by Peter Schiff, Schiff Gold:

The price analysis last month highlighted that gold was trapped between long-term support and resistance. It highlighted:

Regaining $1700 is a positive turn, especially with the explosiveness of the move. That said, $1800 has proven to be a much harder hurdle to hold above. At $1750, it sits right in the middle of what was once very solid support and solid resistance. A move through either could create a snowball effect.

While last month was a very neutral analysis, the data this month points to a bit more positive momentum. Let’s take a closer look at the data.

TRUTH LIVES on at https://sgtreport.tv/

Resistance and Support

Gold

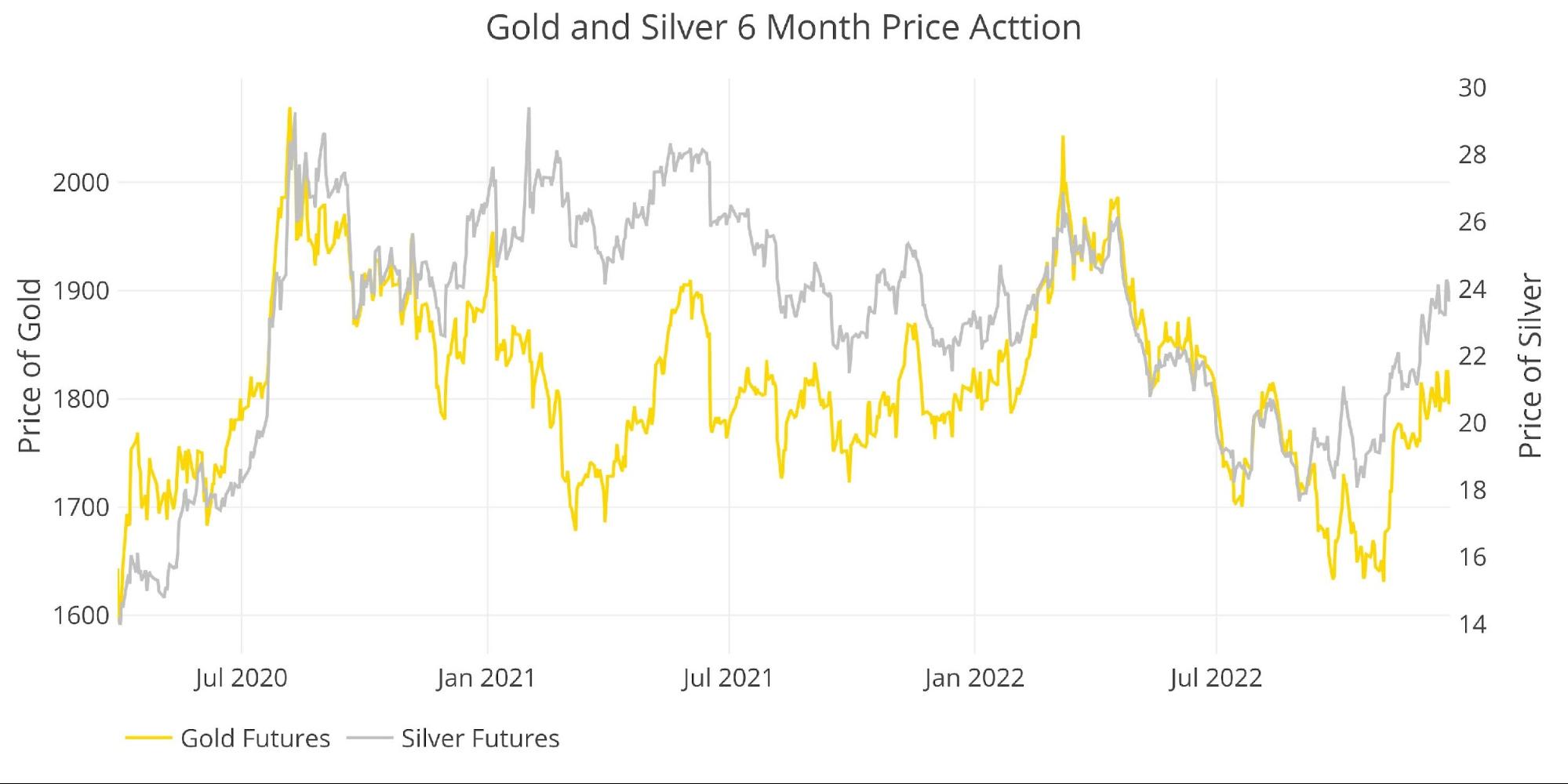

Gold has had a long-term relationship with $1800. It gets trapped below, hits the resistance several times, and finally breaks through. Inevitably, something will trigger a sell-off and gold will get pushed back below $1800 and the process starts over. Considering where the Fed is in the tightening cycle, gold has fewer and fewer reasons to sell off. The next strong move above $1800 may be the one that finally launches it over $2000.

