by Peter Schiff, Schiff Gold:

While the data this month looks weak, I think there is more to the story. My hypothesis is speculative in nature, so I will save it for the end after going through the data.

Gold: Recent Delivery Month

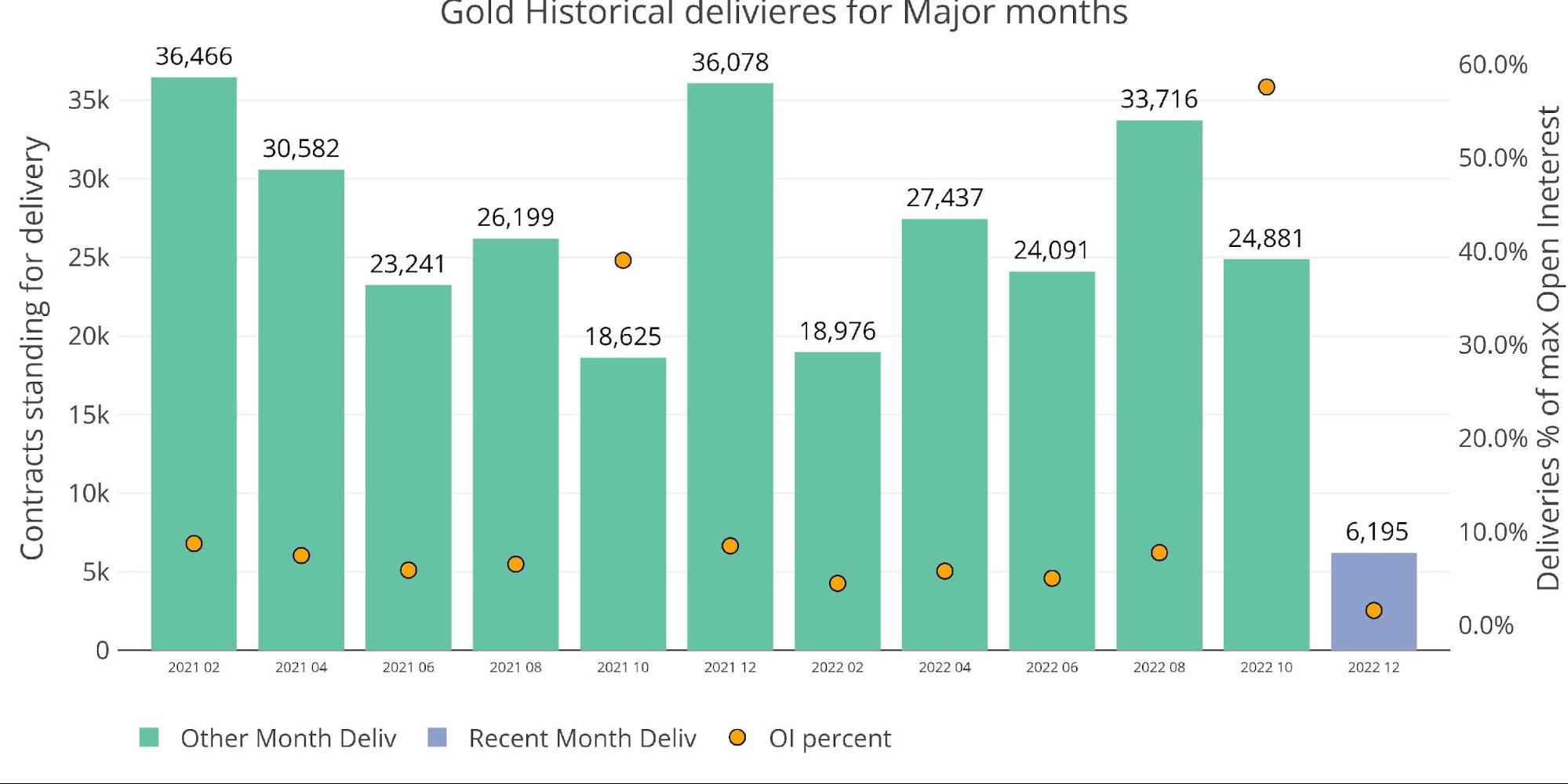

Delivery volume in December has begun. On the first day of delivery, 6,195 contracts were delivered.

