounted for on a central bank balance sheet as a liability. Under any definition, these are the characteristics of credit and matching debt obligations. Nor do the macroeconomists have an explanation for why it is that central banks continue to hoard massive quantities of gold bullion in their reserves. Furthermore, some governments even accumulate gold bullion in other accounts in addition to their central banks’ official reserves.

The wisdom of central banks and Asian governments to this approach was illustrated this year when the western alliance led by America emasculated the Russian central bank of its currency reserves with little more than the stroke of a pen. This is the other side of proof that the legal distinction between money and credit remains, despite any statist attempts to redefine their currency as money. That it can be reneged upon further confirms its credit status.

We must therefore amend our approach to analysing gold and its bed-fellow, silver. Other precious metals have never been money, so are not part of this analysis. Silver was dropped as an official monetary standard long ago, so we can focus on gold. With respect to valuing gold, the empirical evidence is clear. Over decades, centuries, and even millennia its purchasing power measured by commodities and goods on average has varied remarkably little. But we don’t need to go back centuries: an illustration of energy prices since the dollar was on a gold standard, in this case of crude oil, makes the point for us.

The first point to note is that between 1950—1971, the price of oil in dollars was remarkably stable with almost no variation. Pricing agreements stuck. It was also the time of the Bretton Woods agreement, which was suspended in 1971. Bretton Woods tied the dollar credibly to gold, until the expansion of dollar credit became too great for the agreement to bear. The link was then broken, and the price of oil in dollars began to rise.

Priced in US dollars, not only has the price of crude been incredibly volatile but before the Lehman crisis by June 2008 it had increased fifty-four times. Measured in gold it had merely doubled. Therefore, macroeconomists have a case to answer about the suitability of their dollar currency replacement for gold in its role as a stable medium of exchange.