Futures finished the week above $1800 at $1804 while the spot market is just below sitting at $1798.50. The coiled spring is getting tighter.

Outlook: Bullish

Silver

Silver finally took out $22 and has been moving up rather quickly. It is leading gold high which is a good sign for both metals.

Outlook: Bullish

Figure: 1 Gold and Silver Price Action

Daily Moving Averages (DMA)

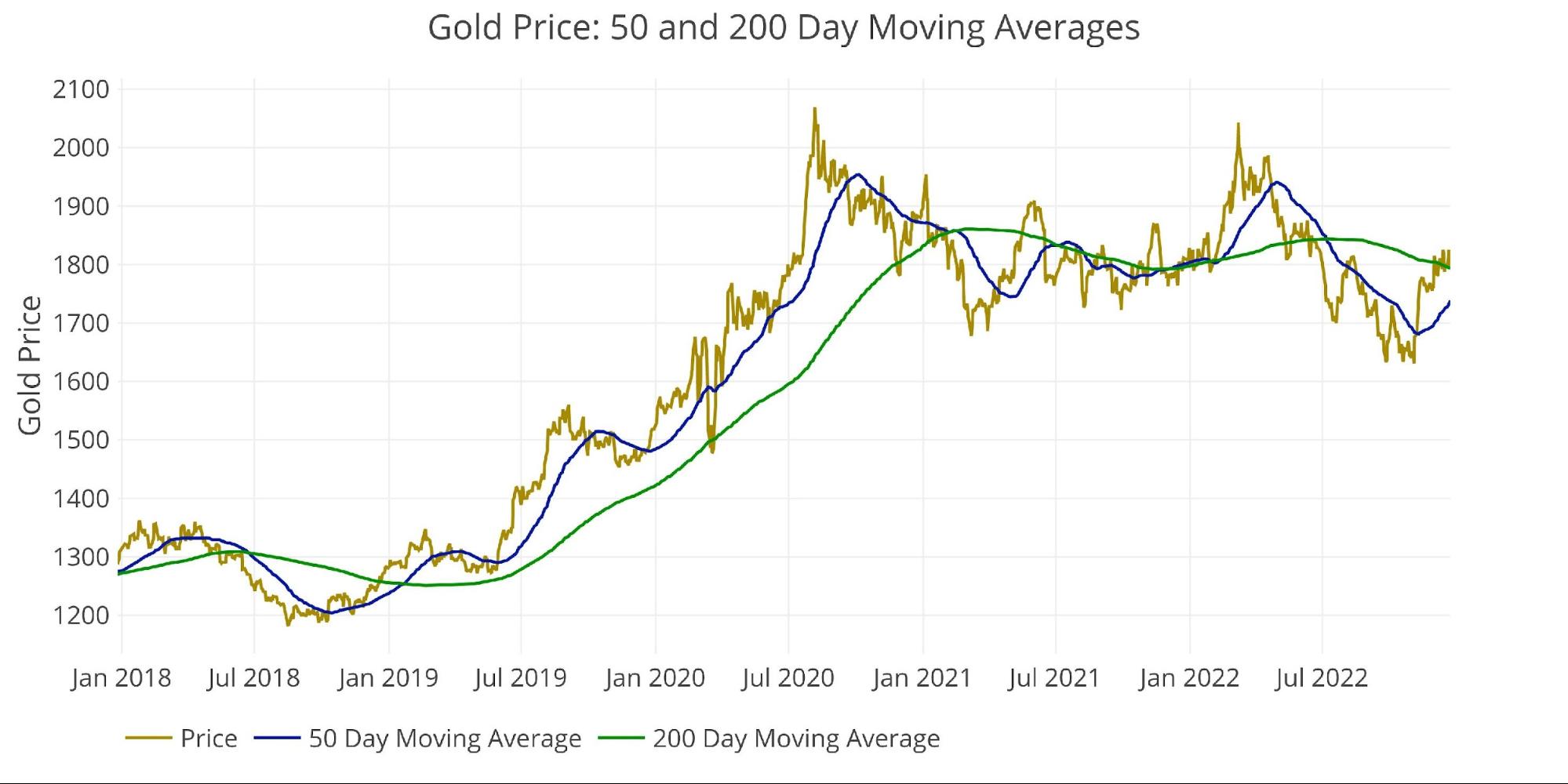

Gold

While gold has not yet technically formed a golden cross, it seems to be heading that way. The price closed out the week above both the 200 DMA ($1793) and the 50 DMA ($1738). The 50 DMA is moving up quickly. While it is too early to wave the all-clear sign, we are getting closer. Expect a bit more choppiness until the golden cross officially forms.