TRUTH LIVES on at https://sgtreport.tv/

Figure: 1 Recent like-month delivery volume

As the chart below shows, there are still 12,730 contracts remaining in open interest (purple bar). This December had the weakest open interest on first notice all year at 18,925 (green bar).

Figure: 2 24-month delivery and first notice

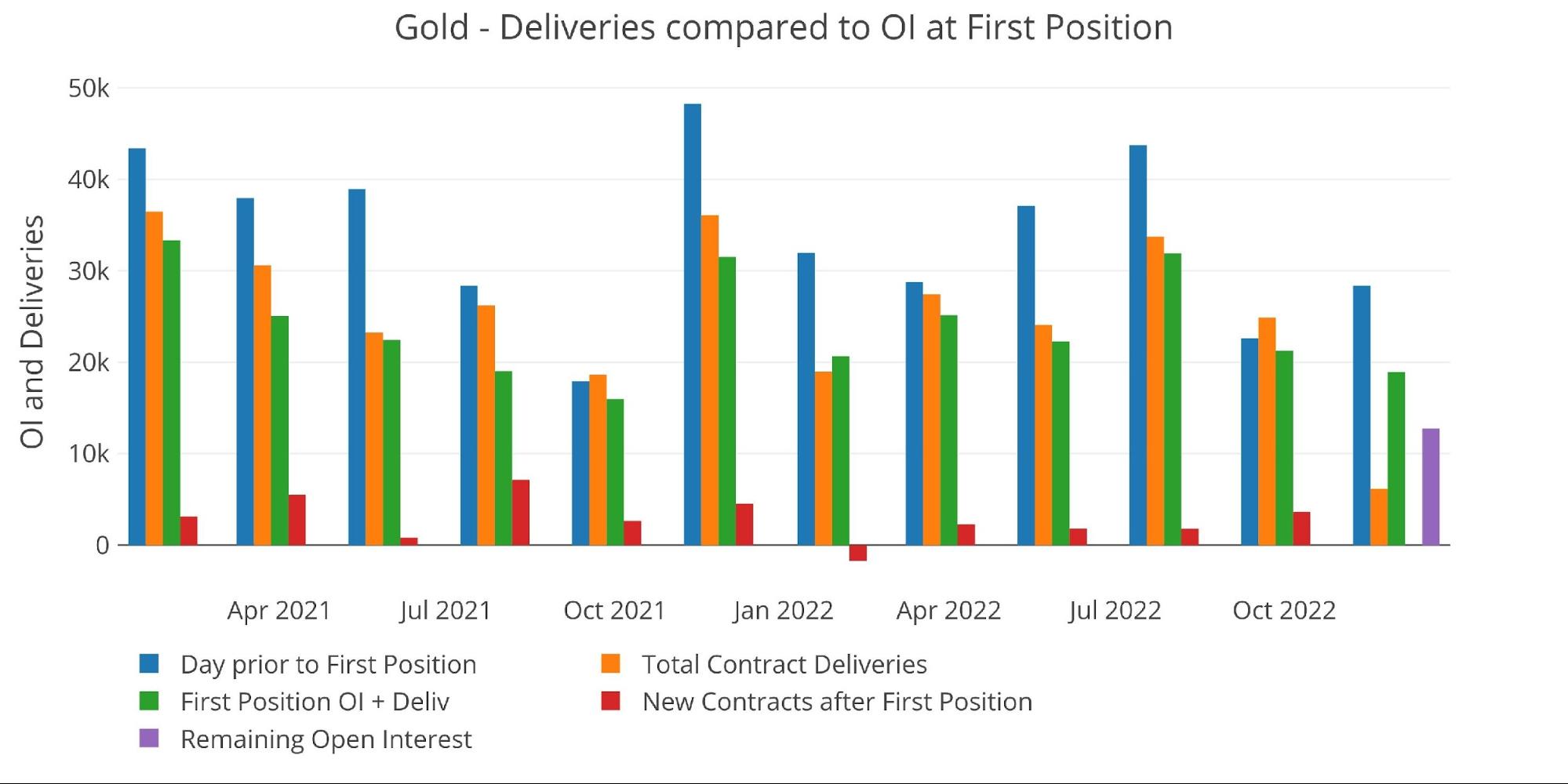

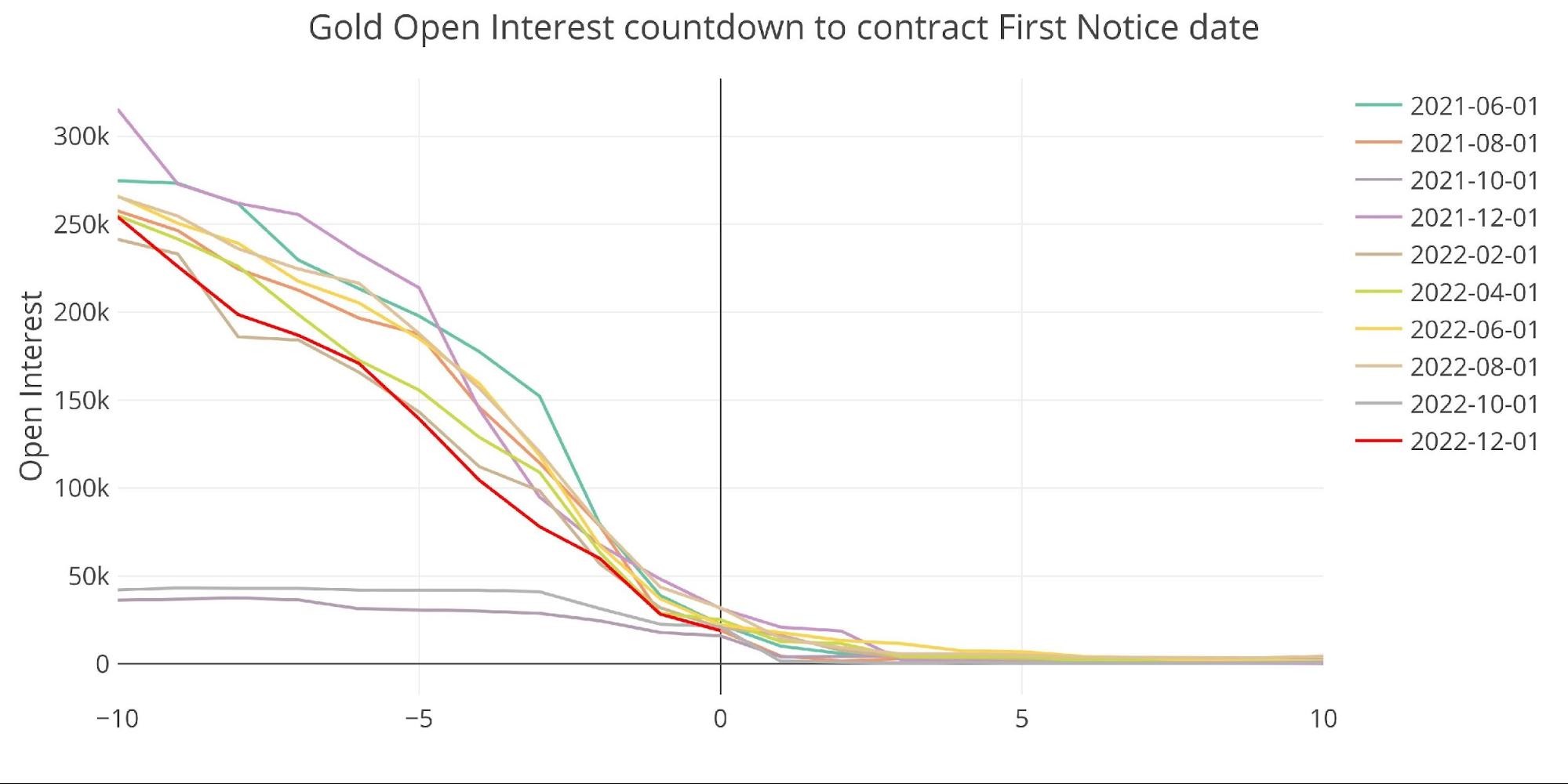

The chart below shows that December had been below trend for most of the contract, so it was not a surprise that it ended slightly weaker. What’s more surprising is how weak December was in general. December is typically one of the strongest months of the year, with last December starting First Notice with 31.5k contracts.

Given the strength in gold the last few weeks it is odd that December would cap the year off with the weakest finish of any major month, including October.