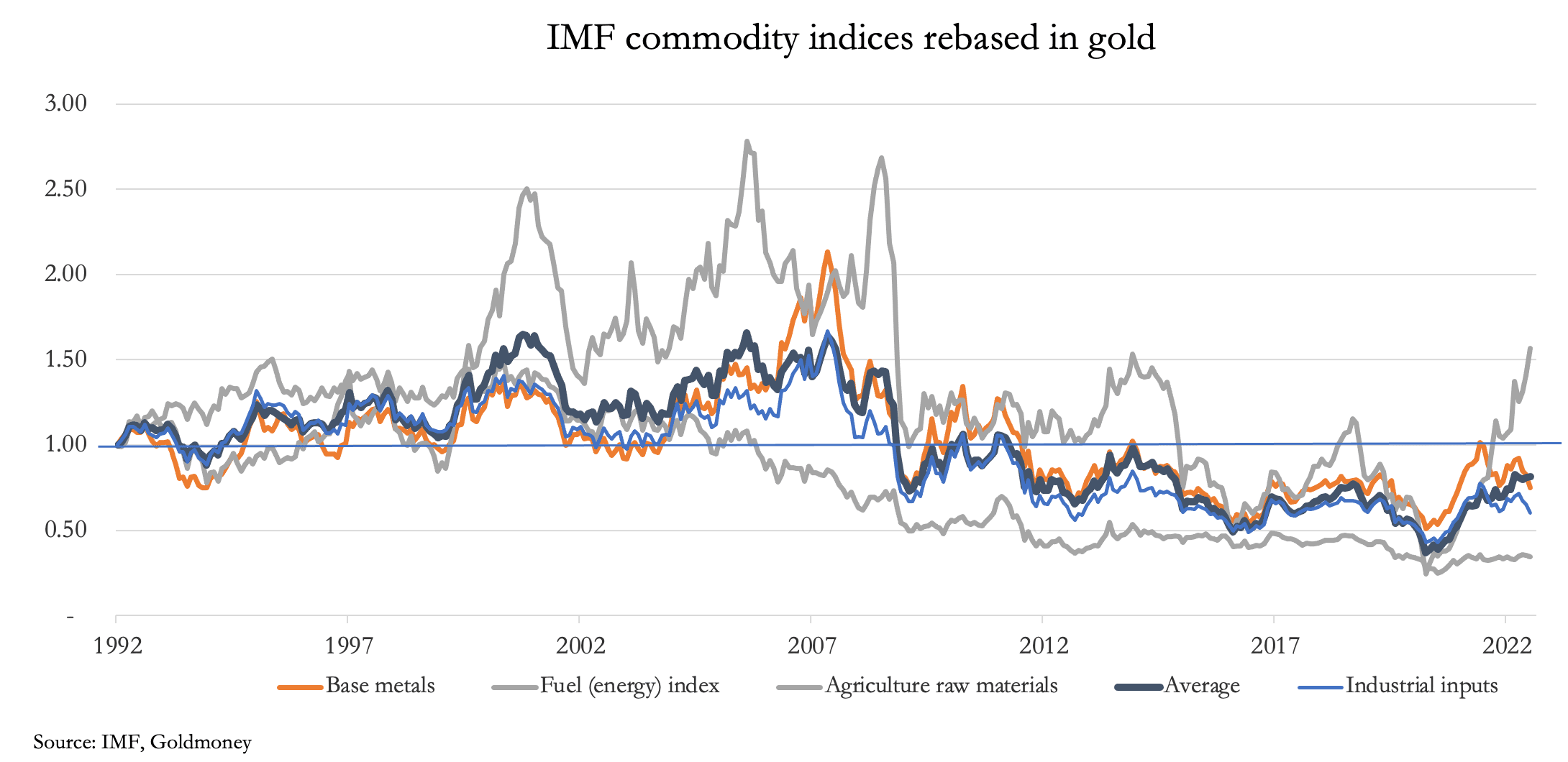

The next chart shows four commodity groups, consolidating a significant number of individual non-seasonal commodities, priced in gold. Over the last thirty years, the average price of these commodities has fallen a net 20%, with considerably less volatility than priced in any fiat currency. Whichever way we look at the relationships between commodities and mediums of exchange, the evidence is always the same: price volatility is overwhelmingly in the fiat currencies.