Outlook: short-term choppy into medium-term bullishness

Figure: 2 Gold 50/200 DMA

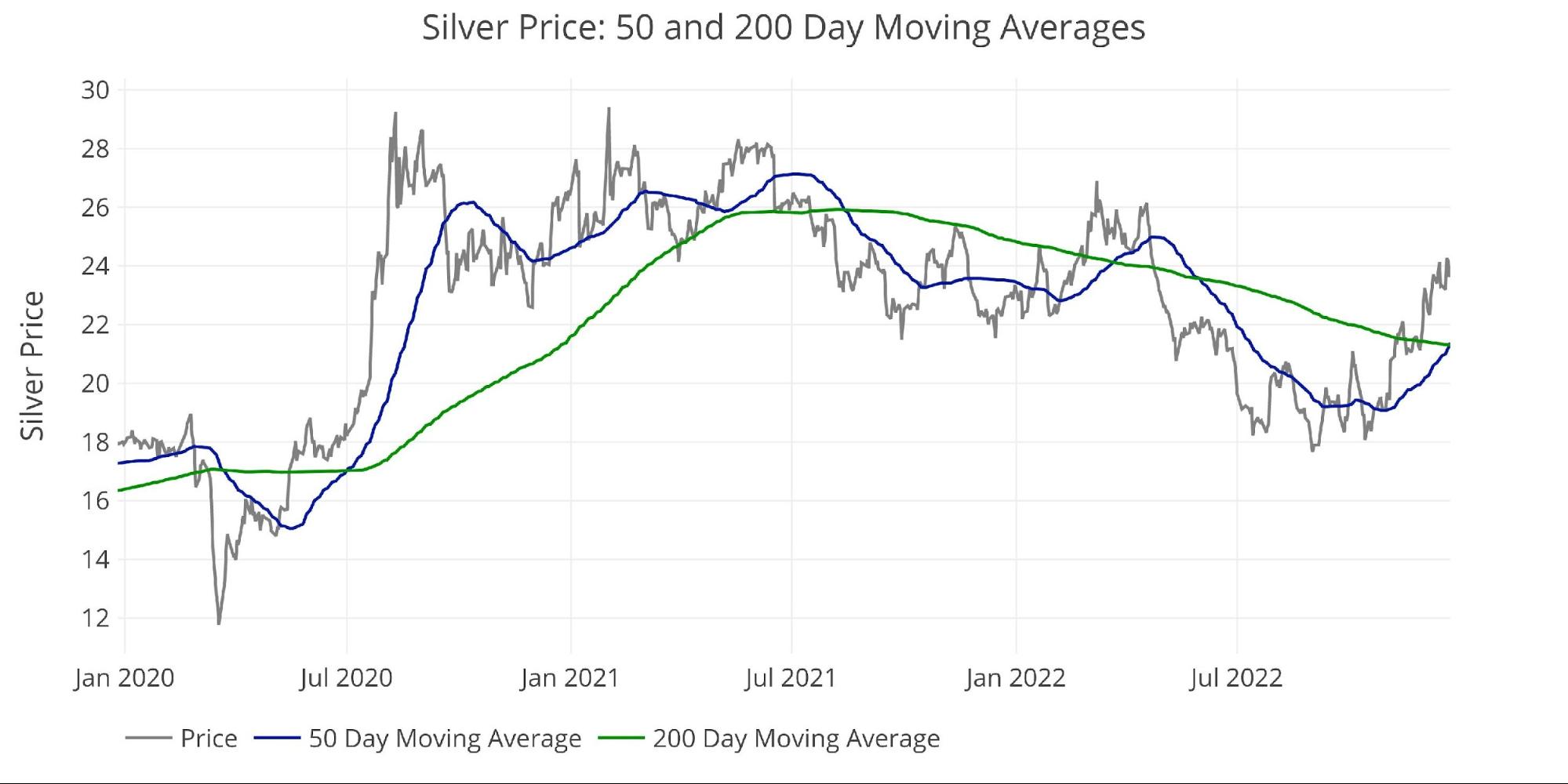

Silver

Silver formed a golden cross just yesterday. The current price of $23.92 was high enough to drag the 50 DMA ($21.38) above the 200 DMA ($21.30). Silver has had several false break-outs over the past few years and follow-through next week might be limited due to the holiday. That said, given the intense physical demand in the metal during 2022, silver could blast into 2023 to start the year.

It’s still a bit too early to get very bullish, but when silver takes off it could be very explosive.