Figure: 3 Open Interest Countdown

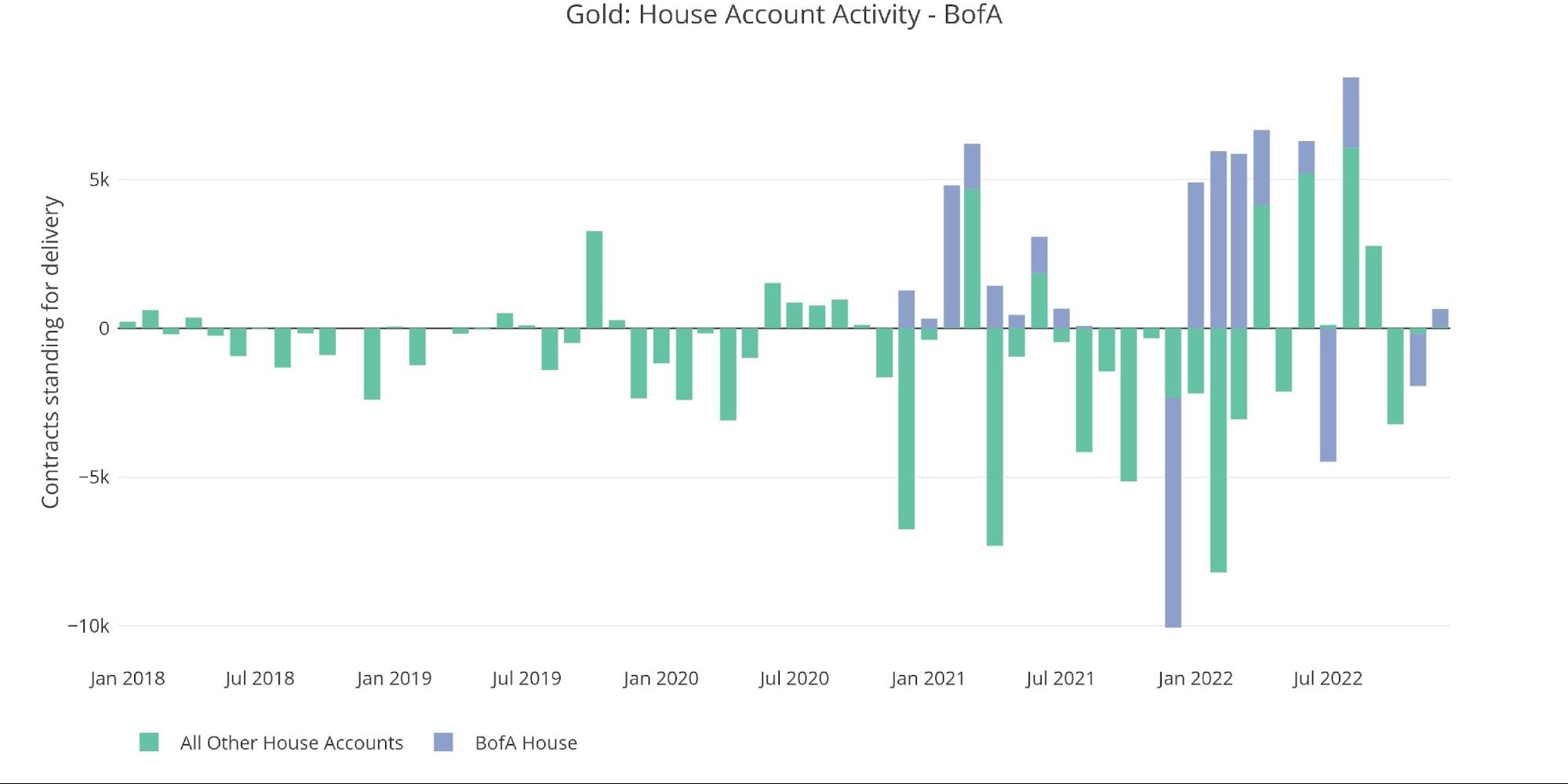

The bank house accounts have been quieter in recent months, though BofA continues to be one of the major participants, this time taking delivery of gold (595 contracts) after delivering 1,762 contracts in November.