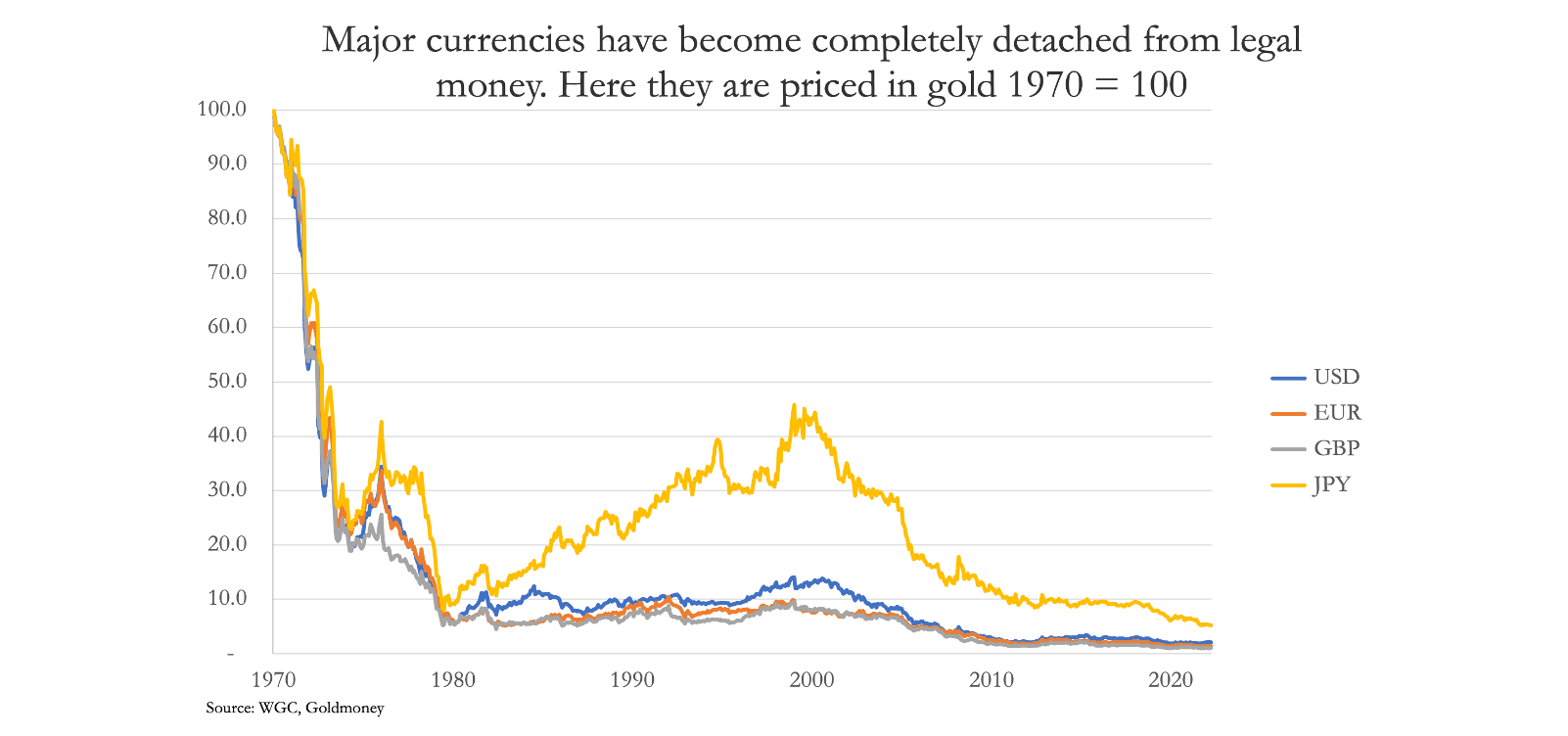

The only possible conclusions we can draw from the evidence is that detached from gold, fiat currencies as money substitutes are not fit for purpose. Our next chart shows how the four major fiat currencies have performed priced in gold since the permanent suspension of the Bretton Woods agreement in 1971.

Since 1970, the US dollar, which establishment economists accept as the de facto replacement for gold, has lost 98% of its purchasing power priced in gold which we have established as still fulfilling the functions of sound money by pricing commodities with minimal variation. The other three major currencies’ performance has been similarly abysmal.

Analysts analysing the prospects for gold invariably assume, against the evidence, that price variations emanate from gold, and not the currencies detached from legal money. There is little point in following this convention when we know that priced in legal money commodities and therefore the wholesale values of manufactured goods can be expected to change little. The correct approach can only be to examine the outlook for fiat currencies themselves, and that is what I shall do, starting with the US dollar.

2023 is likely to make or break the US dollar

Outlook for dollar credit

We know that the commercial banking system is highly leveraged, measured by the ratio of balance sheet assets to shareholders’ equity, typical of conditions at the top of the bank credit cycle. While interest rates were firmly anchored to the zero bound, lending margins became compressed, and increasing balance sheet leverage was the means by which a bank could maintain profits at the bottom line.

Now that interest rates are rising, the bankers’ collective attitude to bank credit levels has altered fundamentally. They are increasingly aware of risk exposure, both in financial and non-financial sector lending. Already, losses in financial markets are accumulating both for their customers and for banks themselves, where they have bond exposure on their balance sheets. Consequently, they have begun to modify their business models to reduce their exposure to falling asset values in bond, equity, and derivative markets. Furthermore, while US banks appear less leveraged than, say, the Eurozone and Japanese banking systems, paring down bank equity to remove intangibles and other elements to arrive at a Tier 1 capital definition severely restricts an American bank’s ability to maintain its balance sheet size.

There are two ways a bank can comply with Basel 3 Tier 1 regulations: either by increasing shareholders’ capital or de-risking their balance sheets. With most large US banks capitalised in the markets at near their book value, issuing more stock is too dilutive, so there is increased pressure to reduce lending risk. This is set by the net stable funding ratio (NSFR) introduced in Basel 3, which is the ratio of available stable funding (ASF) to required stable funding (RSF).

The application of ASF rules is designed to ensure the stability of a bank’s sources of credit (i.e., the deposit side of the balance sheet). It applies a 50% haircut to large, corporate depositors, whereas retail deposits being deemed a more stable source of funding, only suffer a 5% haircut. This explains why Goldman Sachs and JPMorgan Chase have set up retail banking arms and have turned away large deposits which have ended up at the Fed through its reverse repo facility.

The RSF applies to a bank’s assets, setting the level of ASF apportionment required. To de-risk its balance sheet, a commercial bank must avoid exposure to loan commitments of more than six months, deposits with other financial institutions, loans to non-financial corporates, and loans to retail and small business customers. Physically traded commodities, including gold, are also penalised, as are derivative exposures which are not specifically offset by another derivative.

The consequences of Basel 3 NSFR rules are likely to see commercial banking move progressively into a riskless stasis, rather than attempt the reduction in balance sheet size which would require deposit contraction. While individual banks can reduce their deposit liabilities by encouraging them to shift to other banks, system-wide balance sheet contraction requires a net reduction of deposit balances and similar liabilities across the entire banking network. Other than the very limited ability to write off deposit balances against associated non-performing loans, the creation process of deposits which are always the counterpart of bank loans in origin is impossible to reverse unless banks actually fail. For this reason, system-wide non-performing loans can only be written off against bank equity, stripped of goodwill and other items regarded as the property of shareholders, such as unpaid tax credits. For this reason, US money supply (a misnomer if ever there was one, being only credit — but we must not be distracted) has stopped increasing.

Short of individual banks failing, a reduction in system-wide deposits is therefore difficult to imagine, but banks have been turning away large deposit balances. These have been taken up instead by the Fed extending reverse repurchase agreements to non-banking institutions. In a reverse repo, the Fed takes in deposits removing them from public circulation. More to the point, they remove them from the commercial banking system, which is penalised by holding large deposits.