Outlook: Prepare to be VERY Bullish

Margin Rates and Open Interest

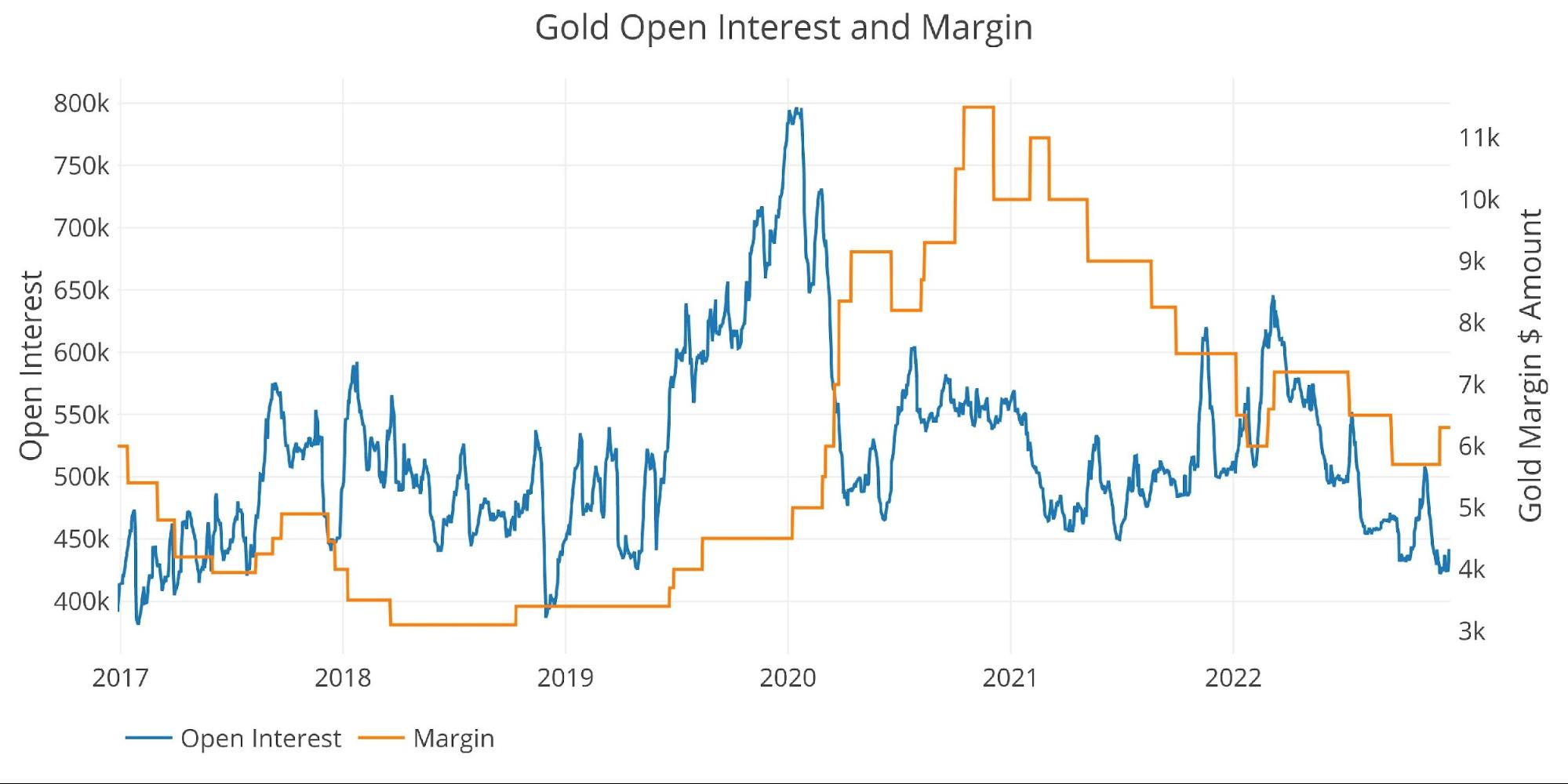

Gold

Open interest is near multi-year lows, yet the price has held up very well. The last pop-up in open interest was likely shorts rather than longs. The shorts have closed but this still leaves lots of dry powder from the longs on the sidelines to jump on any bullish momentum.

The one thing that will hold back a truly explosive move in gold will be the CFTC raising margin rates to contain the price. That could be short-term in nature though. If physical demand maintains, the CFTC could increase margin rates to 100% and it won’t slow down the freight train.

Outlook: Cautiously Bullish

Figure: 6 Gold Margin Dollar Rate

Silver

Silver is in a very similar posture to gold with open interest at the lowest level in years with margin rates also on the lower end of the range.

Outlook: Cautiously Bullish

Figure: 7 Silver Margin Dollar Rate

Gold Miners (Arca Gold Miners Index)

The gold miners have been consistently leading the price of gold in both directions for years. The current move in the miners is stronger than it was back in August when gold even got above $1800. While the sector was very oversold, it’s a positive development that the ratio has rebounded so strongly. This means stock traders are expecting the price advance to continue.

Similar to the gold barrier at $1800, GDX is facing a similar barrier at $30. Despite all the Fed headwinds, both the metals and miners are holding up well. If GDX breaks through $30 it could be a big move higher. Until then…