Figure: 4 House Account Activity

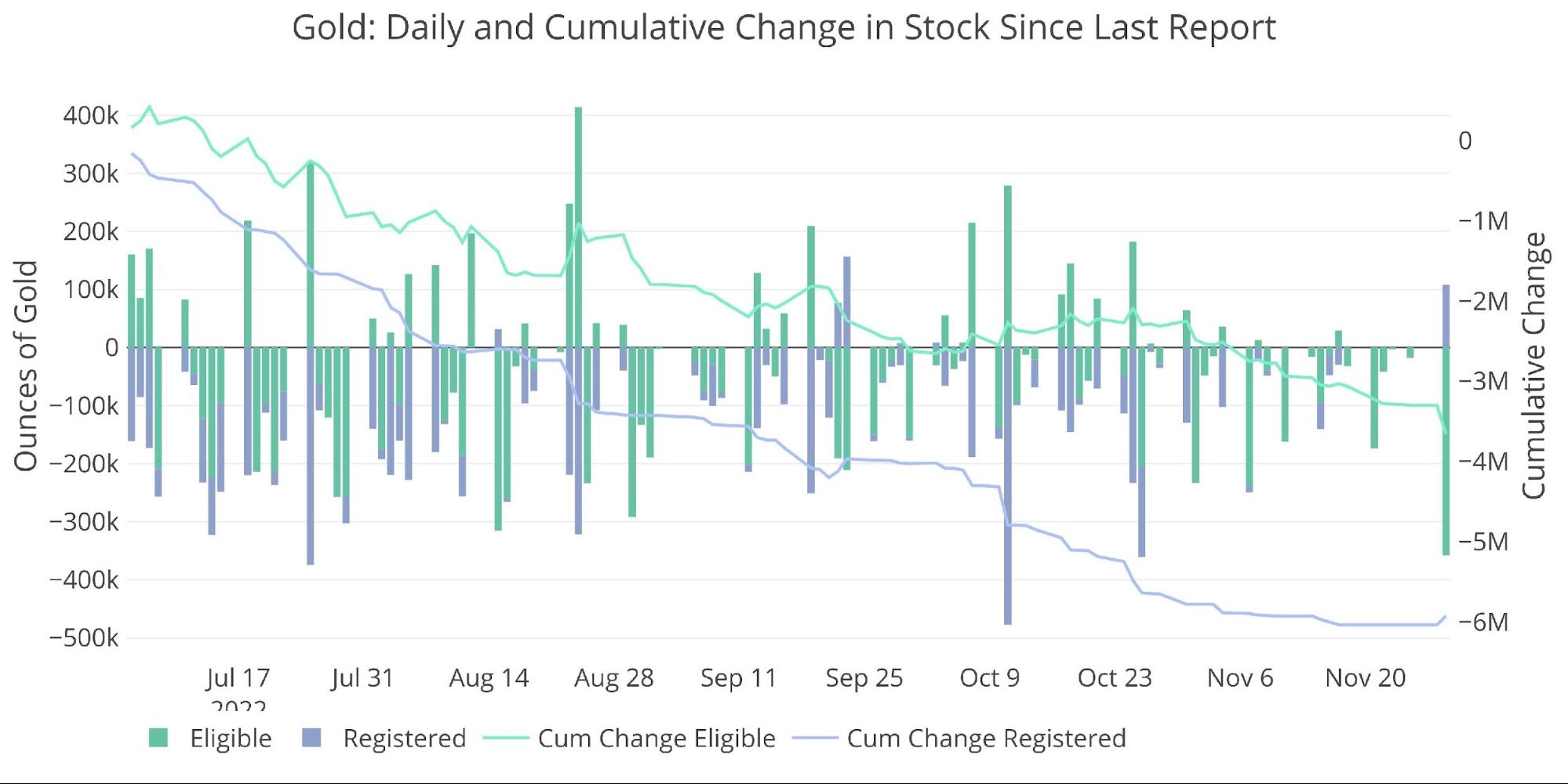

Although delivery volume has dipped slightly, the extraction of metal from the vaults continues.

Figure: 5 Recent Monthly Stock Change

The chart below shows the total net daily change from the chart above. As can be seen, almost all increases in the chart above are just instances of metal changing between Registered and Eligible. Over the last 104 days, there have only been 8 total days of metal being net added to Comex vaults and zero since Oct 21st.

The Comex has lost 9.5M ounces of gold since July 1st. Why are the Comex vaults unable to replace this inventory?